A year that began with the cancellation of NASA’s flagship mission for orbital servicing, assembly, and manufacturing may seem inauspicious for companies with similar goals, but in part, it’s a signal that entrepreneurs (and the DOD) are ahead of the civil space agency.

OSAM-1 started in 2016 as a mission to refuel an aging LandSat, but gradually gained new mission goals involving a robotic arm that would build a communications antenna and assemble a truss akin to the structures on the ISS. The program, however, suffered from delays at prime contractor Maxar, and was canceled to clear the way for other projects.

But one key justification to end the effort, per NASA: “Surveys of industry members have revealed no dependence on OSAM-1 technologies nor technology gaps that OSAM-1 uniquely fills.”

That’s because private companies are already launching missions—though still largely demonstrations—that capture the key technology needs for OSAM activity, including rendezvous and proximity operations between spacecraft, robotic manipulation, the design of upgradable spacecraft, in-space refueling, the production of goods on orbit, and even the assembly of structures in space.

Unlike the other elements in our series—launch, satcom, and EO—OSAM is a grab bag of novel business plans made possible by the recent revolution in launch technology and burgeoning investment in on-orbit assets.

DEMAND SIGNAL

On-orbit servicing operations are in high demand. They are needed to protect the space environment from debris, to assemble commercial space stations in LEO, and to allow for updating assets in orbit, a priority for the DoD.

These efforts are characterized by their technical novelty, but also the challenge of their business plans: The sector struggles with the chicken-and-egg problem that characterizes many new markets.

Consider refueling satellites: Before satellite operators invest in engineering spacecraft that can be refilled in orbit, they need to know there will be someone to do that refueling—but those companies can’t raise money to launch their businesses without evidence that there will be satellites with ports. That’s one reason for organizations like CONFERS, which brings together stakeholders in satellite servicing to figure out useful standards and norms to undergird the nascent industry.

Despite the challenges, the promise of terrestrial efficiency in orbit, and the government’s willingness to back these ideas, has put the wheels in motion that could lead to significant benefits—and possibly, the first space-native business empires.

UP CLOSE AND PERSONAL

Successful rendezvous and proximity operations (RPO) require GNC systems that can operate autonomously using optical and lidar sensors, often relying on computer vision, and reliable and precise propulsion systems.

The first private companies to demonstrate this were SpaceX and Orbital Sciences while building autonomous resupply spacecraft for the ISS’s commercial cargo program. NASA’s care for the humans onboard the ISS led to deep scrutiny of these systems, but it paid off for both companies—SpaceX’s navigation tech fed into the crew Dragon, while Northrop acquired Orbital Sciences, which fed technology into its industry-leading mission extension program.

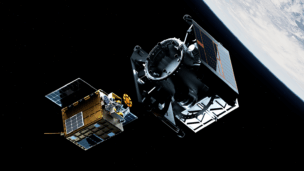

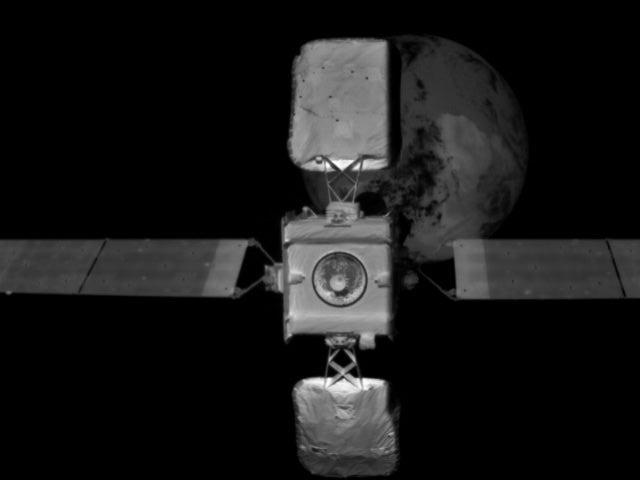

SpaceLogistics, the OSAM-focused Northrop subsidiary, has made the largest strides in this regard: In 2020, its Mission Extension Vehicle docked with an Intelsat spacecraft in geostationary orbit, using its thrusters and guidance systems to keep the satellite operational beyond its expected lifespan; the company performed a second life-extension mission in 2021. In 2025, the company will launch its Mission Robotic Vehicle, which will use a robotic arm to affix modular propulsion systems to spacecraft to keep them in orbit longer.

