There’s opportunity aplenty in the Pentagon’s race to prepare for conflict in space, but companies are facing challenges aligning their technology, scale, and business model to take advantage.

Voyager Space is best known for its role in Starlab, a commercial space station being built as a joint venture with Airbus. However, the roll-up company books 50% of its revenue from national security customers, and last month, hired Matt Magaña, the former president of Blue Canyon Technologies, to fill a new role leading its defense business.

Goldilocks syndrome: Magaña spent 18 years at Raytheon Technologies before joining Blue Canyon when the prime purchased the small satellite builder in 2020, giving him a unique perspective on the challenges facing both established contractors and new entrants.

Start-ups can offer low prices to customers because they’re betting on future growth and haven’t capitalized all their investments, but that model can be difficult to scale, he said. Primes, on the other hand, carry massive infrastructure that can force their price points too high.

“We’ve got to turn the paradigm upside down [by] leveraging the commercial base, leveraging investors, and finding ways to bridge that gap between cool VC technology and huge, bureaucratic organizations,” he told Payload. “We’re really trying to find that middle space—we are a privately-funded company that actually is profitable today.”

Voyager defense: There are three major areas where Voyager is investing in national security space, Magaña said.

- Solid rockets: The company is working with Lockheed Martin to develop motors for the Next Generation Interceptor, and partnering with Raytheon on SM-3, a US Navy missile interceptor.

- Intelligence: Voyager sells TALIX, a signals intelligence and mission planning software tool that is also at the center of a partnership with Palantir, the defense software firm.

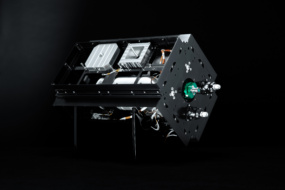

- Satellite payloads: The company is expanding its avionics business and pursuing laser optical communication terminals that are in high demand at the Pentagon.

“There’s a whole Air Force full of winged planes that are coming to the end of their life, that are all going to move into a space form,” Magaña said. “There’s not even enough throughput, even with SpaceX, to be able to handle all the multiple missions between the NRO, between the Space Force…there’s so many entities that are trying to bring capabilities there.”