Lockheed lobs an offer to buy Terran.

Lockheed Martin ($LMT) is seeking to add spacecraft manufacturer Terran Orbital ($LLAP) to its space portfolio, according to an SEC letter filed on March 1.

The offer to buy Terran at $1 per share is slightly below the company’s current share price of $1.07, but is an 11% premium relative to the 30-day average price of $0.90, according to Lockheed. The proposal would see the defense contractor giant pay out ~$600M to investors and debtholders.

How we got here: Lockheed Martin is a major Terran customer and investor. In 2022, the company invested $100M into Terran to help build out manufacturing capabilities. Lockheed’s current stake in the company exceeds 28%.

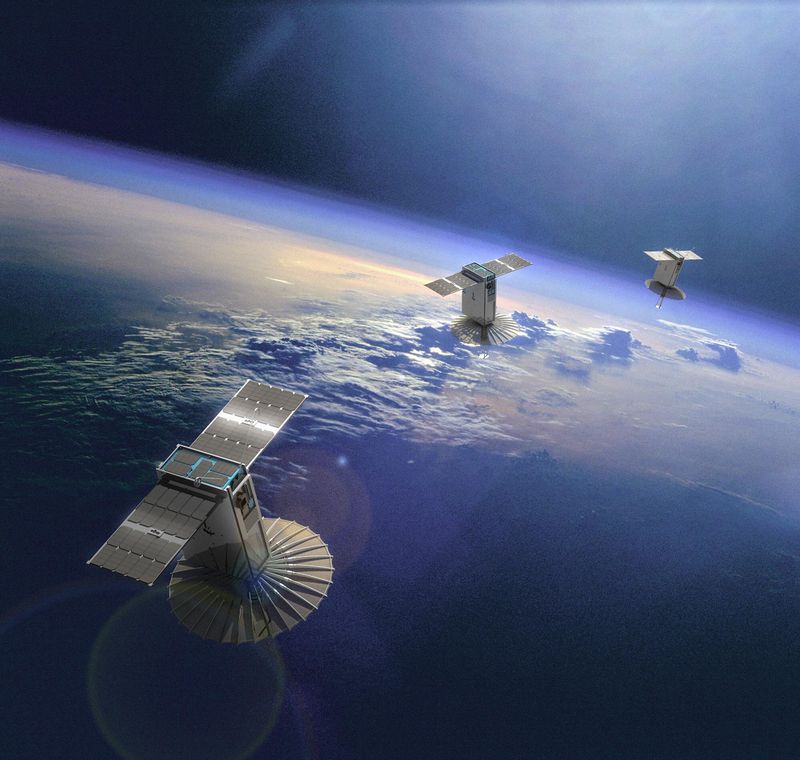

Lockheed relies heavily on Terran to build its satellite buses to fulfill its large SDA contracts

- In October, Lockheed awarded Terran Orbital a contract to build 36 Tranche 2 Transport Layer satellite buses.

- The company is also building 42 Lockheed buses for Tranche 1.

In the SEC filing, Lockheed said it was “Terran’s largest revenue-generating customer accounting for the majority of the backlog.” Terran also has a $2.4B mega contract with Rivada to build 300 internet satellites. The company recently received a milestone payment from Rivada, but Rivada has yet to become a significant revenue contributor.

Investor pulse: Terran reported $70M+ in Q4 cash balance, up from $38.7M in Q3. Considering the company’s average cash burn of ~$35M+ a quarter, investors are concerned about liquidity and long-term survival. Since going public via SPAC in 2022, share prices have plummeted nearly 90%.