Expect new players in the spacefaring game, says Euroconsult.

Analysts from the space market intelligence firm have released their third annual report on the state of space exploration. Gone are the days when only a few major powers monopolized spacefaring—instead, Euroconsult sees a future where many more nations are active participants and investors in space exploration.

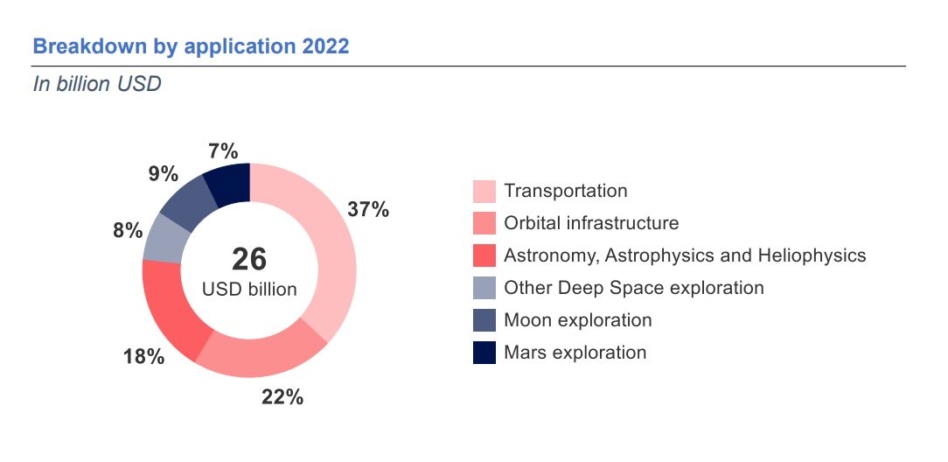

In 2022, governments across the globe have spent a combined $25.5B on space exploration activities so far, a 7.3% increase over 2021 spending. Over the next decade, a slew of planned exploration projects, spanning everything from infrastructure programs to science missions, are expected to drive that number higher each year, hitting ~$31B by 2031.

Historically, a small handful of nations have accounted for the vast majority of space exploration investment. That was the case in 2022, with the top 5 spenders—the US, China, ESA, Japan, and Russia—accounting for 94% of exploration dollars. These leaders are expected to increase their investments over the coming decade, driving growth alongside new entrants beginning to invest in their own budding domestic space industries.

Over the next decade, investment is expected to be concentrated in a few key areas: space transportation, orbital infrastructure, and solar system exploration.

Space transportation

This year, the most government investment went into space transportation, with $9.6B spent around the globe. The vast majority of this spending came from the US and its major investments in a human lunar lander and in SLS/Orion for the Artemis program. Euroconsult projects that US investment in human space transportation will remain relatively steady over the next decade, reaching $7.6B in 2031.

Globally, total transportation spend—on rockets, satellites, rovers, landers, and the like—is expected to reach $10.7B in 2031. Much of the overall increase is driven by China, whose investment in space transportation is expected to increase from $627M in 2022 to more than $2B by 2031, now that its Tiangong space station is operational.

Orbital infrastructure

With a handful of government-sponsored space stations headed for orbit within the next decade, it comes as no surprise that investment in orbital infrastructure is expected to keep trending upward. Governments have sunk $5.5B into space infrastructure in 2022; in 2031, Euroconsults expects that number to sit at $6.3B.

The increase will mainly be driven by China’s space station investment and by NASA’s Lunar Gateway development. The estimate also assumes that the ISS will remain operational through 2030.

Exploration

Other solar system projects make up most of the rest of the expected investment in space exploration over the next decade.

Lunar exploration tops the list of priorities. Euroconsult projects that investment in lunar missions will more than double from $2.2B this year to $5B in 2031, as nations across the globe prioritize human missions to the Moon as well as piles of probes and landers. Keeping up with the trend, the US and China are likely to lead the pack in spending.

Mars exploration projects come next, with many leading spacefaring nations planning exploration missions. This year, the US invested 66% of the global government funding for Mars exploration, and the analysts expect US investment to remain relatively steady at ~$1.2B per year.

The analysts also note that a new era of deep space exploration via cubesat is just beginning. These low-cost, often high-reward missions enable new entrants to perform their own exploratory missions and science, and they’re gaining steam, with about 455 missions planned in the years ahead.