Mo Islam

Tony, thanks so much for being with us.

Tony Frazier

Well, thanks for having me. Appreciate it.

Mo Islam

Well, okay, so just to kick things off, why don’t you give us a quick overview? What is Leo Labs? What do you guys do?

Tony Frazier

Yeah, so really we’re building a living map of orbital activity for enabling dynamic space operations. So we have a global network of ground-based radars that are persistently monitoring activity in low Earth orbit. So we currently catalog about 22,000 objects today and we’re collecting over million measurements a day of those objects to be able to figure out where things are, where we expect them to be and could that cause problems? That could encourage our customers to be able to move their high value assets to safety and also provide insight to our military customers to activities that might be of interest to them.

Mo Islam

Where are you guys based and how long have you been around?

Tony Frazier

Yeah, we were based in Menlo Park, California. So the business was originally spun out of Stanford Research Institute. So it was in a lab. And the founding story was there was a set of funded research from National Science Foundation to apply these radars to monitoring the Northern Lights. So they’re in research for astronomy. And they found there was a bunch of noise in the data, which turned out to be satellites that were being tracked. So another lab within SRI identified this as a way to apply that data to a different mission. And that’s where the concept for Leo Labs was formed. So it was spun out of Stanford Research Institute. They have a ventures group. And then that’s when we raised the seed round and then subsequently, you have now raised over $120 million through Series B.

Mo Islam

How did you end up at the company?

Tony Frazier

I joined the company in March of this year after a 13 year career at Maxar, where I joined GOI back in end of 2010 and was with the company through multiple M&A activities. So, GOI combined with Digital Globe in 2013 and then in 2017, early 2018, we became Maxar through Digital Globe’s acquisition by MDA to create Maxar. And so during that time, I really got an opportunity to learn a ton about commercial space as an operator. So I ran multiple businesses within the company as it went through its journey to go from collecting data to being a full provider of information and insight and doing that for variety of mission partners, both with the US government and international partners. And so ended up running a billion dollar P&L there as a rest of my time at Maxar. We were bought by Ivent International in a PE take private deal and decided to move on to other endeavors last fall. And so as I was looking for what next, I was really interested in identifying a company that had a unique technology that was focused on a mission that I thought was gonna be impactful over the next couple of decades. And so as I looked at a ton of options I’ve settled in on when focusing on space domain pretty quickly. And then as I evaluated the different players, thought Wheel Labs had an enormous opportunity. So I joined in March and I’ve been on board for coming up on six months with the company.

Mo Islam

We will definitely talk about what advantages LeoLab has over other players, but I do want to just double click a little bit on LeoLab’s mission and vision and why that compelled you. What is so important about what you guys are doing at LeoLab that led you to join the business?

Tony Frazier

Yeah, yeah, for sure. So a couple kind of thoughts. One is, know, Maxar, we invested billions of dollars building the constellation that we flew for the Earth Intelligence missions that we supported. And in 2016, we had an event where a piece of space debris hit one of the solar panels of our satellite. And it really makes it real when you see that that know, high value asset could be at risk in terms of not being able to fulfill, you know, its full mission. You want these assets to live a useful life of seven to 10 years, ideally longer than that. And so, you know, that made it very real and tangible for me. The other thing that was, I think, formative in me having appreciation for the mission is I’m also on the board of Iridium. And Iridium, I’ve been on the board for, I’ve been my fourth year on board, but in 2009, you know, they lost one of their satellites, you know, due to a collision with a Russian, a defunct Russian satellite, Cosmos, you know, satellite.

And so I think, those two events gave me an appreciation for why this mattered, like knowing where things are and where they’re going to be, you know, to support more sophisticated maneuver planning. But then, you know, I also saw that, you one of the areas that Maxar was focused on was, you know, how to better characterize activity in space. And so I played a role in helping getting our license modified to support non-Earth imaging. And I didn’t realize at the time the role that LeoLabs played in being able to provide effective tracking of objects to queue collection by high-resolution sensors like what Maxar offers. So those are all areas that I thought gave me a real appreciation for the mission. And then in making my rounds with different people in the investment community in the industry, that we’re seeing the kind of growing threats that we need to respond to. Also government stakeholders that I’ve worked with in the past, all, the themes are very consistent. That this mission is not going away, it’s becoming a bigger threat to both safety and security. And in particular, today we’ve seen that there are, there’s roughly 9,000 active payloads on orbit in LEO that we track every day. That’s up 10X from where it was in 2019. So less than five years ago it was 900 active satellites. There’s 13,000 pieces of space debris that range from a thousand rocket bodies to fragments over 10 centimeters in size, 12,000 objects that size. And so with that kind of exponential growth of the threat that there was a need to be able to have that type of living map that could give people insight into how to support their various mission operations.

