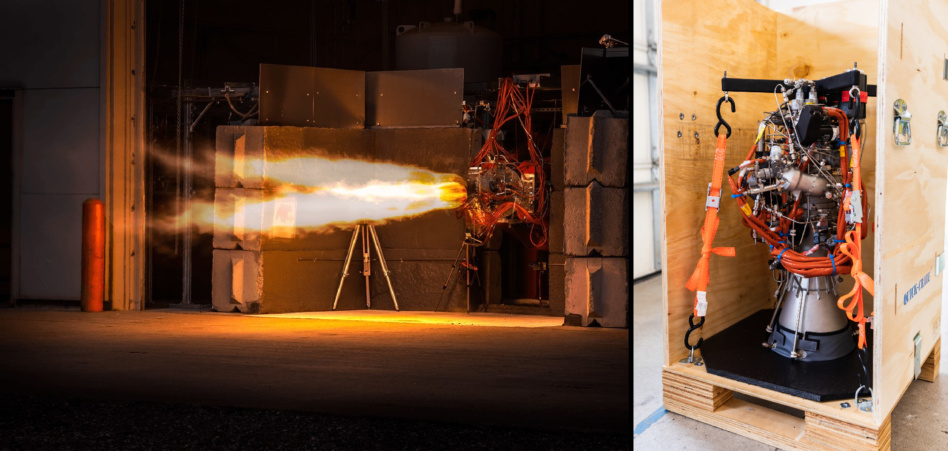

Images: Ursa Major. Left: Hadley hotfire @ Ursa Major HQ in Berthoud, CO. Right: Hadley being prepped for shipment.

Ursa Major officially signed its 200th employee this week, CEO Joe Laurienti tells Payload. The Colorado startup, which bills itself as “America’s only independent pure-play rocket propulsion company,” had just north of 125 employees in early December when it raised $85M.

So, using some back-of-the-envelope math, headcount jumped 60% in just over a quarter. Ursa Major also tells Payload that 75% of its technical team has previously worked at SpaceX or Blue Origin (Laurienti was previously at both, working on the Merlin and BE-3 engines).

Beyond the recruiting binge…

Ursa Major’s first production units have come off the manufacturing line. Two weeks ago, the startup said it’s delivered one Hadley engine apiece to Phantom Space and Stratolaunch.

- The company has 8–9 commercial customers, Laurienti tells Payload, and roughly a dozen government contracts.

- Ursa Major counts Pentagon entities and prime contractors as customers, but that’s about as specific as it will get. Laurienti declined to say who specifically is putting in Hadley orders.

…Hadley? Ursa Major’s first product is an oxygen-rich staged combustion engine with 5,000 pounds of thrust. Ripley, Hadley’s bigger sister, is 10X more powerful but still under development. Finally, there’s Sneaky, which is Payload’s name for a third-gen propulsion system that Ursa Major has teased but kept under wraps.

Flip the script

Ursa Major wants to turn the industry playbook of vertical integration on its head. Rather than build all or most of a vehicle, this horizontal integration evangelist is heads-down making liquid rocket engines for three verticals: 1) space launch, 2) on-orbit propulsion, and 3) hypersonics.

While this isn’t a new idea, it has fallen out of favor over the decades. Laurienti gets pretty animated about the state of the US launch and defense industrial base.

- Reacting to a recently blocked takeover deal, Laurienti says: “Aerojet has found a niche in repurposing very old technology because they have been the only player in town.”

- “Our current and potential DoD customers are excited about what Ursa Major can do,” Laurienti says. Your consolidation is my opportunity, as the saying goes.

Impacts of the war

Ursa Major has estimated that $2.1–$2.4B of “immediate market vacuum” in launch was created from Russia’s invasion of Ukraine. Soyuz isn’t flying Western payloads, RD-180s are off the market, and Ukrainian engine-making has dropped to a standstill.

- “We’ve actually received outreach from Ukrainian companies,” Laurienti says. They’ve asked: “‘Can we safe-harbor IP?’ Nothing’s advanced there yet, but the amount of outreach has been pretty overwhelming.”

Time to ramp

Ursa Major delivered 4–6 pre-production engines over the last two years. Right now, it’s at an engine every ~2.5 weeks, and by the end of Q2, Laurienti says “we will have delivered probably 12 engines this year.” By the end of 2022, Laurienti says he’s confident that Ursa Major will have made 30 engines and be producing them at a rate of one per week.