Launching satellites to space is a risky business. The field of orbitally proven vehicles remains small, sensor and payload technology is new and constantly changing, and certain orbital regimes are getting more crowded by the month.

Insurers, of course, are no strangers to risk.

The space insurance industry dates back nearly 60 years. But the last few years have seen a sharp increase in the number of objects deployed in orbit—as concerns mount about geopolitical tensions in space, weaponization of the domain, and the risks of orbital debris.

The 2022 edition of the Global Risks Report, released annually by the World Economic Forum, highlights space as a key risk area. “A greater number and range of actors operating in space could generate frictions if space exploration and exploitation are not responsibly managed,” WEF notes in its report. “With limited and outdated global governance in place to regulate space alongside diverging national-level policies, risks are intensifying.”

The amount of debris in orbit—roughly one million pieces over 1cm in diameter—alongside geopolitical risks and increased frequency of human spaceflight have raised alarms for analysts. 76% of respondents to the WEF’s Global Risks Perceptions Survey said that international risk mitigation efforts in space were either totally absent or in the earliest stages.

Still, insurers continue to underwrite satellite operators, braving the high-risk and, often, high-reward space environment. With higher risk, the environment gets tricker to navigate and premiums are more complicated to work out. Nonetheless, industry insiders say there’s plenty of cash to be made in writing smart policies for space players.

The state of the space insurance market

In the US, launchers are required by law to procure liability insurance for each mission, covering the launch personnel and the operator.

For satellite operators, though, it’s a different story. “Companies in the US aren’t required right now by the regulators to actually procure any type of liability insurance,” Patton Kline, a senior VP at Marsh’s aviation and space practice, told Payload.

Whether satellite operators are required to buy insurance varies depending on where the company is based. EU and UK satellite operators, for example, are required by regulators to purchase liability insurance on their satellites.

On the insurance provider side, space is an opportunity to capitalize on a unique risk environment that’s entirely siloed from conditions on Earth.

“Space is very interesting as a line of business for an insurance company, because it is uncorrelated from any other class of business,” Denis Bensoussan, head of space at Beazley, a London-based insurer, told Payload. When natural disaster strikes on Earth, every part of a general insurer’s portfolio can be affected. Space assets are unaffected by terrestrial conditions, so they can pick up the slack when the insurer’s other businesses are making claims.

A quick history lesson…

Geosynchronous satellite operators have a long history of procuring insurance for their satellites. Lloyd’s of London wrote the first space insurance policy in 1965.

In 1967, the US, UK and Soviet Union opened the Outer Space Treaty for signatures. The treaty entered into force later that year. Under Article VII of the treaty, launching states are liable for any damage caused by their space assets to people in another signatory country. The treaty doesn’t address damage caused to another country’s assets.

Premiums for space asset coverage have historically been high, reflecting the nascent and risky technology. They can be 10-20x higher than aviation premiums. But between the ‘60s and the 2010s, premiums dropped to ~5-20% of the policy cost, depending on the insurer and reviews of individual systems. Between 2002 and 2019, each year saw a further decrease in premiums (minus a small hiccup in 2007), though the space insurance industry’s margins grew narrower and narrower.

Things changed, though, leading up to the 2020s. In 2018 and 2019, losses exceeded gross premiums—and in 2019, total losses amounted to nearly $800M, compared to $400-450M in gross premium value. “That essentially doubled and tripled premiums in some cases over, really, a very short amount of time,” Kline said.

A few high-profile failures drove the losses in 2019. A Chinese satellite failed to deploy its solar panels in orbit in August, resulting in ~$250M in losses for insurers. A Vega launch failure later on resulted in $414M in losses—the largest space insurance loss ever. Two other failures led to an additional ~$200M in losses. In early 2020, the radio satellite SXM-7 failed, leading to a loss of $225M for insurers, which many underwriters counted toward 2019 numbers.

At the time, Assure Space, a top space insurer, made waves by announcing that it would no longer cover satellites in LEO, except for a few policies that excluded collision coverage.

The insurance industry has reaped a profit on space policies each year since 2019 (though it was a close shave in 2020), and premiums have fallen back down to about 5-20% of the policy value. 2022 insurance industry capacity is back to pre-2019 levels, driven by new entrants in the space industry.

GEO vs. LEO insurance

The satellite insurance market in GEO is well-established. Most owner-operators purchase a standard policy for launch plus one year in orbit, then may renew on an annual basis. It’s a pretty straightforward process, considering the fact that it involves an asset circling the globe at 17,000 miles per hour.

