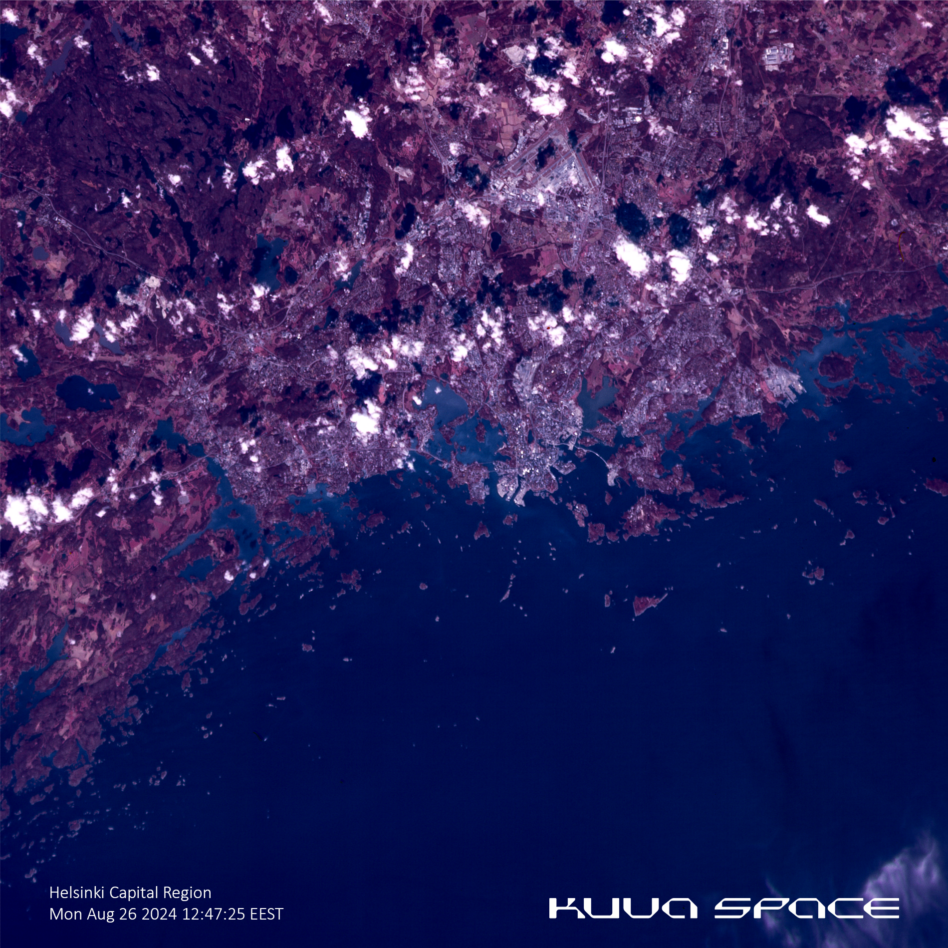

China has bested the US in the commercial remote sensing Olympics, at least according to the Center for Strategic and International Studies.

The think tank released a ranking yesterday that doled out four gold medals to American companies, compared to five awarded to Chinese firms.

Analysts from CSIS, Taylor Geospatial Institute, Taylor Geospatial Engine, and the United States Geospatial Intelligence Foundation compared publicly purchasable data from different providers across metrics like ground sample distance, resolution, collection capacity, and revisit.

While the results show improvement in US performance from a 2021 version of the exercise, authors of the study say it captures a dynamic state of competition and that US policymakers will need to learn from the outcome to see better performance down the line.

New is better: Eight systems—four from the US and four from China—made their podium debuts after being launched in 2021 or later. CSIS’ David Gauthier noted that Maxar’s WorldView satellites will likely win a podium spot when they come online soon.

Different needs: China’s dominance in some fields, like long-wave infrared and C-Band SAR, reflects the existence of existing civil systems in the US that likely precluded commercial efforts. Future US LWIR providers Albedo Space and Muon Space are expected to launch new spacecraft in 2025.

Look to Washington: To fuel continuous improvement, the authors advocate for the government to take a more active role in the sector as regulator, investor, and customer.

- Regulators need to allow for innovation—US SAR providers barely existed in 2017, but after NOAA loosened its rules in 2020 and 2023, US companies have emerged as industry leaders.

- The report noted something we’ve all seen: Private investment in new remote-sensing systems is trending down. More investment will be necessary for innovation.

- While the USG is now a significant customer for optical imagery, the report found that major contracts for other kinds of data, including SAR, hyperspectral, and radiofrequency, have yet to be awarded.

“Being a passive bystander and expecting market forces to drive the advance just isn’t going to be good enough,” Sue Gordon, a pioneer in US geospatial imagery who retired as deputy director of national intelligence, said. She noted that the intelligence community could learn from NASA’s model of funding commercial competitions to develop needed technology.