Pine Technology Acquisition Corp (NASDAQ:PTOC) and Tomorrow.io (née ClimaCell) have called off their SPAC merger, the two said yesterday. $PTOC closed the day down ~1.4%.

Announced Dec. 7, the transaction was expected to give the weather forecasting company (and nascent constellation developer) a $1.2B post-deal valuation, while providing Tomorrow.io with up to $420M in gross proceeds.

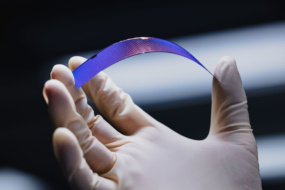

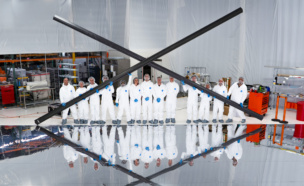

- Tomorrow.io planned to use the windfall from going public to finance the production of a 32-smallsat constellation. These satellites will be fitted with proprietary storm-tracking radars, to boost weather forecasting capabilities.

- The startup counts Uber, Ford, Delta, and JetBlue as customers, among other companies (and government users).

PTOC’s POV: The SPAC cited “market conditions” for agreeing to terminate the merger. It’s back on the hunt for another target, and has until March 15, 2023 to complete a merger.

Tomorrow’s take

“Our mission does not change and neither do our growth plans,” CMO Dan Slagen told Payload via email. “Our constellation marches forward as planned.”

- While Pine Technology was and is a “tremendous partner,” Tomorrow.io CEO Shimon Elkabetz wrote in a LinkedIn note, it ultimately became clear in recent months “that the best choice for the company and its expansive growth is to remain private for now.”

- “Our duty is to ensure we choose the best way to operate towards our mission given changing macroeconomic conditions,” Elkabetz noted. The company will revisit public market options down the road.

The upshot

As we’ve written ad nauseum, SPACs have had a tough go in recent months. This called-off deal, along with a biopharma merger also canceled yesterday, represent the 9th and 10th canceled SPACs in 2022. On average, a SPAC has been called off every 6.6 days so far this year.

While industry watchers have said they expected a slowdown in space SPACs, most didn’t expect the spigot to shut off. We’ll be keeping close tabs on other announced mergers to see if deal-making completely drops off, especially in light of new geopolitical flux.