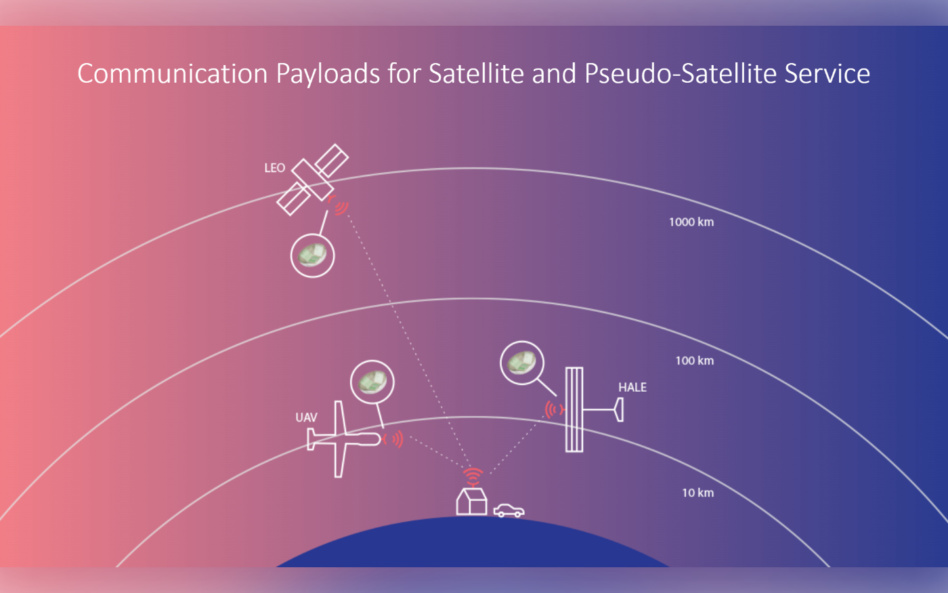

LEO, though, is a much newer market, and most of the technology headed there is newer and has less flight heritage for insurers to look back on. It’s a lot less common to find operators closer to Earth purchasing insurance for their satellites.

“Traditionally, I would say, GEO comm operators usually procure launch plus one year in orbit,” Kline said. “For some of the newer operators, for some of the smallsat companies or for some of the constellations, a lot of times they’re procuring launch-only coverage. And a lot of times, that’s because they have a lot of satellites up there and they may have redundancy in their constellation already.”

It’s all about risk tolerance. If an operator is building a LEO megaconstellation, chances are they’re expecting a handful of them to fail, so taking out insurance on each individual satellite doesn’t make much sense. These individual satellites are also far cheaper to produce than large GEO buses, so if a few don’t work, the losses are minimal, relatively speaking.

“Most of the players in LEO are either new or in the development phase, and they don’t really have the revenue base or clients that need to be protected at this stage,” Bensoussan said.

The differences in modes of financing for GEO and LEO birds also contributes to the likelihood they’ll procure insurance. In general, operators in GEO are older, revenue-generating companies. When an established GEO owner-operator wants to launch a satellite worth $100M+, it’ll finance that project by raising debt. Lenders generally require as part of the terms of financing that operators insure the cost of the satellite.

“Banks are very conservative,” Bensoussan said. “They want to make sure that the asset is protected. And if the asset fails, they want to get compensation from the insurance.”

Broadly speaking, though, LEO operators tend to be venture-backed and newer to space (and have yet to discover solvency). They’re acting with a build-fast-and-break-things mindset, and the investors financing those projects are more willing to accept the risk that things might break after launch.

“LEO operators are mostly using venture capital money,” Bensoussan said. “And venture capital money has a different appetite toward risk, or technical risks, than banks.”

Changing with the times

To an extent, premiums are linked to flight heritage, reliability, and underwriter reviews.

If you’re launching a satellite on a rocket with a longer history of success, the insurance premium as a proportion of the total policy will be lower than if you’re flying with a newer, less proven rocket.

Same goes for satellite premiums. Experienced underwriters go through a detailed review of new satellite systems before determining premiums. If a satellite is using proven systems with flight heritage, its premiums will be lower than an experimental satellite that an underwriter deems more likely to fail.

Determining premiums doesn’t just hinge on an individual system’s successes and failures, but also on the space industry as a whole. If, as in 2018 and 2019, a series of insured launches fail and those operators submit claims, then the insurance industry will have to raise premiums across the board to offset losses.

Launch tests are often not insured at all. If they are, they’re typically insured under small policies. American operators tend not to insure their experimental satellites at all, and operators in higher-risk environments like LEO also frequently forgo insurance. About half of all new satellites are insured.

Premiums now are sitting at ~5-20%, depending on a number of factors including heritage and maturity.

Looking forward…

We often say here at Payload that the space industry is at an inflection point. In the coming years, the industry expects the gravy train to keep rolling. Launches will get more and more frequent, new medium- and heavy-lift rockets will come online, and tens of thousands of new satellites will take up residence in Earth’s orbit over the next decade.

The space insurance market is poised to change, too. Bensoussan says that as the LEO market matures and begins generating revenue, operators will eventually have to warm to the idea of buying satellite insurance.

“It’s a sort of learning curve, and most of the players have not matured yet to the point where insurance is becoming…a necessary step they need to take,” said Bensoussan. “We’re going to see much more demand for insurance from the LEO world, but I think it would take us to adapt to the new paradigm in LEO.”