Less than a year after acquiring European rival Inmarsat, Viasat ($VSAT) management told investors Tuesday night that the two companies’ operations had been integrated successfully.

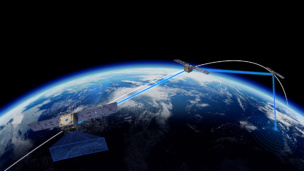

The companies hope the blockbuster deal will position them to compete with LEO satellite networks such as SpaceX’s Starlink and Amazon’s forthcoming Kuiper.

Top line: Despite 8% revenue growth to $1.1B last quarter and a $3.7B backlog, the satcom giant doesn’t expect to be generating positive free cash flow until 2025.

Instead, earnings are going into building and launching seven new spacecraft, a process that ran into trouble last year:

- The first ViaSat-3 satellite, launched in 2023, revealed an antenna problem that required correction on the second satellite in the series, which will now launch in early 2025.

- The third ViaSat-3 satellite uses a different antenna and will launch by the end of this year.

Doubled indemnity: Viasat said it submitted an insurance claim of $421M for the first ViaSat-3 satellite, and a $349M claim for an Inmarsat satellite that failed after launch in February 2023, with expectations to recoup their losses by 2025.

One bright spot is Viasat’s global in-flight connectivity business, which now plugs some 3,500 aircraft into the internet. Founder, CEO and chairman Mark Dankberg expects another 700 aircraft to join them in the next year. (It depends on how quickly manufacturers like Boeing and Airbus deliver them.)

Viasat’s variety of spacecraft makes it well suited to connect moving vehicles, and the company can manage peak demand at places like airports where lots of airliners are in one place.

“[Airlines] don’t get any credit from passengers for having WiFi if they don’t use it,” Dankberg said.