Editor’s note: BryceTech’s report was released last month, not this week. We missed the original release and mistakenly thought the report was new when we recently came across it. Payload regrets the error.

BryceTech’s latest quarterly launch briefing is out. These reports are the gold standard for rocket data. We read ‘em, reread them, and drill the slides like they’re flashcards. That way, we can memorize and recite stats on command at launch cocktail parties.

Before dissecting BryceTech’s Q2 ‘22 report, we’ll establish a key definition for those who aren’t acquainted. Upmass = payload mass launched to orbit from Earth.

Q2 headline takeaway

SpaceX effectively doubled everyone else combined in upmass.

Upmass + spacecraft breakdown:

- The Hawthorne, CA company launched 158,666 kg upmass and 473 spacecraft in Q2.

- Next up was China’s CASC with 38,822 kg upmass and 36 spacecraft launched.

- Russia’s Roscosmos took bronze with 17,189 kg and eight spacecraft for the quarter.

- ULA was next for American launchers with 13,000 kg and one (big) spacecraft.

- Rounding out the Top 5 pack was Arianespace with 9,829 kg and two spacecraft.

Honorable mentions: ISRO @ 523 kg, Rocket Lab ($RKLB) @ 288 kg, South Korea’s KARI @ 201 kg, ExPace @ 150 kg, i-Space @ 18 kg, and Astra ($ASTR) @ 11 kg.

Cadence

SpaceX flew 16 missions, good for a launch rate of 1x/week. CASC flew 12 and Roscosmos conducted four flights.

- Rocket Lab launched three missions. Notably, though, we’d add that Rocket Lab tied CASC for second place in total spacecraft launched in Q2 (36).

- Everyone else mentioned above flew once in Q2.

Home base: If you slice up trips to orbit by nationality, US launchers flew 50% of all Q2 missions. SpaceX alone accounted for 38%. Chinese launchers flew a third of all launches.

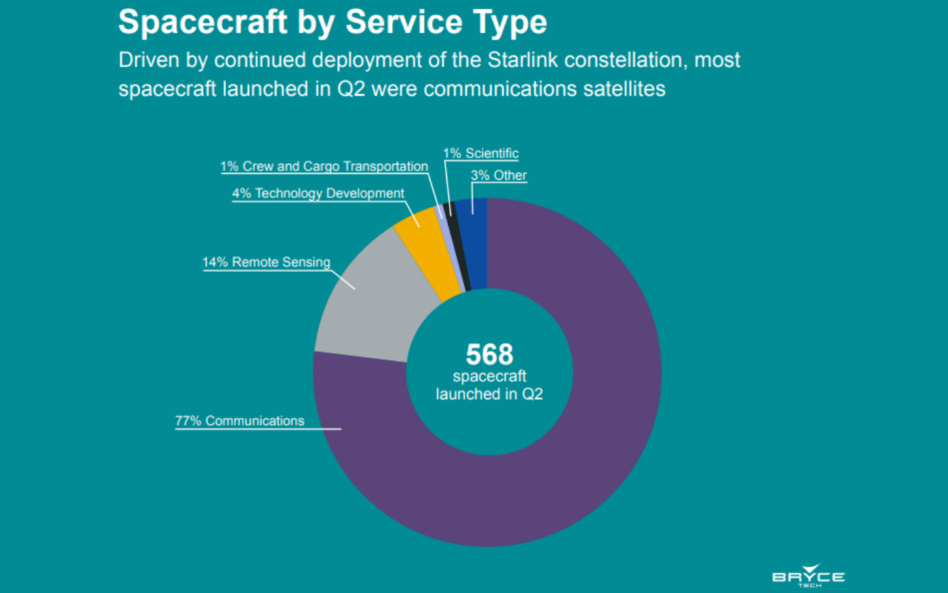

Q1 comps: SpaceX still blew away the competition in A) upmass and B) total spacecraft launched. 90.8% of spacecraft launched in Q2 are operated by commercial entities (vs. 88% in Q1).