Live long and prosper…

Another day, another three-comma space contract.

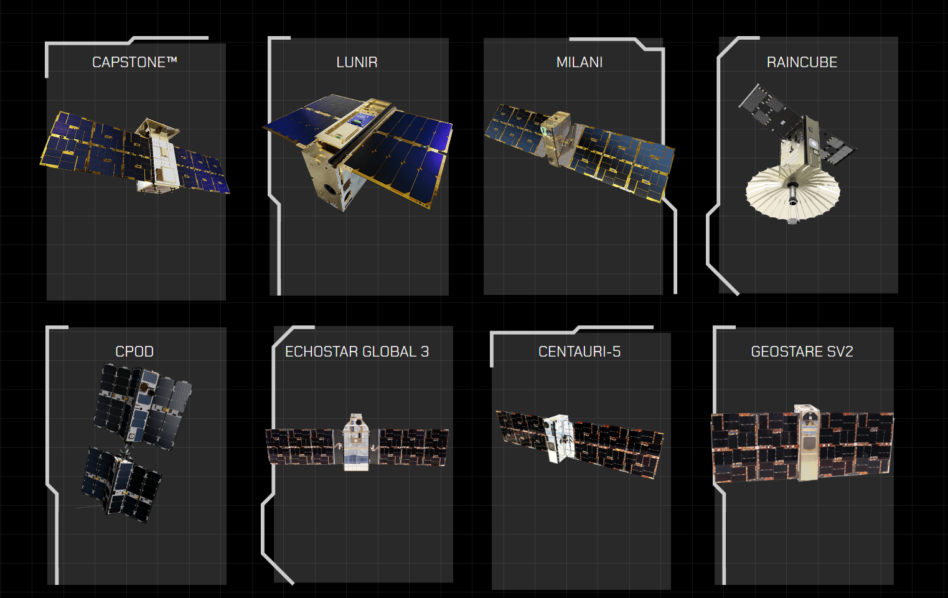

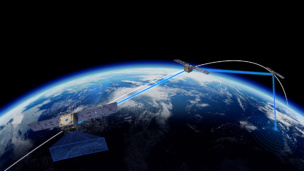

Terran Orbital said Wednesday that it won a $2.4B contract to design, build, and deploy a 300-bird constellation for Rivada Space Networks. The Rivada constellation will consist of 288 LEO satellites and 12 spares. They’ll be linked by lasers, packing on-board data routers, and tasked with providing high-speed wholesale connectivity to terrestrial network operators.

The customer: Rivada

Rivada plans to launch two fleets of 300 satellites, for a grand total of 600, and owns a valuable Ka-band spectrum license. The regulatory deadline to launch the first constellation falls in 2026, so the clock’s a-tickin. In addition to the spectrum rights, Rivada has a stash of valuable IP, with patents for systems such as “dynamic spectrum arbitrage” and “open access” platforms.”

The Rivada job

Tyvak, Terran’s wholly owned subsidiary, is the formal prime contractor for the Rivada job. Tyvak will assemble, integrate payloads, and test the ~500 kg satellites (at the top end of Terran’s manufacturing sweet spot). Terran will also develop portions of the ground segment for the Rivada constellation.

Terran Orbital’s response

“This is a tremendous validation of everything that we’ve been talking about and doing here at Terran,” CEO Marc Bell told Payload. “It shows that we can mass produce satellites at an affordable cost and provide a high-quality product at the same time,” and “is one of, if not the largest smallsat contracts ever awarded.”

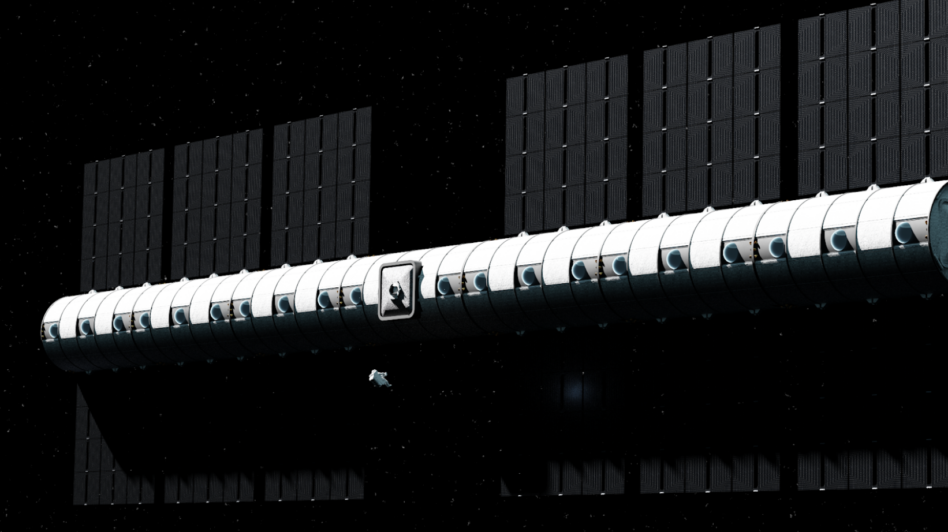

The site

Terran has a new facility “coming online in four weeks, which is where we will build the bulk of Rivada,” Bell said. The satellite manufacturer, which primarily sells into the government market, recently opted to expand its Irvine, CA digs, rather than move forward with an even bigger factory on Florida’s Space Coast.

Terran’s production process is highly automated, Bell said, which means it can work around the clock. He also noted that the company controls 85% of its supply chain, with the big exception being semiconductors. The Rivada job will put Terran’s manufacturing lines “in a constant mode” for the next few years, as opposed to the “start-and-stop” nature of government procurement.

Execution and speed are key, given the deadline for satellite deployment. Rivada said that it plans to start deployment in 2025, with full deployment of fleet #1 by mid-2026.

The reaction

Shares of Terran Orbital ($LLAP) finished Wednesday up 71%. $LLAP is a reference to “live long and prosper” and the inspiration for the first line of this story.