On Wednesday, the Department of Defense released a report on the state of competition in the defense industrial base (DIB).

So, how is the state of competition? Not great, per the report.

Synopsis: Since the 1990s, consolidation has hit the aerospace and defense sectors harder than most. There were 51 prime contractors in the ’90s. Now, there are five: Lockheed Martin (NYSE:LMT), Raytheon (NYSE:RTX), General Dynamics (NYSE:GD), Northrop Grumman (NYSE:NOC), and Boeing (NYSE:BA).

Space: Satellite suppliers have been cut in half, the report notes, from eight in 1990 to four in 2020: Boeing, Hughes (owned by EchoStar, NASDAQ:SATS), Lockheed, and Northrop.

- In the expendable launch vehicle category, there were six providers in 1990. Now, there are two. Note: Reusable vehicles are not mentioned…

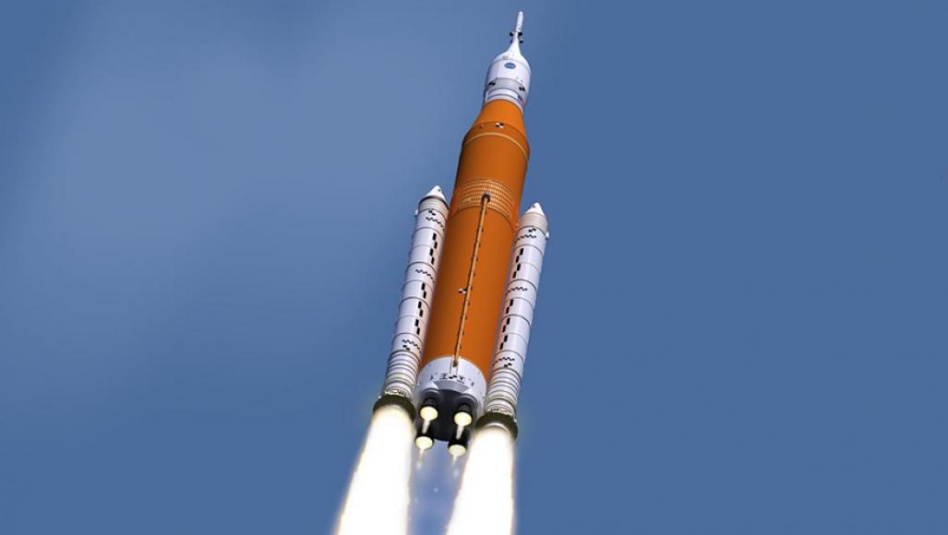

- Though the report doesn’t call out the now-nixed Lockheed/Aerojet acquisition, it does touch on propulsion consolidation (see picture above). Only two domestic suppliers remain, the report notes.

Other notable themes: Vertical mergers (acquiring a company in your supply chain) have become more popular in recent years. Low interest rates fuel more M&A activity. Finally…”Consolidation in the US defense industry historically increases under budget reduction pressures and slows during periods of growth.”

The report, per the White House, proposes a course of action for the Pentagon “to rebuild its competitive bench, lower costs for taxpayers, and safeguard [US] national security.” The report’s five overarching recommendations:

- Strengthen merger oversight (ahem).

- Reduce IP limitations.

- Encourage new entrants (ie, reduce barriers to entry for the non-primes).

- Increase “opportunities for small businesses.”

- Implement “sector-specific supply chain resiliency plans.”

“These efforts to increase competition will deliver benefits for cost, schedule, quality, performance, innovation, and industrial capacity,” the DoD said.

+ And while we’re here: Space features prominently in the declassified version of a US Government Accountability Office (GAO) report about the Pentagon’s strategic challenges vis-à-vis China.