Terran Orbital is the latest space company that will take its talents to the public markets (via SPAC, of course). SPACs, or special purpose acquisition companies, have become quite a popular vehicle for space companies looking to raise capital.

The California-based satellite manufacturer said today that it would merge with Tailwind Two, a blank-check company led by Casper Sleep CEO Philip Krim. The WSJ first reported the news.

“We looked at all the different options…SPACs, direct listing, and IPO,” Terran CEO and cofounder Marc Bell told Payload in an interview. “It’s just a vehicle,” Bell said. “The SPAC was the least risky way to raise capital and go public.”

- “I’m very familiar and comfortable with SPACs,” Bell said. He sponsored a SPAC way back in 2007, when reverse mergers were not nearly as popular as they are now.

Deal details: Terran’s post-merger valuation is expected to be ~$1.58B. Upon the transaction closing, expected some time in Q1 2022, the combined entity will list on the New York Stock Exchange and trade under the ticker LLAP.

- The deal is supported by $345M from Tailwind Two and a $50M PIPE, provided by AE Industrial Partners, Beach Point Capital, Daniel Staton, Lockheed, and Fuel Venture Capital.

- Francisco Partners and Beach Point Capital will kick in an additional $75M.

- Lockheed and Francisco Partners may also provide an additional $125M in debt financing, subject to certain stipulations.

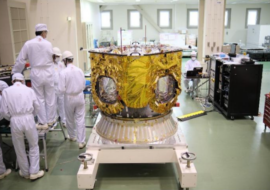

Terran 101: Founded in 2013, Terran is a vertically integrated satellite manufacturer, involved in design, production, launch provisioning, mission control, and in-space support. Terran manages 32 ground stations. The manufacturer is also developing its own synthetic aperture radar (SAR) constellation.

A month ago, Terran said it would build a $300M, 660K-sq.-ft. satellite factory on Florida’s Space Coast. Space Florida, the Sunshine state’s development authority, is providing conduit financing. Once complete (exp. 2025), Terran says its Florida facility will be capable of producing 1,000+ satellites a year.

- Around the same time, Terran also announced a planned expansion of its Irvine, CA, facility.

Ready for primetime? Asked if he’s worried about the volatility and always-watchful eye of the public markets, Bell said Terran’s line of work within the larger space industry is largely de-risked.

“We have a stable customer. We build [satellite] busses,” Bell said. “Everyone’s focused on launch, but someone’s gotta build the satellites. So that’s us.” Terran is one of few remaining independent US satellite manufacturers, Bell pointed out. “Instead of being acquired, we decided to partner.” And SPAC.