LOOK AT THAT JUNK, MOVE THAT JUNK

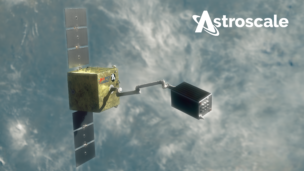

Smaller start-ups are making a go at these kinds of operations as well. Astroscale has already performed one RPO demonstration with its ELSA-D mission in 2021, and is midway through its ADRAS-J mission. That partnership with JAXA will see Astroscale’s spacecraft travel to an abandoned rocket body in orbit and inspect it, then attempt to synchronize its spin with that of the target. The demonstration is expected to pave the way for a follow-on JAXA mission that will fund a vehicle to grapple the rocket body and pull it out of orbit.

Astroscale has several other pilot missions in the works, as does its European competitor ClearSpace, which has won multiple government contracts to remove junk from orbit.

But the structure of these missions also shows the business challenge faced by these companies: Figuring out who is going to pay for their work. The Secure World Foundation is convening stakeholders at a July conference in Tokyo to talk about just these questions.

FILL ‘ER UP

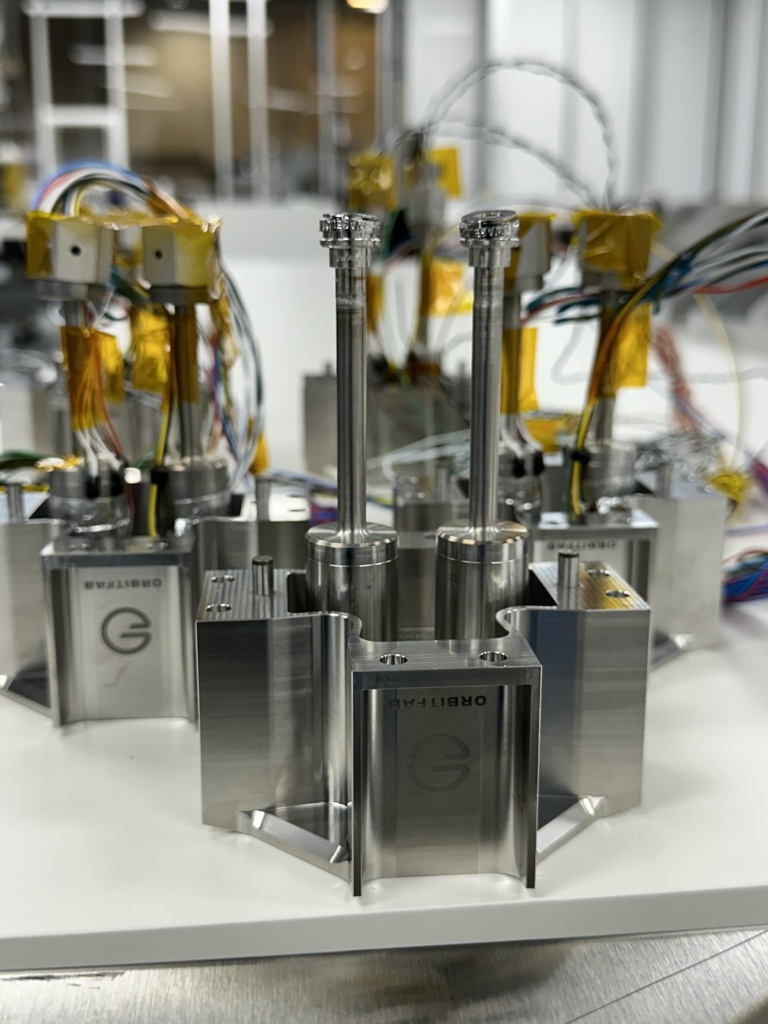

As Northrop’s MEVs shows, one of the first ways to make money at servicing is keeping satellites alive longer, so companies are looking for ways to reorient the ecosystem towards satellites that are designed to be refueled. Northrop’s design for a fuel port, for instance, has been chosen as one potential standard by the US Space Force, which can make the design available to its contractors.

The start-up Orbit Fab has taken a similar approach with its recently released RAFTI fuel port—while capable of in-space replenishment, the component is designed to be used for routine propellant loading before launch as well. The goal is wide adoption of the port, which will lay the groundwork for Orbit Fab’s real business plan to become a universal gas station in space, per CEO Daniel Faber.

