AST SpaceMobile is raising $400M through convertible notes to continue building out its BlueBird constellation, the company announced on Wednesday.

For the uninitiated: A convertible note is debt that can be converted into equity if a certain stock price is reached (in this case, $26.99—20% higher than when the raise was announced). AST is able to raise money without issuing shares immediately; investors get a healthy dose of downside protection (debt) and upside exposure (potential to convert to equity).

Win-win? Not necessarily for existing shareholders. $ASTS shares dropped 12% yesterday on dilution concerns.

Convertible note nitty gritty:

- Interest rate: 4.25%

- Maturity: 2032

- Capped call: $44.98

- Net proceeds: $387.9M

535% surge: AST shares have exploded 535% over the last 12 months, driven by two main factors:

- Two key commercial and financing partnerships with Verizon and AT&T

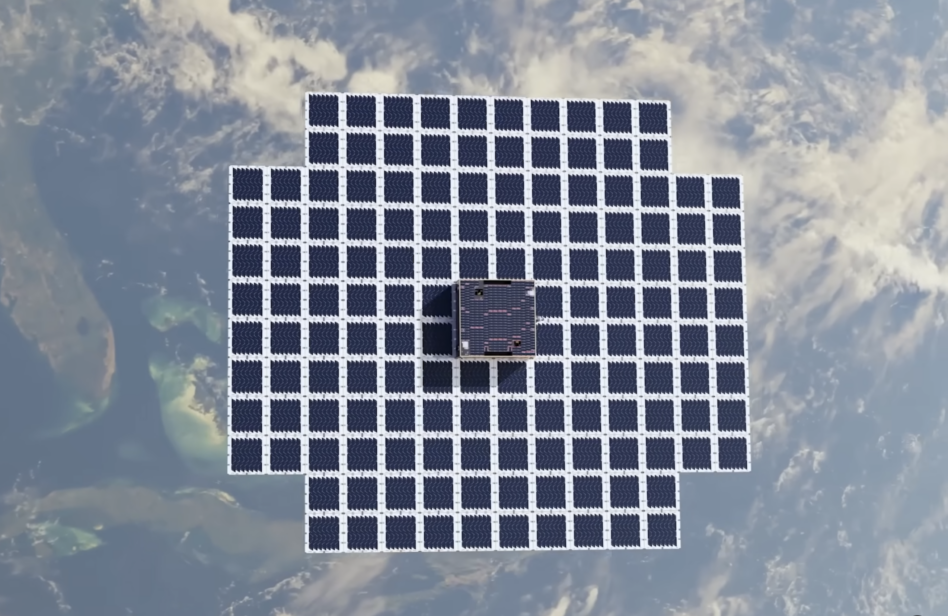

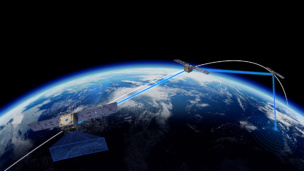

- The launch of its first commercial satellites in September

Yesterday, the FCC granted AST a Special Temporary Authorization to begin testing its direct-to-cell service with AT&T. The go-ahead means the company’s five BlueBird satellites—which launched in September—can begin operations.

Constellation economics: The company had $567.5M of cash + equivalents on Dec 31, according to an SEC filing submitted Wednesday. With the additional $388M from the convertible bond, AST will have nearly $1B in the coffers to build out its expensive BlueBird constellation.

- In November, the company signed contracts to launch 45 BlueBird satellites, with the option to increase that number to 60 through 2026.

- The average cost of direct materials and launch per satellite is $19M to $21M, management revealed on its Q3 earnings call. 60 satellites x $20M = $1.2B.

- This week’s funding announcement will go a long way toward helping AST fund the billion-dollar endeavor.

+ Ligado’s spectrum: AST SpaceMobile and Ligado Networks announced a deal earlier this month to transfer 40 MHz of L-band Mobile Satellite Service (MSS) spectrum to AST. The company believes the spectrum acquisition will help increase coverage and enable connectivity speeds of up to 120 Mbps