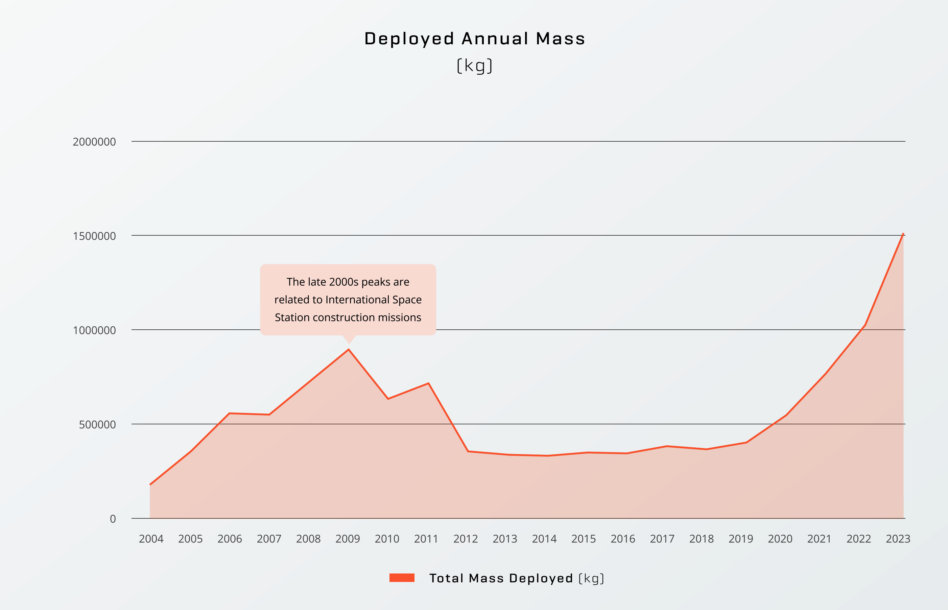

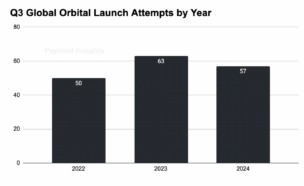

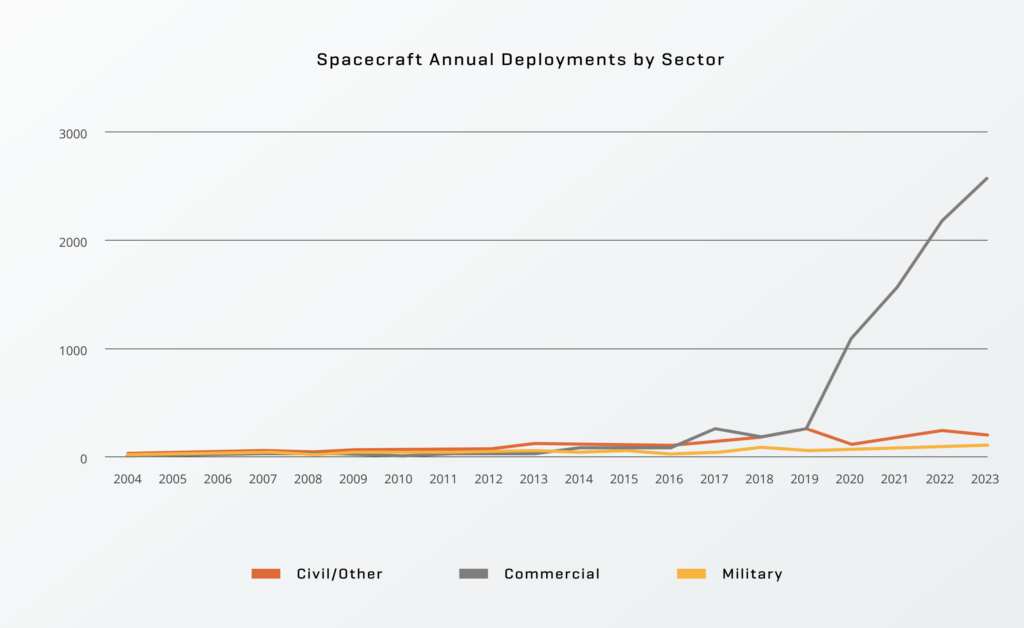

There were 2,877 spacecraft deployed in 2023, an increase of 14.6% over the year before, bringing us to 9,241 active satellites in orbit— plus 3,356 derelict vehicles clogging the spacelanes and putting missions at risk.

Guess who’s responsible for the boom? One big hint: it’s not civil or military actors.

That’s all drawn from a new report tracing the spacecraft lifecycle from Slingshot Aerospace, a space situational awareness company, and Seradata, a satellite intelligence firm Slingshot acquired in 2022.

“I couldn’t believe the number of times it says most ever,” Melissa Quinn, Seradata’s general manager, told Payload. And while accelerating space activity isn’t exactly news, Quinn says readers of this report should clock that “okay, it’s getting real. Enough chat, what’s the action here?”

