The Earth observation market is refocusing efforts on profitability, government funding, and addressing niche issues, as commercial demand has not yet materialized to the extent many anticipated.

EO insiders estimate today’s market consists of about 50% US government, 25% allied government, and 25% commercial, the latter of which primarily serves markets such as insurance, oil and gas, property, critical infrastructure, and supply chain.

“The commercial sector has recently been more budget constrained, given macroeconomic headwinds,” a Planet spokesperson told Payload. “In the near term, we expect growth will be driven by the government sector, particularly during the period of heightened security, increased sustainability priorities, and climate risks.”

With the commercial market in flux, EO companies are re-falling in love with government customers—and their large budgets. “If half the market is the US government, why wouldn’t I focus on it?” Umbra cofounder Gabe Dominocielo told Payload.

Internationally, governments are preparing to spend big bucks on using eyes in the sky to address increasing global geopolitical conflict.

“Overseas defense budgets are increasing as a percentage of GDP,” BlackSky CEO Brian E. O’Toole told Payload. “And within that dynamic, increasingly larger portions of investment are going to space-based capabilities.”

The drawback of relying on government funding is that budgets do not expand exponentially, and the federal EO budget is likely to be divided into even smaller pieces to try to accommodate new startups entering the market.

Public EO: Some of the largest EO players are publicly traded, providing unique insight into market size and growth:

Previous FY revenue:

- Planet ($PL): $220.7M, 15% YoY growth

- Spire Global ($SPIR): $105.7M, 31.7% YoY growth

- BlackSky ($BSKY): $94.5M, 44.6% YoY growth

Maxar—which was taken private last year at a $6.4B valuation—generates well over a billion dollars in annual revenue, though that number has been declining.

Maxar, Planet, Spire, and BlackSky have all been around for 10+ years and are refocusing their efforts on profitability.

Previous FY Net Loss:

- Planet: $140.5M, a 13% YoY improvement

- BlackSky: $53.9M, a 27% YoY improvement

- Spire Global: $64M, a 28% YoY improvement

Spire Global achieved positive cash flow in Q1. BlackSky reported positive net income in Q3, and just $3.8M in losses in Q4.

Early mover advantage: The early movers in the field have managed to secure a strong foothold through substantial initial investments, creating a barrier to entry that could stave off startup encroachment.

Umbra, a synthetic aperture radar imaging provider, spent years investing in R&D and capex to build out its constellation.

“We’re in our ninth year; imagine a newcomer having to compete with that,” Dominocielo said. “Do you really want to go out and raise $300M?”

Bye-bye widget: Despite a maturing market and capable market leaders, VCs were still keen on EO in 2023. However, investors are getting pickier about product market fit and differentiation.

“There’s no longer free money to build a cool capability,” Aravind Ravichandran, founder of TerraWatch Space Advisory and Insights, told Payload. “The product has to solve a specific problem, and there has to be demand for it.”

Differentiation: For startups navigating rough funding waters, success lies in distinguishing oneself through speed, quality, price, or specific niche capabilities.

Niche capabilities include a focus on data and analytics, edge computing, hyperspectral, climate detection, sovereign services, VLEO higher resolution imaging, or superior unit economics to offer a better price.

So who got funded in 2023?

- Tomorrow.IO raised an $87M Series E funding round for its weather intelligence and climate security platform.

- SatSure, an India-based multispectral satellite startup, secured $15M Series A.