Mo Islam

So, makes sense. What was the, I am kind of curious, what was the need within the company to kind of bring you on? Because obviously before you, CEO, the former CEO and co-founder Dan was at the helm and I believe if I’m not mistaken, he has now transitioned to COO. So what was sort of the impetus to kind of bring you on in your background? Obviously you have a great background, you’ve done a lot of really awesome things in the industry, but just kind of curious, what was happening within the business that was requiring Tony’s help.

Tony Frazier

Yeah, I think the key area was that we were transitioning as a business from a startup to a scale-up. And Dan, which has been an enormous, he’s been kind of an incredible mission partner through this transition. And he now is our chief operating officer for the company. So he leads all of our engineering activities and all the radar operations worldwide. So we still play active as part of my executive team. But going through the process of dealing with a handful of customers to dozens of customers, going from proving the technology works to having a deeply integrated emission and really scaling bookings and revenue growth, that’s a lot of what I focused on at Maxar where I can really compliment him. And so what we’ve done is we’ve had a very effective partnership where he brings strong subject matter expertise and really his love for the tech. And then I’m able to help drive P&L, go to market, other areas where as we scale up to realize our potential, we’re gonna be able to support this as a critical mission partner over the next couple of decades.

Mo Islam

So you alluded a bit to sort of the scale of the problem of debris and traffic management, but I do want to talk a little bit more about how important and how big it truly is. And I ask that because there’s a number of great businesses doing what you guys are doing at Leo Labs. a question I get actually very frequently from investors and folks who are studying the market is, is this debris problem really a problem? What is going on? Is this like, you know, just overstated? And I certainly don’t believe that, but I am kind of curious to get Leo Lab’s perspective on how big is this problem? How do you quantify it for the industry, especially for newer startups, companies raising capital who maybe aren’t focused necessarily on, you know, debris or traffic management as a part of their operations from day one, should it be? How do you think about that?

Tony Frazier

Yeah, no, it’s a great question. Yeah, I think that what I would say, Mo, is that we’re seeing with this growth in the number of objects, so operational payloads, so again, 9,000 operational payloads, as well as the growing amount of both rocket bodies and debris, that the number of high probability collision events is just growing. And there’s an event that happens very frequently. It feels like weekly, you know, that is just further exacerbating the problem. And so a couple of recent examples, I know you provided coverage of the G60 launch, you know, that China did with their Starlink equivalent satellites, where they added 18 new payloads on orbit. Those 18 payloads were the precursor to what they expect to add another 600 satellites by the end of 25 to eventually build out a 14,000 satellite constellation that’ll compete with Starlink. so there’s a clear exponential growth of the number of objects.

Unfortunately, their second stage rocket exploded and created over 700 pieces of space debris that we began tracking that were at roughly 350 kilometers in height. so, and then that debris field dispersed and is putting know, a wide set of satellites below 500 kilometers at risk that we then need to be able to support in some capacity. And so we’re seeing kind of an increased cadence of these events, which is making the problem more significant. I’d also say that for the company, we’ve seen a big inflection point in customer adoption. And so we’re still early in the life cycle for this industry. But we announced a weeks ago, you know, the progress we had in the first half of 2024. And, you know, announced that we were awarded over $20 million in new contracts in the first half of the year. That was that came from a diverse customer base. So that included the multi-agency across the U .S. government, working with seven other nations, both the support military and civil missions, as well as winning contracts with many of the largest commercial operators in the world. And so I think we’ve seen that all those customers see utility in our capability. And as they start to really fully integrate it into their mission operations, there is plenty of headroom for growth there.

Mo Islam

Let’s just to put on our tinfoil hats on for a second. Do you believe in the Kessler syndrome? Which for the audience is a sort of theoretical scenario in which sort of the density of objects and Leo becomes high enough at some point that, know, collisions between objects generates a cascade of debris, which gets bigger and bigger and, more collisions and you have this like domino effect and eventually Leo becomes unusable.

Tony Frazier

It is a real break. It is a real break.

