Ursa Major has struck a deal to supply Vector Launch with “several” propulsion systems, the company tells Payload. Ursa’s Hadley engines will power the main stage of the Vector-R launch vehicle in future demonstration missions for national security customers.

A word on Vector: The seven-year-old startup, which has raised more than $180M, declared bankruptcy in 2019. The thought-to-be-dead rocket developer is in fact not dead, and last October, tweeted a photo of its Vector-R, with strong “rumors of my demise were greatly exaggerated” vibes:

That first mission, according to Vector, will demonstrate its liquid-fueled rocket technology…and:

- A responsive mobile Transporter Erector Launcher (TEL)

- A remotely controlled command subsystem

- Reusable launch hardware

Where Ursa Major comes in

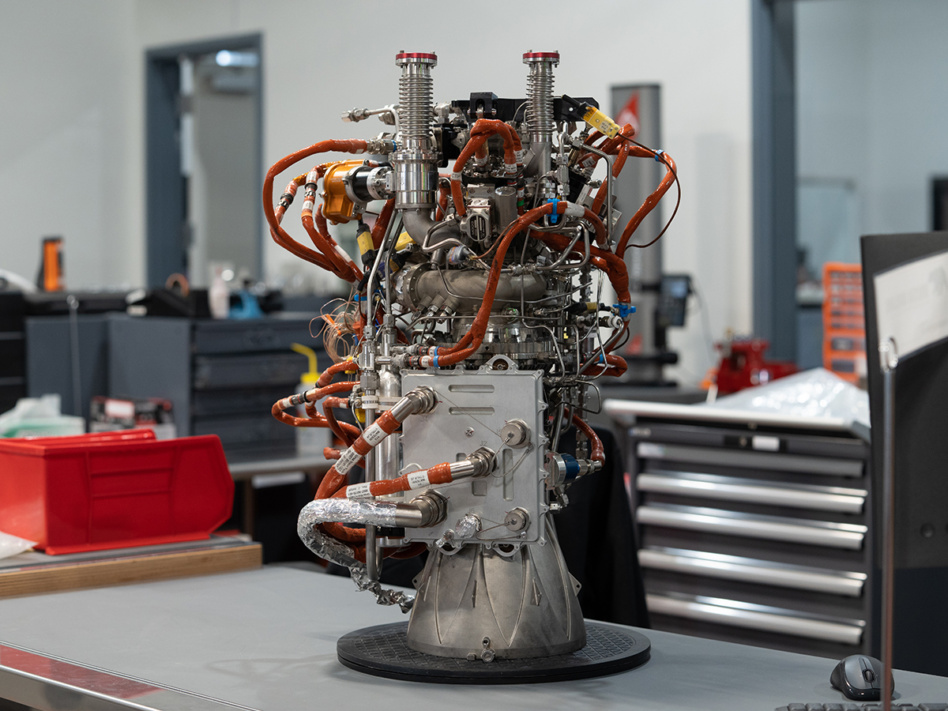

The pure-play propulsion provider will supply Vector with Hadley, its 5,000-pound thrust, oxygen-rich staged combustion engine. Ursa Major is supplying Hadleys to Phantom, Stratolaunch, and a handful of other commercial and government customers. The startup’s target markets are A) launch, B) hypersonic systems, and C) in-space transportation.

For details on the partnership, check out today’s Pathfinder with Ursa Major CEO Joe Laurienti. To skip right to the Vector news, click here.

A deep dive on Ursa Major

For today’s Pathfinder podcast, we sit down with Joe Laurienti for 50 minutes.

Joe cut his teeth at SpaceX and Blue Origin before setting out on his own and starting Ursa Major in 2015. The Colorado upstart raised $85M in December 2021 and started ramping engine production last year. It has two bigger, badder beasts in the works: Ripley, Hadley’s bigger sister, is 10X more powerful. Arroway, which is further out, is a 200,000-pound thrust, liquid oxygen and methane staged combustion engine.

On today’s show, Joe and Ryan talk about the startup’s family of engines; its origin story; and how big of a market Ursa Major believes it’s going after. We also discuss:

- Joe’s involvement with USC’s Rocket Propulsion Lab

- His time at SpaceX and Blue Origin

- Where headcount, production, and sales currently stand

- Ursa Major’s propulsion tech and production processes

- Reverse engineering the startup’s strategy

- Flipping the playbook of vertical integration on its head

- Ursa Major’s partnership with Vector, Phantom, and others

- Our Max Q questions: How many launch companies will really make it? Is small launch viable? Is the $4.7B sticker price of Aerojet Rocketdyne a valuation ceiling for companies building engines? How could Ursa Major become more valuable?