The world is shrinking fast.

We’re more connected than ever, and we have the growth of satellite communications technologies to thank. In the past year alone, the satcom industry has made major advances in internet coverage, in-flight connectivity, technology development for direct-to-device, and emergency broadband services…the list goes on.

It hasn’t been easy for the industry. Many younger companies have struggled to secure funding for their large constellation amid the more restricted capital markets of the last year or two, and the path to generating revenue is still uncertain.

“We’re going through sort of a rough patch,” Iridium CEO Matt Desch told Payload, referring to the investment landscape for satcom. “Some of it is economically driven, but a lot of it is driven by the uncertainty in our market right now as a major disruptive force goes through.”

He’s referring, of course, to the elephant in the room.

The Starlink effect: SpaceX’s deployment of Starlink at breakneck speed is putting pressure on other LEO broadband players to remain competitive. When the biggest, most well-capitalized company in the space is launching several batches of new satellites per week, the companies who do not own their ride to space (read: every other satcom company) have to figure out how to succeed at the edge.

“You can’t not pay attention to what SpaceX and what potentially Amazon are doing, where they’re injecting tens of billions of dollars into the ecosystem,” Viasat’s president of global space networks, Craig Miller, told Payload. “That’s never been done before.”

The proliferation of Starlink and other broadband megaconstellations—Amazon’s Kuiper, Telesat’s Lightspeed, and OneWeb, to name a few—is leaving investors unsure of how and where to take advantage of the rapid change, and many younger players looking to deploy large constellations for connectivity are struggling to secure financing to reach the level of expansion they need.

The upshot: The story of the satellite communications industry over its lifetime has been a progressive movement toward mobility, globalization, and speed. Rapid change and the push for new market adoption over the last year is forcing the growth of partnerships and advancements in technology, while investors are left to figure out the businesses that have a chance of generating real revenues.

A push for proliferation and resilience

When Russia invaded Ukraine in February 2022, satellite communications systems were among the first technologies targeted. Russian forces brought down Viasat’s KA-SAT network on the eve of invasion, restricting the Ukrainian forces’ ability to securely share information, and they continue to look at communications as a point of vulnerability.

The response from governments has been a push for resilience, proliferation, and other security measures in satellite communications infrastructure—particularly in the US, where the DoD is grappling with how to prepare for potential conflict with China.

The SDA’s Proliferated Warfighter Space Architecture (PWSA) is central to US efforts to improve military communications. The agency has doled out billions of dollars to build the Transport Layer of its architecture, which is connected via laser links and is responsible for transmitting data quickly and securely from point to point. These contracts are massive windfalls for satellite manufacturers, and represent a large part of government investment in satcom.

The next generation of position, navigation, and timing (PNT) systems is also being developed as part of the push for resilience. The PWSA will incorporate an alternative PNT system (the Navigation Layer) that acts as a backup, and a number of space companies, including Xona Space and Satelles, which was recently acquired by Iridium, are developing commercial backups.

Direct to device

There’s a new target market for satellite connectivity services taking shape. The direct-to-device sector is eyeing the 5.5B mobile devices in operation around the world and the potential $300B up for grabs there, Lynk CEO Charles Miller told Payload.

“The reason it’s such a big deal is we’re not solving a problem in the satellite industry,” Lynk’s Miller said. “We’re not solving a problem in the space industry. The space and satellite industry is small compared to mobile wireless.”

On the mobile network operator (MNO) side, direct-to-device technology is seen as a potential new growth sector for an otherwise stagnating market that is facing a race to the bottom with speed and pricing.

It’s yet to be seen how exactly the D2D market will take shape. Satellite companies are approaching the market via two distinct paths for customer adoption:

- Partnerships with MNOs (Starlink, Lynk, AST SpaceMobile)

- Partnerships with manufacturers (Iridium’s standards-based approach, Apple and Globalstar)

An approach like Starlink’s has the potential benefit of allowing phones to maintain their connectivity across dead zones in regions where they’re already licensed—like making sure you don’t lose service when you’re out in a rural area, assuming there’s enough capacity on the network.

For Iridium, the standards-based Project Stardust approach aims to provide global coverage to devices that adopt Iridium’s hardware standards—a sector where the company says it’s signed hundreds of partnerships. Stardust “will give us a whole new low-cost set of product offerings that will integrate really nicely into the massive terrestrial IoT,” which has become core to the company’s offerings, Desch said.

