Firefly Aerospace will temporarily stop preparations for an early 2022 Alpha launch, following a CFIUS recommendation that a foreign owner divest his equity stake, Bloomberg reports. That stake, about 50% of Firefly shares, is owned by US venture fund Noosphere Venture Partners, run by Ukrainian-born investor/entrepreneur Max Polyakov.

CFIUS = The US Committee on Foreign Investment in the United States. It’s an obscure but increasingly influential interagency panel that reviews deals for national security risks.

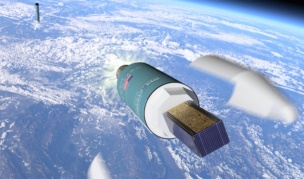

Backing up: Polyakov invested $200M in the then-bankrupt Firefly Space Systems in 2017. Since then, the company has been able to build Alpha, its small launch vehicle, which made an orbital launch attempt in September—at the time without pushback from US authorities on the company’s foreign ownership.

Polyakov had been distancing himself from Firefly for some time. In September, he sold $100M of his shares after the company raised $75M in Series A financing. Polyakov also left Firefly’s board last year.

Why now? Mounting tension between Ukraine and Russia, most likely—though the exact reason was not revealed by any of the parties involved.

What next? Firefly is postponing its second launch of Alpha, which was meant to take off from Vandenburg this month. The company does not yet have a target date to reschedule the launch, Firefly told SpaceNews. Firefly was originally hoping for up to five Alpha launches in 2022 depending on the success of the January launch. That’s all up in the air now, pending regulatory approval.

A previous version of this story mistakenly stated that Alpha’s first orbital launch attempt took place in November, that the $75M raise was part of a Series B round, and where Noosphere is based. These errors have been corrected.