Mo Islam

So I’ve heard it used a number of different times in the past in conversation, kind of curious where you stand on it.

Tony Frazier

I don’t have a percentage that I would call out of Black Swan event, but it’s certainly something, it’s a real risk that we’re focused on how to help prevent it. And a lot of the, some of the more interesting use cases that we’re seeing in customers applying, our data is to be able to support very dynamic space operation. So true machine to machine maneuvering of their satellites without humans in the loop in order to be able to mitigate that growing risk. And again, that risk is coming from a combination of things like debris, you so non-maneuverable objects. But we’re also seeing just with the congestion. And again, this is congestion coming from not just US actors and our allies and partners, but from other adversarial nations which aren’t cooperative, they’re not sharing information. And so then that creates risk as well. And so, you know, now with, you know, the prospects of 14,000 know, Chinese satellites on orbit that are not coordinated with their US counterparts, like that creates additional opportunities that we need to be mindful of and help mitigate those risks as well.

Mo Islam

So to take a step back just on Leo Labs technology, can you just walk us through the general architecture of the system? Like what exists today? What hardware exists today? What have you guys built and what’s sort of deployed and out there in market?

Tony Frazier

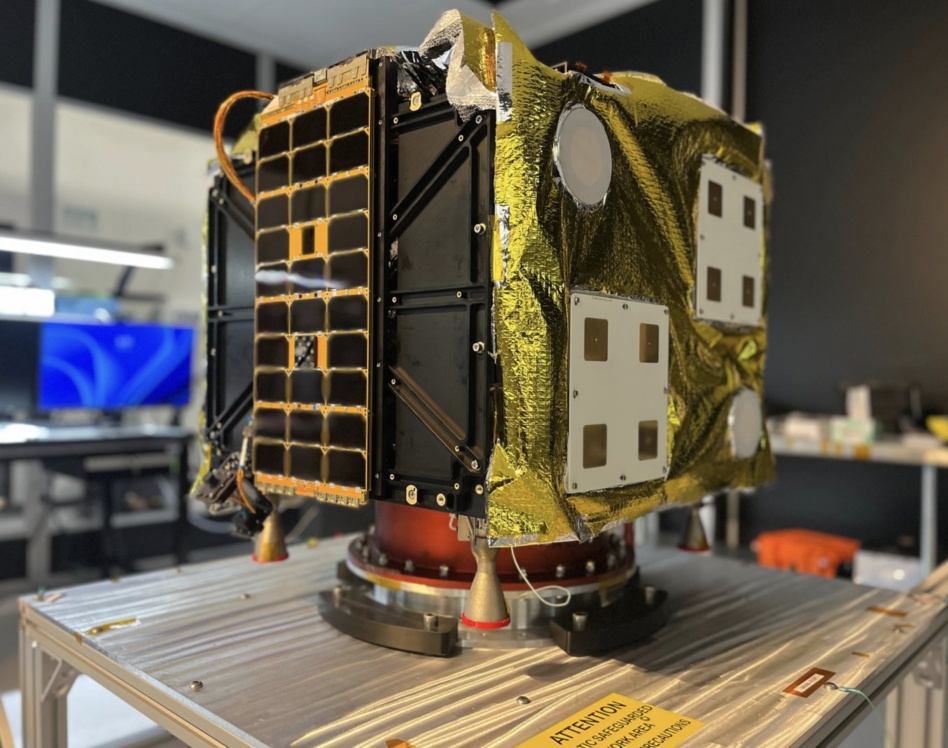

Sure, sure. So we have six sites around the world where we have 10 active radars that are deployed. We have geographic diversity for those radars. So our location started out in the U .S. sites. So we had in Alaska and in Texas. Those were the original two sites. And then we now have sites in the Southern Hemisphere, so in Western Australia and in New Zealand. We also have sites in the equatorial region, so Costa Rica in the Azores, an island off the coast of Portugal. And so those radars, which are all you know for the most part they’re soft-defined radios that are in a 1D phased array, they emit a beam of energy, which then is able to transmit and then receive. And then it allows us to be able to, for a task and command, be able to detect the location and trajectory for objects larger than 10 centimeters in size. And so the global network, then is able to, we generate a, with that state vector, a prediction of what the future orbit is gonna be. And then that is used to look for the next track, where if a object is seen by our New Zealand radar. And then the next pass, we’re looking at how it would be tracked by the Midland Texas radar.