Viasat’s Miller said that the company is also pursuing a direct-to-device path related to its involvement in the Mobile Satellite Services Association (MSSA), a spectrum-sharing group consisting of Viasat, Terrestar Solutions, Ligado Networks, Omnispace, and Yahsat. The alliance will take the regions of spectrum already held by these companies, which may be valid only in certain geographic regions or narrow frequency bands, and combine them to create a more global, continuous spectrum access to expand each company’s commercial offerings.

Consolidation down

The major GEO comms providers and broadcast companies have been surveying the growth of the industry, and all signs are pointing to the future being in A) mobile broadband and B) LEO. That, combined with the capital environment, has led to an increase in M&A activity in satellite communications, marked over the past year by Viasat’s acquisition of Inmarsat, Eutelsat and OneWeb’s merger, Echostar and Dish’s merger, and the talks between Intelsat and SES.

“That’s a very natural next step for folks to be able to respond to what the end users are asking for—the sense of always-on connectivity,” Nicole Robinson, chief growth officer of ground station operator Comtech, told Payload. “You can’t do that with one modality, with one orbit, with one set of frequencies. So having an integrated package, I think multi-orbit is a response to that, and the M&A activity is a reflection of that.”

The multi-orbit mergers in the field have a strategic angle as they expand. Viasat’s merger with Inmarsat, for example, takes the reliability and concentrated coverage of a legacy GEO constellation and combines it with the flexibility and global coverage of a LEO constellation, opening new opportunities and offerings in the in-flight connectivity sector, where the company is seeing the most growth.

“That’ll provide a huge uplift to what we’re able to do,” Viasat’s Miller said. “Instead of having two pots of capacity, we have one network that works together.”

Changes on the ground

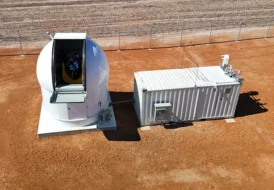

The increase in multi-orbit constellations presents a new challenge to ground station operators, which are evolving more flexibility in how they connect to satellites via new hardware and expanded capacity to receive transmissions across a variety of frequencies.

“The pace of play has changed,” Robinson said. “We have to evolve and innovate at the pace of the space segment right now. If it were just geostationary satellites, those were lasting 15–20 years in orbit, and the ground infrastructure really was keeping pace with that design life. Now with the LEO constellations, and with SES and their MEO constellation, roughly every three years you’re innovating on the space side. So you have to do the same on the ground side.”

The capital market cools

Capital has been harder to come by in the past few years. The satcom industry in particular has seen a tapering in private equity interest as the market has changed quickly—both due to Starlink’s rapid growth and other forces.

“There is a lot of pressure on the fixed broadband market, and at first glance, maybe it looks like it’s Starlink that’s doing it, but the real driver on that market is the proliferation of cable and fiber,” Viasat’s Miller said.

That’s led to shaky ground for comms companies looking to secure capital. “It’s probably a bit more of an uncertain market than the boom days of about five years ago, when, you know, everything looked possible, everything was being funded,” Desch said.

“Private equity investors as well have gotten kind of cold right now,” Desch added. “They’ve been burned. They’re seeing the disruption that’s going on in the industry, and they’re not exactly sure how to take advantage of it right now.”

The regulatory angle

The backbone of the satellite industry is broadband spectrum, and that’s a hotly contested and regrettably finite resource. As the LEO broadband industry grows quickly, regulatory bodies, including the UN-affiliated International Telecommunication Union (ITU) and the FCC in the US, are working out how best to deconflict and assign priority to companies while still enabling new services and companies to flourish.

- The ITU doesn’t have a mandate to encourage industry growth—it’s just making sure everyone’s abiding by their spectrum allotments and not causing interference and/or conflict.

- The FCC does have a responsibility to encourage industry growth in the US, and its position between operators vying for spectrum is not an easy place to be.

The rapid increase in the utilization of LEO over the past several years has left regulators to reevaluate how spectrum is allocated.

“If you look back at how the regulatory environment in GEO works, there’s a long-standing, 50–60 year history where orbital slots are allocated, and frequency and spectrum are allocated as part of an international agreement with well established sets of rules,” Viasat’s Miller said. “I think it’s been massively successful in that nobody owns GEO. There’s room for players of all shapes and sizes…There’s no framework like that in LEO, and it really is the Wild West.”