Ed. Note: This is a vastly abridged version of Payload’s “Secret Monthly Newsletter” that you can unlock by referring just one new subscriber! This month’s newsletter included access to a larger macro presentation that includes this—and much more.

In less than a week, the June CPI (Consumer Price Index, an index that tracks the price of goods and services and is a key measure of inflation) number will be released. July 13 is a date worth marking on your calendars.

If the CPI print comes in over expectations (it was last clocked @ 8.7%), then we’ll likely see another leg down in equity markets. High CPI → central bank interest rate hikes.

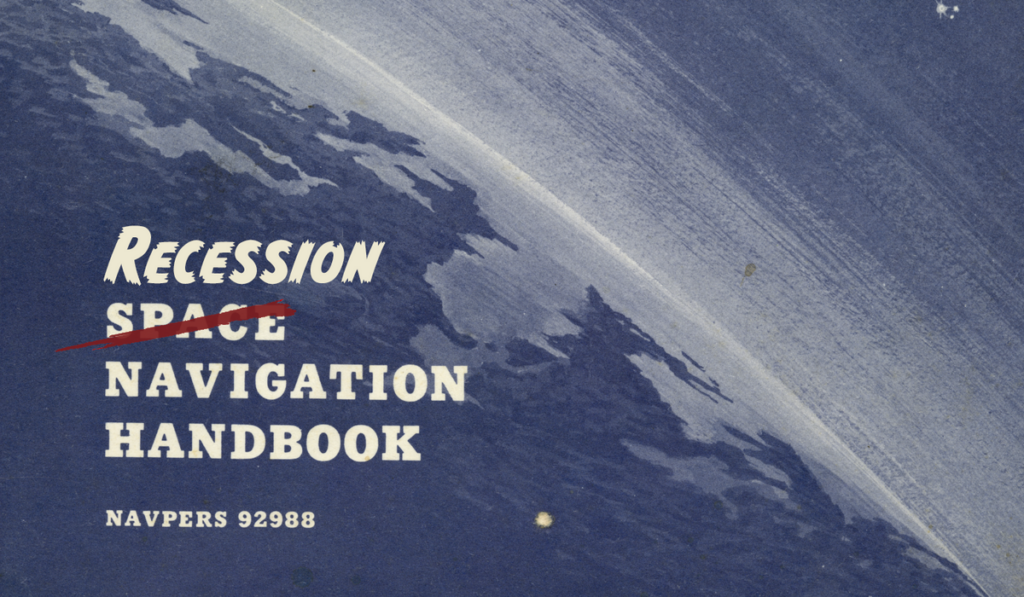

Two weeks after the June CPI print, we’ll get Q2 GDP data. Why is that so important? Well, you may recall that Q1 GDP growth was -1.6%. The technical definition of a recession is two successive quarters of contractionary real GDP growth. If that Q2 number comes in under 0.0%, it means the US economy is in a technical recession.

Consider also…

- The June University of Michigan Consumer Sentiment Index reached an all-time low for the survey.

- Conditions across car- and home-buying (also U. Mich surveys) have fallen off a cliff and bottomed out at 10-year lows.

- We’re in a global food crisis, fueled by the war in Ukraine. For the first time since 1972, both food and energy prices are rapidly increasing simultaneously.

- The average stock in the NASDAQ, Russell 1000 Growth Index, and the Russell 2000 Small Cap Index is down 40%-50% from peak levels.

- Markets are repricing “real world” and “digital world” assets, giving a premium to products directly tied to US infrastructure and discounting companies linked to software, fintech, cloud, social media, and the much-ballyhooed metaverse.

In the midst of the macro turmoil…

…a bright spot is aerospace and defense. A&D has outperformed the S&P 500 by 14+% and NASDAQ by 22+%. The conflict in Eastern Europe has accelerated both defense spending and the race for space supremacy.

However, it has been a tale of two cities

At first, some saw the SPAC market as a harbinger of new space startups and their investors having “made it.” SPACs created liquidity for a sector that historically did not have clear exit opportunities.

Instead, the reverse merger phenomenon created poor incentive mechanisms that allowed for misguided behavior between management teams and financial institutions. And we now see a clear bifurcation between traditional aerospace and the new space model.

What’s next?

Our best guess: a culling of the herd and consolidation. Many players went public too early in their lifecycle, failing to realize that as a public company, forecasts need to be met or your stock price suffers quarterly (or daily, for that matter).

However, not all hope is lost! This is a healthy shakeout. Consider it a course correction for the industry, which will pave the way for more efficient business models and illuminate the path to profitability..

We at Payload continue to firmly believe that the global space race is one of the most important technological contests of the decade. The financial upside case is just beginning.

+ For more, catch Payload’s most recent Pathfinder episode, where Ryan and Mo digest this data and unpack what it means for space.