Then we’re able to maintain custody of that object over time. And so that feeds our process. And then the time it takes to go from a radar pass to a state vector, which is essentially a indication of where an object is in a trajectory, that happens within five minutes. And then once we have that measurement, we’re able to do a full over-determination, we’re able to analyze how two objects might be on a collision course, and so we can provide a collision avoidance alert. And then that also feeds into other analytics that we’ve built. And so the radar network feeds a catalog, an orbital catalog of 22,000 objects. And then we built a series of analytic algorithms to be able to understand what’s normal, what’s the pattern of life that we would expect. You afford the catalog and where there’s some anomaly, you know to that eventually alert, you know some operator to take action

Mo Islam

So going back to your point on sort of the capability and you mentioned 10 centimeters, I’m kind of curious, is now we know for sure that even objects under 10 centimeters can pose pretty significant issues for spacecraft. Is 10 centimeters sort of enough for the time being to get you quality level mapping and sort of determination of these projected potential conjunction events? And is it a technological limitation right now that it’s just 10 centimeters? And how do you see that evolving over time? Like what’s sort of the strategy around kind of mapping and becoming more more precise around the object?

Tony Frazier

Yep, yeah, that’s great questions. So we think of the current mission today, the customers that are currently adopting our services, they see value in both the sensitivity, so the size of the object, we can track the frequency of updates. So there’s a persistence that we’re able to generate. So how often can we revisit that object? And then the accuracy and the timelines, the latency. So kind of think of those as the different attributes of quality in our system. And so we certainly feel that today we’re providing a service that again augments other sensors that are applied to this mission in a way that is additive. so that certainly has been validated just from the use cases that our customers are applying what we do today. Now in terms of your broader question, we see a lot of opportunity to continue to evolve our to take on additional missions. And those can take a couple different forms. One is we announced earlier this year that we were awarded a Superphase II contract to help contribute to the maturation of one of our next generation radar technologies. So we track today in two frequencies.

So there’s UHF and S-band. And what we’re doing there is we’re moving to a modular architecture that allows us to, instead of emitting a pencil beam, so you kind of think of our current 1D phased array, they’re emitting a pencil beam of energy up and then the objects traverse that beam steerable, so we can point in different directions, but that’s kind what the current concept of operations is. The next generation technology we’re building is more of a direct planar array, where it’s emitting a cone of energy. And because of that, we’re able to do more sophisticated tracking in different orbital regimes. And so some of the things that we’re really interested in are how that can be applied to better search and discovery of objects for non-cooperative launch, which is a big issue in the national security community, as well as how we can extend to other orbital regimes. And so the more power, the larger the radar array and the more power you apply to it, the more sensitive it is. And so it can track smaller objects at lower orbits. It also can extend into other orbital regime, so beyond LEO, into MEO and GEO. And so we’re exploring that as a, that’s kind of a future investment that will make, you know, as we burn down some of the technology risk in those designs. We’re also really interested in some of the emerging missions. I know you’ve covered Albedo as an example of a commercial operator that’s flying in very low Earth orbit. There’s a lot of investment happening not just from commercial operators but also adversaries in that area and so we view VLIO as another mission that a proliferated network of these types of sensors could really help contribute to.

Mo Islam

How does the LeoLab system differ from other kind of services in the market? I mean, I can already think of one, which is just the nature of how you track debris, which, you know, there’s a couple other interesting methodologies that are certainly out there, but I’m kind of curious, like, how do you differentiate the system?

Tony Frazier

Yeah, yeah, great question. So these missions can get prosecuted through a combination of ground and space-based sensors in different phenomenons. And so there’s radar. There’s optical, there’s RF, you can think of kind of applying that both on the ground and space. And so really what we’ve focused on, what makes our unique advantage is the fact that with a global ground-based radar know, network, we’re able to support that detection and tracking mission with high mission assurance across all weather conditions. So all weather, day, night, you know, we’re able to maintain custody of these objects. You know, if you use an optical sensor, you know, if there’s clouds, you you’re constrained there, the lighting conditions have to be right, you know, in order to be able to effectively track objects. And so, and then there’s a number of space based architectures which are interesting. know, many of them, you know, the, you what we do is more analogous to more of a wide field of view monitoring all objects in space. More narrow field of view sensors are good for characterization. Being able to tell exactly what that object is, like what type of solar panels it has, what payloads it has, those types of things. And so we really view what we do as complementary to many of the space-based approaches, and really even the ground-based optical, for that matter, but the Arboreal differentiator is for LEO in particular, being close to the earth where we have enough power to collect data out to the extent of LEO, so 2000 kilometers, and be able to do it consistently through all weather conditions with a highly autonomous system. That really is what distinguished us.

