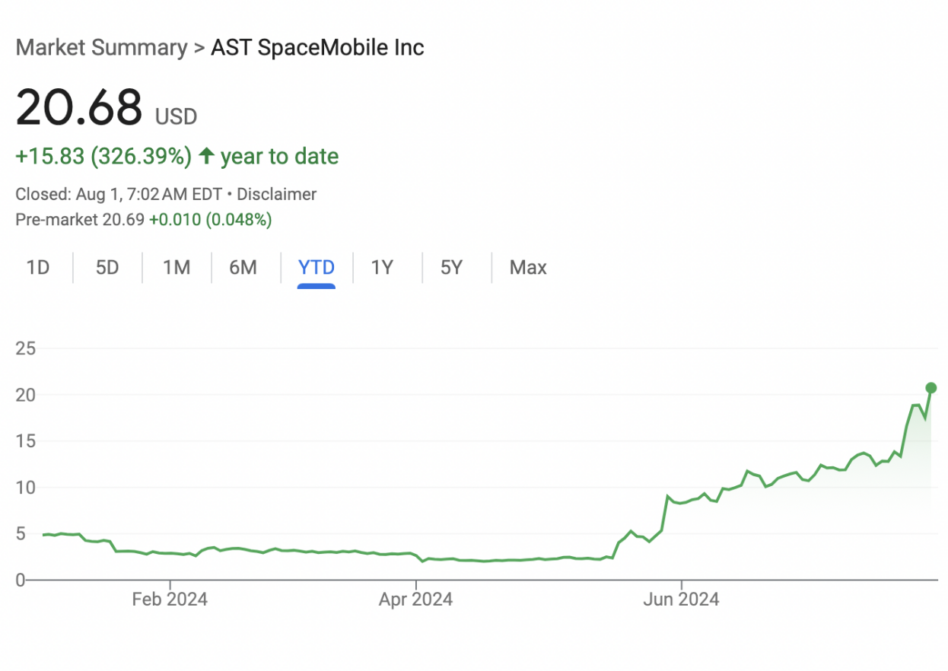

Direct-to-cell provider AST SpaceMobile jumped another 18% yesterday, bringing its year-to-date market gains to a staggering 326%.

The company’s market cap now sits at $5.6B, ranking it among the highest-valued space businesses in the world after SpaceX.

Heat check: AST’s market cap is ahead of Echostar’s ($SATS) $5.5B market cap, a company that generated $17.3B of revenue last year. It is also larger than Iridium’s ($IRDM) at $3.4B, Rocket Lab’s ($RKLB) at $2.6B, Viasat’s ($VSAT) at $2.6B, and Planet’s ($PL) at $739M.

AST’s really, really good 80 days: Three announcements have driven the company’s stock appreciation.

- On May 15, the company announced a commercial agreement with AT&T to provide direct-to-cell connectivity as an opt-in service. The pair have been partners since 2018, including AT&T’s participation in the company’s $155M funding round this year, but the contract signifies a deepening commercial relationship.

- Two weeks later, on May 29, AST announced that it was teaming up with Verizon. The deal included a $100M payment to AST, $65M of commercial prepayments, and $35M of convertible notes.

- On July 24, the company announced that its first five commercial satellites had completed assembly and were ready for prime time, with a launch slated for September.

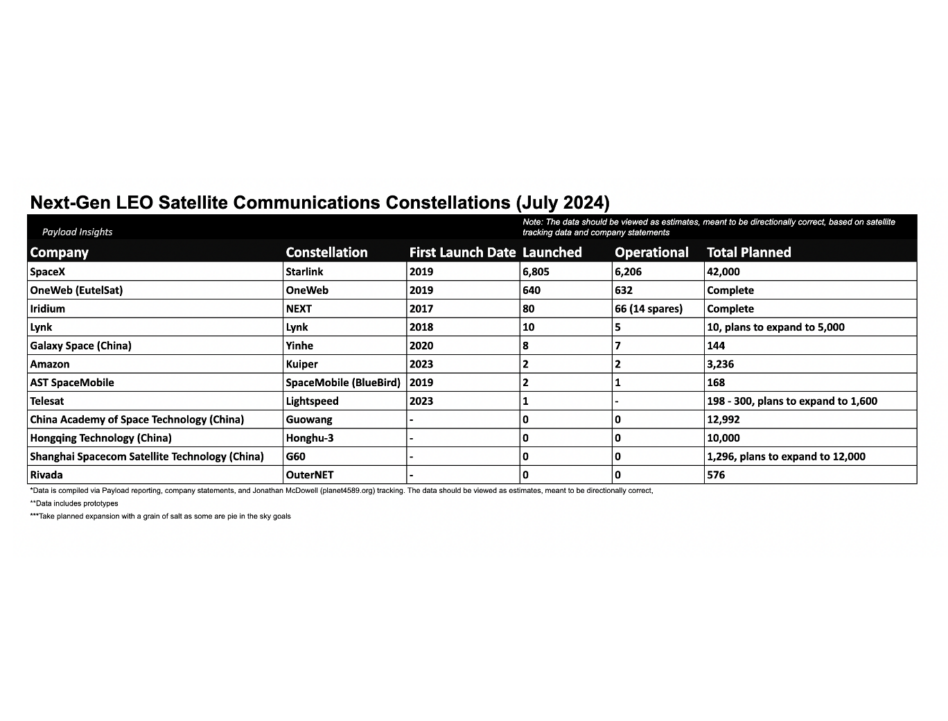

After AST launched its prototype BlueWalker 3 satellite in 2022 and successfully tested its 5G direct-to-cell capability last year, the company now has its sights set on ramping up production of its multi-billion dollar 168-bird constellation.

For AST, the Verizon and AT&T alliances, two of the largest US wireless carriers, provide a direct path to significant revenue opportunity and deep-pocketed financial support for a company that saw $268M of negative free cash flow last year.

The partnerships also set the company up as a potentially formidable competitor to SpaceX’s Starlink network in mobile connectivity. The launch and satellite giant has partnered with T-Mobile for direct-to-cell and has deployed 100 Starlink satellites designed to support the still-unavailable service.