With all eyes on swarming LEO constellations, you might think that satellites in GEO are falling behind, with future annual orders of the high-flying spacecraft expected to be cut in half.

But the future of the industry might come in a small package—or a large one.

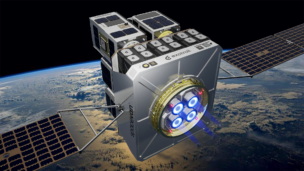

Micro: Makers of small satellites for GEO made up the bulk of newly announced spacecraft in 2023, with Astranis and SWISSto12 leading the pack. Astranis, which focuses on providing connectivity to regional and national partners, announced a new satellite this week, in partnership with South American ISP Orbith, which aims to boost connectivity in Argentina.

Despite suffering a malfunction attributed to a flawed solar panel on its first operational satellite, Arcturus, the company has a full manifest on each of its next two launches, expected this year and in 2025. CEO John Gedmark said the company expects to launch 20 spacecraft in the next three years.

How will it find them? ExoAnalytic Solutions, a space situational awareness provider, rolled out a new, low-cost GEO tracking product yesterday. The company, which operates a network of 400 telescopes that track objects in orbit with software initially developed for missile targeting, says it can track objects in GEO with uncertainties of less than 100 meters.

Astranis tested the service to track the deployment of its first satellite, while ViaSat is using it to track its own high-orbit spacecraft.

Is the next big thing…big? The other big hope for GEO birds is a renaissance in heavy lift, where competition between Vulcan, New Glenn, and Falcon Heavy drives down the cost of launching large spacecraft—or Starship becomes a regularly-flying commercial option. Cutting those costs could change the economics of big payloads in high orbit—something that start-ups like K2 are betting on.