Mo Islam

So you mentioned a couple advantages of space-based architectures, but I’m curious, if the goal is to provide a service in its simplest form to say, there’s something that’s about to hit you, out of the way, right? What is the advantage of space-based architecture? Because it sounds like to me at the end of the day, field of view is probably the most important thing here. Field of view and obviously increasing the accuracy of that field of view as much as you can over time. But saying like, hey, we think that there’s a piece of debris we can identify really, really well and it’s really small and here, but if we kind of move, scale up that field of view just a tiny bit, we have all of sudden lost accuracy. I don’t know if I’m kind of describing the issue as eloquently as you probably would, but maybe talk a little bit about like, what is an advantage of space-based architecture?

Tony Frazier

Yeah.

Mo Islam

Clearly there is one, are companies out there that are building systems around that and raising money around that.

Tony Frazier

Yeah, my point of view on it is that the space-based is a good complement for characterization, not for tracking. And so what we’ve seen is that, to your point, if it’s a non-cooperative or an uncooperative object, so a piece of space debris which can’t maneuver, you want to be able to know what it is, where it is, and does it pose risk. And then that’s typically enough for space traffic management. However, for space domain awareness, you may want to be able to, again, if there’s a object that is maneuvering towards you and doing a coplanar or proximity operation, you want to be able to know more about what it is, what are the length of the solar panels, can it deploy another object? Are there other potential risks that would inform them what your course of action would be to mitigate that risk. And so what I’ve seen is the most synergistic capability to what we provide is that we provide the accurate tracks and then we’re able to inform the other space-based collectors where to look. And then they’re able to, by looking, see details that then would inform an operator what to do to mitigate that threat. And that’s more of interest to the military stakeholders, again, whether it’s US or allied, space operators that we’re working with.

Mo Islam

How scalable is your radar system as LEO proliferates? As you have tens of thousands of more satellites, you have more debris, is it as simple as putting more radar systems on the ground or higher complexity, more advanced phased array systems? How do you scale your system ultimately?

Tony Frazier

Yeah, we have a today with the current network, we’ve been able to scale our collection capability to support the growth without adding incremental hardware to support what we’ve seen as pretty aggressive scaling, north of 2,000 new payloads added a year over the last two years to our catalog and increased amount of space debris. So the metrics I referenced earlier, we’re able to maintain custody of that number of objects without adding additional sites. Now, what we are focused on in the future is we’ve burned down a lot of the non-recurring engineering risk in our architecture. And so there is an opportunity for us to add additional persistence through further geographic deployments of radars, which would just allow us to increase our service level. Not the total number of objects, but to be able to offer high revisit rate for those objects that we really care about. And so for us, it’s not like launching a satellite, in terms of the amount of capital required to be able to deploy a new site. For us, we have been able to get a new site built in six to nine months from when we have gotten permitting on a location, and we’re working to continue to bring that timeline down.

Mo Islam

How much of outside situational awareness data are you integrating with the offering? So third party.

Tony Frazier

So today, yeah, today we, it’s fed from our sensor network. The third party data is more around how we support these typically queuing use cases. And so, you know, where our data is foundational to understand where something is and then we’re helping to another sensor to better characterize that object. A lot of people, we get the question about how we compare to the Department of Defense, their public service. And one of the things that has been really interesting in a parallel with what I saw in my time at Maxar is that there’s an opportunity to really complement the government’s investment in their sensor network. Many of the sensors have been applied to this mission. Traditionally, whether they’re radar or optical, most of those systems are in the Northern Hemisphere. They were built to support the Cold War threat, and they were missile warning. Satellites were applied to space domain awareness.

And so they still are effective in tracking and cataloging the objects, but there’s relatively modest coverage in the southern hemisphere. And so the investments we’ve made in Western Australia, New Zealand, the equatorial coverage we have, they allow a hybrid architecture to be able to get higher persistence across the two. And so that’s a key part of our value proposition is that we can build that type of hybrid system. And we’re seeing that with how we complement the US government, but we’re also seeing with number of international partners they may have a sovereign radar government -owned, you know, sovereign radar system that we then can complement by providing global coverage.