It’s no accident that Space Force is an early adopter of Orbit Fab’s tech, with a demo mission expected next year. As US rivals increasingly gain the ability to threaten US space assets with attacks, and become more reliant on their own spacecraft for military purposes, American strategists are increasingly focused on enabling their satellites to maneuver and react to threats in their environment. That means an end to the days of limited propellant supplies, if they can build up the commercial ecosystem to support that vision.

The propellants we’re discussing here, however, are more easily stored than the cryogenic propellants used by large spacecraft. As part of its Artemis mission to return the Moon, NASA is funding both SpaceX and Blue Origin to develop refuelable Moon landers that rely on cryogenic propellants. Both companies are working to demonstrate the techniques, with Blue having tapped Lockheed Martin to build a propellant-transporting spacecraft as well. The March Starship flight test included a demonstration of internal fuel transfer, and we can expect more work on that path as the vehicle achieves orbital flight.

As an operator of many aging space assets, the government can support the burgeoning industry by hiring companies to help keep them operating. NASA has raised the possibility of a private mission to keep the Hubble Space Telescope operating as a potential partnership with SpaceX’s Polaris Program. In this year’s budget, the Space Force disclosed that it was in discussions with NASA about a potential OSAM mission to reactivate the Spitzer Space Telescope, an infrared observatory that NASA shut down in 2020. On a smaller scale, the OSAM start-up Katalyst is building a sensor package that will be bolted on to an aging Space Force satellite to turn it into a training platform.

“The problem with in-space servicing has always been [that] nobody builds satellites to be serviced… [we] started with one half of that problem, retrofitting satellites that weren’t designed for upgrade in the first place,” Katalyst CEO Ghonhee Lee told Payload.

IF YOU BUILD IT…

The production of goods on orbit is becoming increasingly important as the US decides to replace the ISS with commercially-operated LEO destinations. The companies building those habitats, including Axiom Space, Vast, Voyager, and Blue Origin, need to figure out how to make money off their investments. There’s hope that the kind of microgravity research happening at the ISS now can be the beginning of larger investments in orbital production.

However, the right model has yet to emerge—will it require astronauts, or automated free-flying factories in orbit? Varda Space, a start-up, launched its first mission in 2023, which saw its automated capsule fabricate microcrystals of ritonavir, an HIV medication. After a few months of regulatory delay, the company was able to return its capsule to Earth and assess the medication. Varda reports that the first demonstration was successful, which could tee up efforts to scale production of similar crystalline drugs that can be manufactured more efficiently in orbit. SpaceTango, a spin-out from the University of Kentucky, already builds automated research platforms for experimenters onboard the ISS, is also working on a free-flying orbital platform designed for space manufacturing

One challenge is simply the supply chain: Even in our current renaissance of spaceflight, companies still aren’t seeing the cadence of flights to and from LEO that would allow them to iterate quickly. Nicole Wallace, the CEO of LambdaVision, a company that has flown nine missions to the ISS developing an artificial retina to fight blindness, says scaling will require access to more orbital labs.

ROBOTS AND WHAT THEY BUILD

Space servicing isn’t new—astronauts in the Space Shuttle days fixed a number of spacecraft, most notably making multiple repairs and enhancements to the Hubble Space Telescope. But people are still mostly too expensive to rely on for a space business.

The main capability gap facing OSAM companies is robotics—obtaining a precise autonomous manipulator that can operate in the space environment isn’t easy. Northrop Grumman’s MRV, for example, will feature an arm built by the Naval Research Laboratory. The kind of large-scale assembly envisioned by OSAM-1 isn’t on any commercial firm’s schedule at the moment.

One contender for industry leader in autonomous manipulation is Motiv Space Systems, which built the robotic arm onboard the Mars Perseverance Rover and is currently building a robotic arm for lunar missions.

Another is GITAI, a Japanese start-up that launched a pair of robots to the ISS earlier this year; it already demoed another robotic arm to assemble solar panels inside the station in 2021. CEO Sho Nakonose envisions his firm as a space construction company, but to march up the value chain, plans to begin with in-space servicing and deorbit capability.

These robotic manipulators are candidates to partner with companies building servicing spacecraft—one trend we’re likely to see are more link-ups between companies who have developed capabilities in the relevant technology areas, since few companies have the expertise and capital to tackle any one of these projects at once.