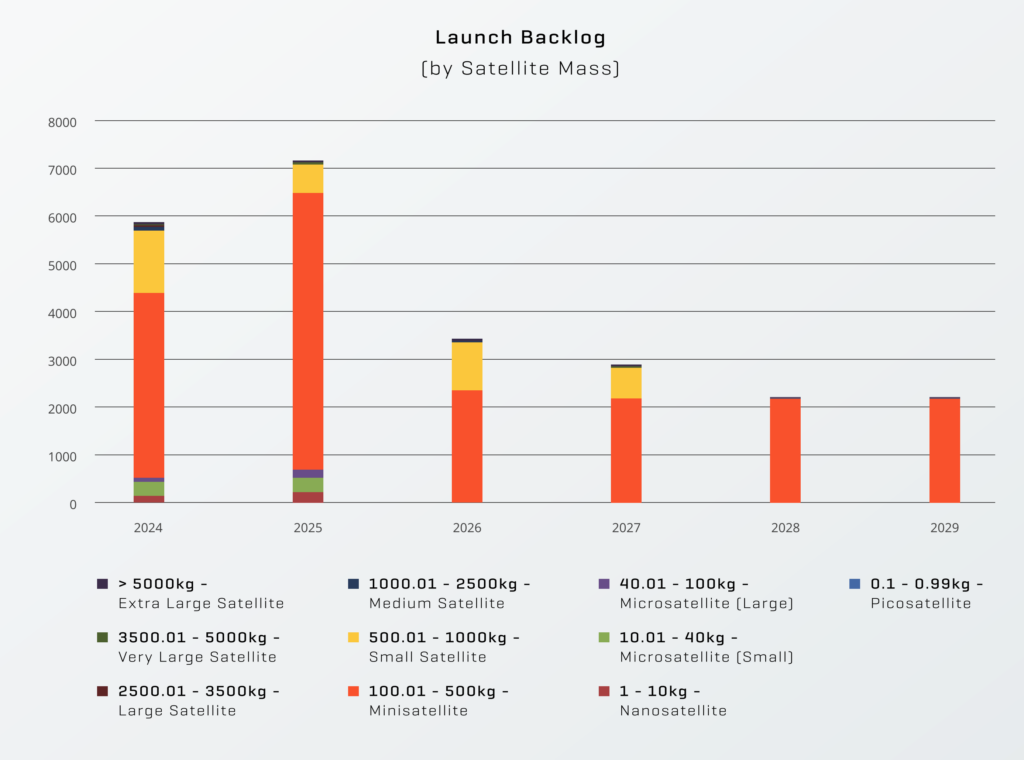

Demand signal: There’s a significant backlog of satellites waiting to launch—with the bulk of them being communications birds weighing less than 500 kg. That’s something to think about for anyone building a launch vehicle—and we can’t help but wonder what that extra-large satellite category will look like if Starship starts routinely flying missions.

Crowds in high places: While a lot of industry attention is focused on LEO and MEO, Slingshot warns congestion is coming for high-altitude satellites as well: The distance between spacecraft there is steadily falling, from 450 km in 2010 to 300 km in 2023.

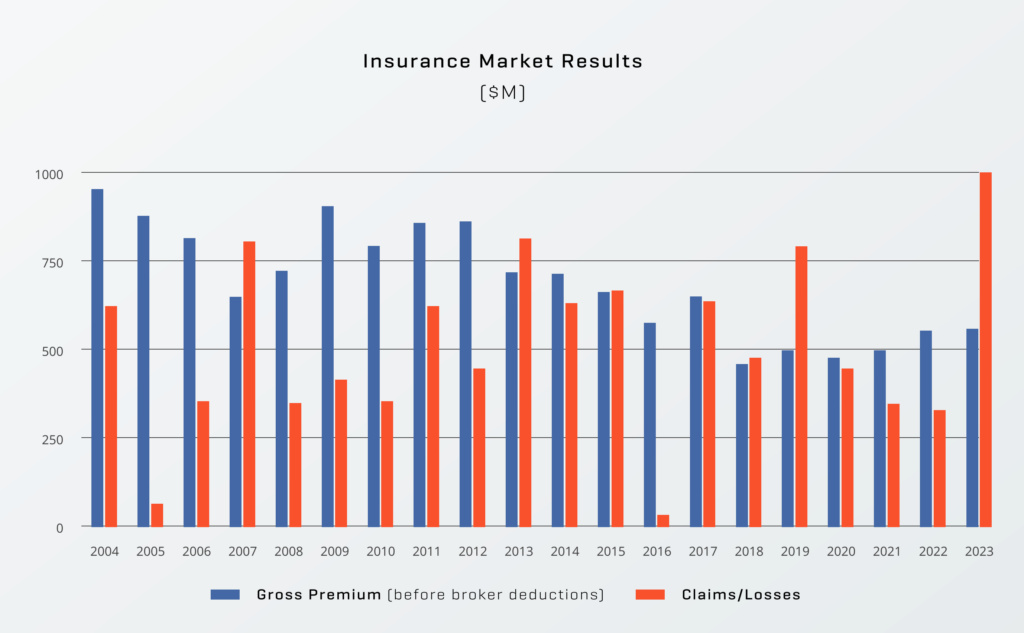

Risk appetite: 2023 was a brutal year for the space insurance biz, with some $995M in claimed losses versus $557M in premium income following hefty claims by Viasat and Inmarsat. That’s likely to make satellite insurance more expensive in the years ahead—a GEO spacecraft operator might have to pay a 10% premium.

Up next: Quinn said she hopes next year’s report will include data around reentries and the environmental impact of satellites. “When we’re talking about the life cycle of the satellite, we’re talking about the whole piece,” she said.

This piece has been updated to correct inaccurate statistics about geostationary satellites from a preliminary version of the report.