Mo Islam

So taking a step out of technology for a second, and I want to talk about the market and sort of demand. How has demand for domain awareness, situational awareness, how has that demand for those services evolved over the last few years? And how do you think it will continue to evolve over the next 10?

Tony Frazier

Yeah. Yeah, I think that the way it’s evolved over the last few years, and again, I’m six months in to my role here, but based on conversations I’ve had with customers, it’s gone from a promising capability to something that they’ve been able to prove is fit for use for certain class of missions today. And then the next phase is how they fully integrated into their architecture, where they stopped doing something that they may have done with a sovereign system and then transitioned that mission over to commercial. And so we’re at this inflection point in my mind where we are not only booking the awards that are fueling growth, the north of 100% year-over-year growth that we’ve seen based on the performance in the first half of the year. But the quality of the work is high, in that the customers are, they’re not just acquiring a service, but they’re proving out that, this is fit for use. Where I can use it to do autonomous maneuver, of my commercial satellites to keep them safe. I can use it to replace and or augment what I would do with a government sensor. I can use it to understand as the Department of Commerce transitions the mission for space safety from DoD over to the Department of Commerce, what’s the role that commercial is going to play in that architecture?

Those are all the types of things that we’re seeing that is positioning us for really expanding RTM over time so it’s similar in some ways when there was kind of my experience at Maxar, what I saw with the adoption of new technologies. I came into Maxar right when it was awarded its Enhanced View contract. And then eventually, I was there for the recompete that led to what our award was from the NRO for the Electropical Commercial Layer contract. And then saw how Black Sky and Planet, what their awards turned out to be as part of that journey as well. And I’d say that we’ve done the work to prove out the utility of the capability. And then now those need to graduate into program record. And we’re very well positioned for those, both across the civil and the national security use cases.

Mo Islam

any catalyst that you not necessarily are predicting, but any catalyst that you think could happen that will significantly accelerate demand. So to state the obvious, there is some type of conjunction event in space that leads to a significant asset loss, or even worse, leads to putting humans in danger. Like in some way, shape or form it has happened already. But I’m kind of curious like we’re in this point and we’ve had conversations with lot of experts and folks on this show and just the organization at large about debris and awareness and the idea, there’s a school of thought that says, until there’s real regulation coming from Congress about the company’s responsibilities, when you put something up in space, it’s your responsibility to make sure you don’t hit someone else or upon your end of your operational life, you dispose of your asset in a safe way, that absent of that regulation, that the growth in these types of services will take some time. But I’m kind curious, what is your perspective? What is your perspective on regulation? What is your perspective on anything that could help accelerate the demand for services like this? What do think about that?

Tony Frazier

Yeah, I think that the look a black swan event can be a catalyst for accelerating, you know, a transition that may take that may have taken years, you know, to do it much, much more quickly. And we saw that with how the Ukraine conflict created a compelling event to accelerate adoption of commercial imagery for a set of national security missions. And so that certainly is a possibility with the, again, increased cadence of these debris causing events that we’re seeing. And so between the recent event with the Chinese launch, what we also saw with the Russian satellite, that exploded about a month ago, that’s added over a thousand pieces of space debris that we’ve been able to track with our sensor network. And so that, think, a, it creates a compelling event for both regulators that, for example, the Department of Commerce, there’s a sense of urgency for them to progress the deployment of their traffic coordination system and ensure they’re taking advantage of all the commercial innovation that’s out there that can power that type of application.

And we’re seeing similar patterns around the world where different countries are seeing it as an important service that they make available. Not unlike air traffic control, there’s a need to provide a similar baseline, basic service for civil and commercial operations. With companies. It really comes down in my mind to your point. There could be a regulatory requirement that says that look for either ongoing mission operations or for launch planning or reentry planning. Here’s a, you need a service of this type in order to be able to effectively assure access to space or responsibly end of life your mission. And so those are areas that we are having conversations about that as another catalyst for long term growth. I think the thing that I would say that is more near term is what we’re seeing around a number of the adversarial space trends. And so as we’re seeing this mix of objects go from US driven to US ally to now adversarial nations and they’re not talking to each other. That’s creating a need for a source of truth that is going to, that can inform operations. And so that’s really where having a commercial operator that’s able to track everything that’s occurring can really unlock value for our customers.