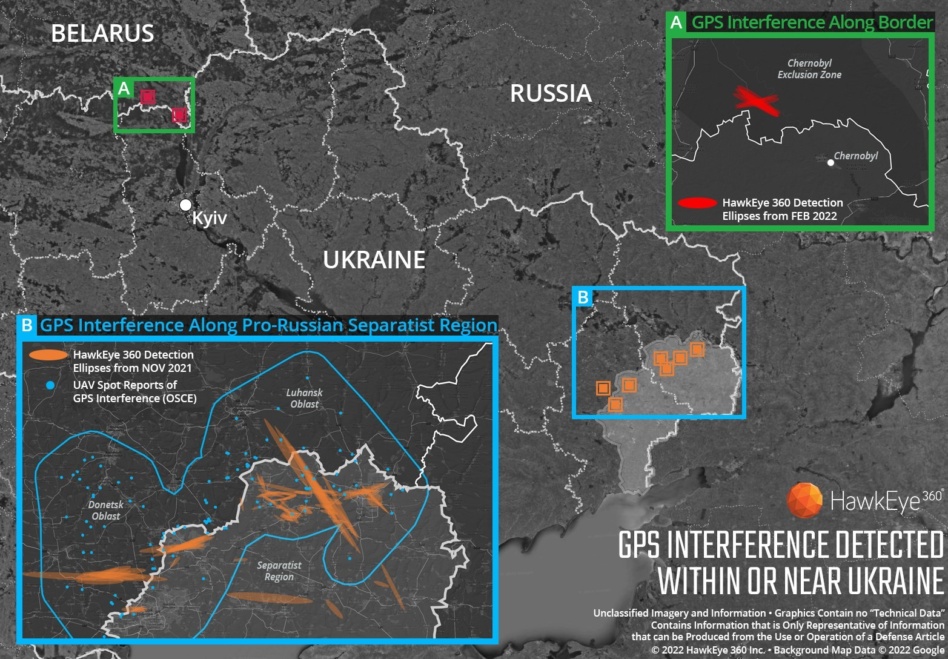

- Hawkeye 360 raised a $58M Series D-1 round for its radio frequency sensing satellites.

- Capella Space nabbed $60M in growth equity financing to expand its SAR imaging capabilities.

- constellr secured a €17M ($18.3M) seed round for its temperature, water, and carbon measurement for the agricultural sector

- Airmo raised €5.2M ($5.6M) of pre-seed funding to build its greenhouse gas monitoring constellation.

- Pixxel secured a $36M Series B funding round led by Google for its hyperspectral data.

- Hydrosat raised a $20M Series A for climate monitoring thermal infrared data.

- Kuva raised a €16.6M ($17.6M) Series A for its hyperspectral satellites.

This year, Albedo nabbed a $35M Series A-1 round for its VLEO (an orbit nearly twice as close to the Earth as LEO) satellites.

Albedo CEO Topher Haddad told Payload that while he doesn’t see the commercial market as “roaring,” the company is looking to differentiate itself and expand the overall EO total by building satellites that will be capable of capturing industry-leading 10-cm optical imaging. The company believes the high-resolution imaging will allow them to enter the drones and planes sensing market.

SpaceX EO

Reuters reported that the NRO is paying SpaceX $1.8B to build a remote-sensing constellation. While EO is not SpaceX’s core competency, the government presumably viewed SpaceX’s proposal favorably due to its history of delivering top-notch service at ultra-low cost. No one is better at building and launching satellites inexpensively than SpaceX, and slapping on a remote sensing payload should be relatively straightforward.

Nonetheless, the government’s selection of SpaceX speaks to the state of the EO market.

“It says the current state of the industry is not that great, [the NRO] doesn’t appreciate the level of scale or quality the market has,” Ravichandran told Payload.

EO is Data for the World

At its core, EO is a data-producing machine.

“I’m long knowledge, and being short Earth observation is being short knowledge,” said Umbra cofounder Dominocielo.

The bull case for the industry hinges on the world’s demand for more information, including data for modern defense, businesses, environmental monitoring, or AI, the latter of which in particular provides a unique opportunity for industry growth.

Spire Global recently announced a partnership with Nvidia to build out an AI weather platform.

“We have unique data from our hundred satellites in space, and Nvidia saw that, we started talking about it, and they wanted us to be an early adopter of their Earth-2 platform,” Mike Eilts, Spire’s general manager for weather and climate, recently told Payload.

Planet also sees the AI wave as a key driver of market growth.

“Planet captures an unprecedented amount of unique data each day, and it would be impossible for humans to review, consume, and derive insights from manually,” a Planet spokesperson said. “AI tools can allow Planet, and our customers and partners, to make satellite imagery more consumable and digestible, enabling users to more easily parse through this data and make informed decisions.”