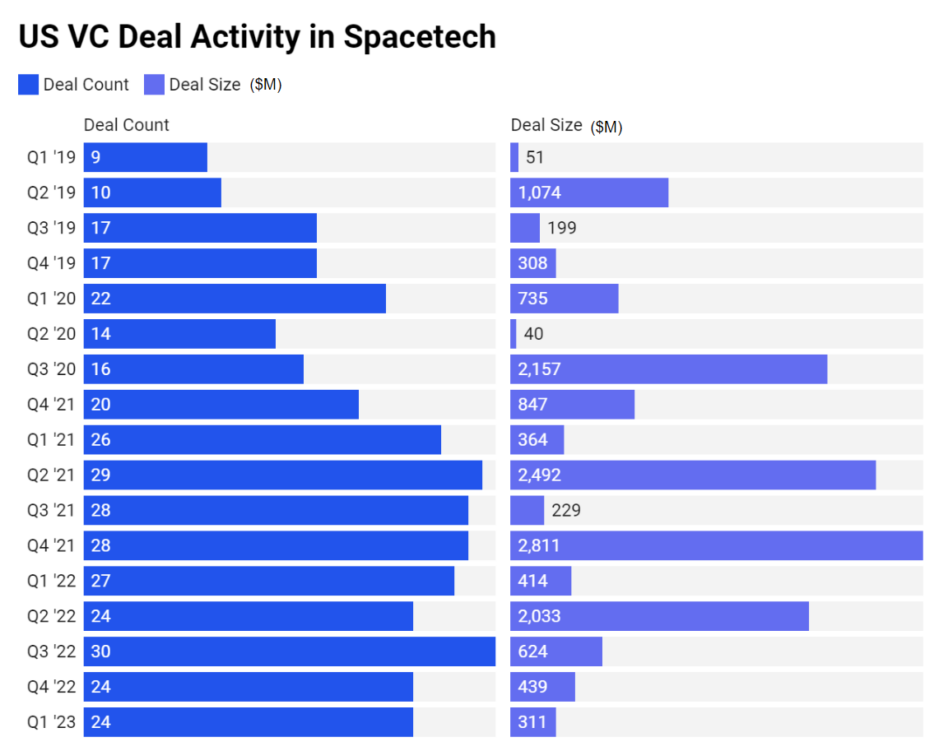

VCs invested $310.7M in the US space industry during the first quarter of 2023, according to new Pitchbook data. It’s the lowest amount since Q3 of 2021, but the 24 deals closed in the quarter is comparable to last quarter.

The biggest deals ranged across different segments of the industry from launch to manufacturing. These include:

- Voyager Space ($80.2M)

- Capella Space ($60M)

- Firefly Aerospace ($30.2M)

- Varda Space Industries ($30M)

- Spartan Radar ($17M)

- Atomos (Aerospace and Defense) ($16.2M)

- Axiom Space ($15.2M)

- Starfish Space ($13.4M)

- Frontier Aerospace ($10M)

- K2 Space ($8.5M)

Pitchbook reports two exits this past quarter totalling $245M.

Payload analysis: While transaction volume has remained the same, total funding is lower on more conservative valuation as VC firms better position themselves in the capital structure. Lower investment can be tied to higher interest rates as investors are more reticent to fund unprofitable space businesses.

Without the availability of inexpensive capital pools, deep tech space startups with decades long R&D schedules and high cash burn are increasingly at risk of consolidation or bankruptcy. This was evident in the recent Virgin Orbit’s insolvency.