Mo Islam

So how does AlioLabs make money today? Are these bespoke contracts where it’s like, we need this particular service, or we need this particular area mapped, or is it like sort off-the-shelf service that both government and commercial pay?

Tony Frazier

Yeah, yeah, great question. we have a platform, so all the data we collect then turns into a catalog and then we provide both access to the raw measurements of the objects that we track in the catalog, as well as derived analytic products that are used to support safety or use for military requirements. Today it’s largely a subscription based business model where based on the number of objects that customers are interested in in tracking They’re able to subscribe, you know to a service level that that allows them to be able to either kind of maintain a base level custody or if they need to Monitor those objects to hire revisit that they then can you know turn that dial up in terms of the service level and so you know, it’s, it’s similar to, you know, you, you know, in the EO world, you know, there’s companies like planet, you know, that, you know, that, have their doves and they’re collecting, you know, the entire earth every day. And then there’s people that subscribe, you know, to the parts of the world they care about. There’s a, an elegant situation in terms of what we do with our global catalog. But then there is because we have a, a taskable system. If there’s certain objects that are of higher interest we’re able to offer a higher revisit rate on those objects. And so you can think of it as, there’s certain metropolitan areas or certain military bases that are more interesting, then we’re able to charge a premium for offering a assured level of revisit across those. So that’s the business model today. And we’ve seen.

Mo Islam

So, sorry, I have a kind of interesting kind of scenario to paint based on what you’ve just kind of portrayed. So, okay, I sort of think I already know the answer to this question, but let’s just say I’m an operator. Let’s just say I’m a startup and I work with you at sort of your lowest tier subscription rates or sort of like whatever the most basic package is. But I mean, you’re monitoring a lot of different things for a lot of different, let’s just say, 5, 10 years from now, a lot of different whole host of companies and organizations and agencies and government and whatnot. And then you’re like, you find something that’s sort of like, that could put me in jeopardy, like my asset in jeopardy. But let’s just say there’s a level of service that I’ve not paid for yet to get that particular piece of data. I mean, that’s not going to preclude you from letting me know like, hey, there’s a potential conjunction event that we that we tracked, that we identified based on some other task that we had from some other company or organization, like, hey, we just figured this out. I assume that that is still very much the case or how does one think about that in terms of like.

Tony Frazier

Yeah, we were a values driven organization, Mo, and we focus on mission. And I had similar conversations when I was at Maxar about how we would support humanitarian assistance and disaster response events where we would frequently, even if we were not getting paid for it, we imaged the before and after impact of a hurricane or tornado. And then we made the community aware of that to support those disaster response missions. And so we have a similar mission-driven culture here at Leo Labs, and so we frequently do provide support for what we would view as high-risk events, but it does highlight why it’s important for the community at large to make that sustainable. And so what we’re seeing is that if you look at what the mission is of the Department of Commerce with the traffic coordination system that they’re building. They’re essentially working to take on the space safety mission that the DOD has managed since the Iridium event in 2009. And so part of what I would love to see is that there’s a baseline service that governments help sponsor that then can support the baseline safety needs for the community. Wixen allows us to incubate and support that pursuit as a program or record. And then we have the ability to offer premium services to the broader ecosystem of customers and partners.

Mo Islam

Roughly on what percentage of the bookings that you’ve closed so far are government versus commercial. Is there any particular category where you’re seeing more initial interest in the service?

Tony Frazier

Yeah, so the number of customers is pretty evenly distributed between commercial and government. The government contracts are larger. So overall, north of 80% of the total awards were from government sponsors. Again, that’s a combination of US and international partners.

Mo Islam

So I know the company recently, I think earlier this year raised a funding round, something in the order of about 30 million. And you mentioned earlier the company’s raised over 100 million so far. And I hope I don’t get yelled at for saying this, but I’m pretty certain that puts you in like the most capital raised in this category of company. So I’m kind of curious, what about the business has attracted this level of capital from the investor community versus others? Like what about the business model, I think has been most interesting or attractive to potential investors.

Tony Frazier

Yeah, think, so my perspective on that, and again, the investors would kind of speak to what drove their thesis. But if you look at the overall investments in space, which I know you track in great detail, the private capital that’s gone into space, there’s north of $300 billion of private capital that’s gone into space in the past decade, of which $250 billion of that is in low Earth orbit. And then we also are seeing increased investment by governments, the support innovation in that old regime. There’s SDA’s investment in building out their transport layer and tracking layer. We’re seeing similar activity by both allies and adversaries around the world. And so we’re seeing kind of the bulk of investment happening in Leo. I think we also have been able to prove out that our approach to using radar based tracking is superior for this mission. So the fact that we have the largest, most comprehensive catalog of objects and that we’re able to update that with high frequency, the data is highly accurate, which then makes it different use for a broad set of missions. Like that also gives us a technical advantage.

And then that’s being proven out with who we’re seeing adopt the capability in terms of, I these are still small, relatively small programs, you from our perspective, it were discretion to surface on the TAM, you know, for this. And we felt like, you know, it’s, you know, part of the reason we wanted to put the announcement out is we feel like we’re validating our industry lead. You know, if you’re growing north amount of percent year of a year, you know, you’re, getting kind of real book instruction, you know, you’re, you’re transitioning from the startup to the scale up. And so I think there was a lot of belief in the promise of the business, you know, based on, the through series a, you know, we were able to get the technical risk down where our marginal cost of deploying the sensor network and then extracting insights from it was, was relatively low, but with decades of a barrier to entry around building this type of system. And then what we’ve been able to demonstrate since then is that we not only can build the system, but we can actually get customers to validate its utility. And so that drove both the original Series B in 2021. So that was $65 million initial Series B, but also the $29 million extension.

Mo Islam

You’ve spent a good chunk of your career at a public company. Is the goal here to be a public company?

Tony Frazier

think it’s a little early to determine what the way to be capitalized is and it’s long term. But we are really confident that there’s a large team here. getting to the point where the business is the threshold in a commercial space business to be cash will break even and, you know, and generating solid gross margins and even without margins and free cash flow conversion, like it’s a high bar in many segments of commercial space. What we’ve seen with our business is, with the traction we had in first half of this year, we’re within line of sight of being cash flow positive on a repeatable basis, which then really gives us ton of optionality in terms of what we can do to realize the full vision of the business.

Mo Islam

Yep, that’s great. Are you going to need to raise any more capital to get to that point when you’re cash flow positive consistently? Off topic here, but can your radars track killer asteroids?

Tony Frazier

We don’t. That would be a great topic to discuss with our CTO, Led Lue, who is a retired astronaut who did, so he’s really passionate about the space safety mission. he actually also, Dual Hat says he’s the chair of a nonprofit that’s focused on avoiding a big event with an asteroid. So yes, we’re not, the current network’s not optimized for that, but we have a subject matter expert who’s really passionate about that mission.

Mo Islam

Well, that was actually going to be my lead in to my final question, is, give us your favorite movie or book space related. actually recently, a few weeks ago, maybe it was on a plane or something, recently rewatched Armageddon. I hadn’t watched Armageddon since we’d been working on payload as a business. And I was like, man, there’s a lot of inaccuracies in this movie much more clear to me now as an adult than when I watched the movie when it was out, which was many, many, years ago. But it was nonetheless a great, great, great movie. Great movie. But anyway, I wanted to ask anything that’s very high on your list.

Tony Frazier

Well, a recent book I read, which is timely, is Phantom Orbits by David A. Mathews. And it is pretty fascinating because it basically tells the story of how a set of characters in Russia and China and the US, we’re getting after different aspects of this space tracking mission. And just the importance of additional navigation timing, satellites, and then how there could be how this fragility given that architecture that can be exploited for military gain. And so it was kind of interesting. It hit very close to home given what I’m doing now.

Mo Islam

Yeah, that seems like too realistic for me right now. It’s funny. There’s this Peter Thiel Joe Rogan podcast, sort of going a little viral and I kind of finished listening to it. And a part of it he talks about, you know, traveling at the speed of light and what that means for sort of weaponry and all this stuff and immediately talking about how unrealistic Star Wars is and all this stuff and I’m like man Sometimes you just want to like escape reality for a second, right? Not spend too much time thinking about what is and isn’t possible But anyway Tony pleasure to have you on the show. Thanks so much for being here and spending time with us as a pleasure getting to hear your background your story and what you guys are building over at Leo Lab so looking forward to getting you back on the show when you guys are cash flow positive.

Tony Frazier

Awesome. Yeah, well, thanks, Mel. Really appreciate it. Yeah, really excited about what you’re doing with Payload. So glad to support you and happy to be back. Maybe with my CTO and COO, maybe we can have them one to geek out. Thanks.

Mo Islam

Yeah, perfect. Thanks, everyone. Until next time.