Last week, BlackSky reported Q2 financial results. The satellite operator beat expectations on top- and bottom-line earnings, riding on the back of key contract wins and a big new integration.

“We have strong momentum across all aspects of our business,” BlackSky CEO Brian O’Toole told Payload in an interview.

Q2 results at a glance

- Revenue was $15.1M, good for a 105% jump over the prior-year period.

- Imagery/software analytical services revenue came out to $13.3M, +161% YoY and 88% of total quarterly revenue.

- The Herndon, VA company posted a net loss of $26.3M and an adjusted EBITDA loss of $8.8M

- BlackSky ended June with $111.2M in cash. Its Q2 capex was $12.1M and its opex was $27M (vs. $29.8M YoY).

BlackSky attributed a $12.1M YoY opex increase (excluding an $18.4M satellite impairment loss and $300,000 in stock-based compensation) to higher depreciation expense from deploying new satellites; hiring more salespeople, developers, and engineers; and the costs of doing business as a public company.

Looking ahead: Management lifted full-year revenue guidance by $4M to $62M–$66M, and now expects 2022 total capex to come in somewhere in the range of $52M–$56M.

Key wins

BlackSky won a ten-year Electro-Optical Commercial Layer (EOCL) contract worth up to $1B from the National Reconnaissance Office (NRO) in May. Back then, we wrote:

- “Based on the numbers alone, [compared to fellow EOCL awardees Maxar and Planet], it would seem BlackSky is punching above its weight with the EOCL contract. The company would argue, though, that it was built for precisely this.”

In Q2, BlackSky also won a five-year Pentagon AI contract worth up to $241M.

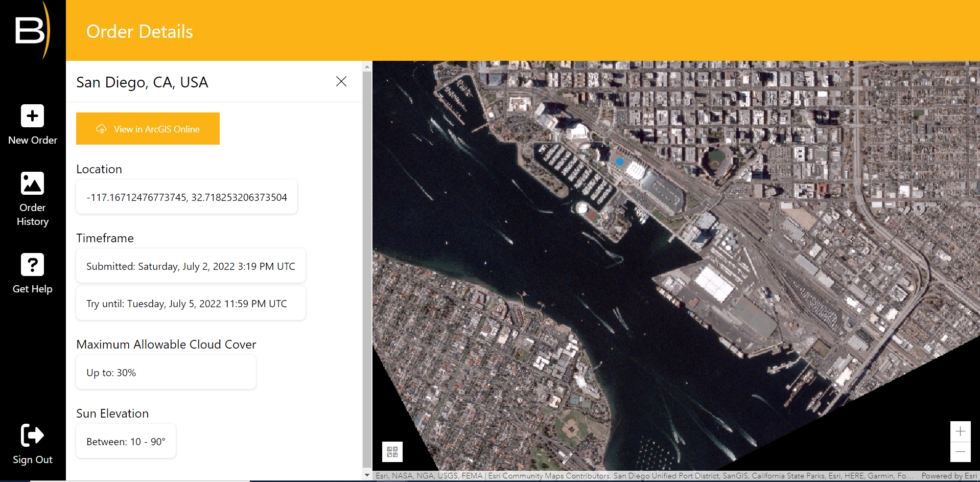

Finally, the company also inked an integration partnership contract with geospatial provider Esri. Users of the geospatial intelligence platform will be able to task BlackSky birds through a cloud-based app. The partnership opens up BlackSky’s capabilities to potentially millions of ArcGIS users.

And now…

…let’s hear from the head honcho himself. On Aug. 3, we briefly touched base with CEO Brian O’Toole to digest BlackSky’s Q2 and get a glimpse of the company’s outlook for the rest of 2022. NB: This interview was edited for clarity and length.

Thanks for the time, Brian. How would you describe the current trajectory you’re on?

We have strong momentum across all aspects of our business. We’re executing government business, both US and internationally, and ramping our commercial capabilities. Obviously, the EOCL award was significant in validating not only our current capabilities, but our future capabilities that the US government is interested in.

I think when we chatted last time, we had that strong campaign last year of deploying those satellites in that short period of time [with Rocket Lab]. With a successful launch back in March and April, we now have a baseline capability that’s really first of its kind, delivering reliable hourly monitoring of the most important strategic events and assets around the world.

We’ve got the platform in place and customers are acquiring our services. So, we’re very pleased with the momentum we have across all aspects of the business.

We’ve harped on this quite a bit at Payload recently. As it relates to market drawdowns and broader macro headwinds, your line of business is a bit countercyclical. Geopolitical catalysts are driving more demand for services like yours. How do the headwinds and tailwinds net out for BlackSky? Are you seeing inflation and supply chain issues really affecting your business?

We’re not seeing any of those impacts right now.

From a supply chain perspective, we’ve been really well underway with the production of our first group of gen-three satellites for a while. We’re out ahead of that. So, we’ve got good visibility on that side of it, but then on the macroeconomics, we’re closing [deals] and our sales pipeline continues to grow. We’re winning deals, growing customers, and we’ve got a lot of momentum going internationally.

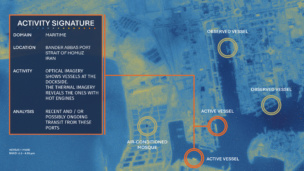

Obviously, the EOCL win gives us good visibility. Then we’re winning a lot of other US government business, primarily in the AI space. And where the momentum’s going with the Space Force, I think, Ryan, what you’re seeing here is the demand for real-time intelligence from space. That can be government or commercial, for national security, supply chain, or intelligence–it’s never been greater.

So we’ve got a great product market fit and a great time in the market. That’s reflected in our growth and momentum.

Your power users, or customer base, is concentrated in D&I [defense and intelligence]. Have you been ramping commercial capabilities and that part of the business, and staffing up on sales and whatnot there?

Our ability to integrate with other platforms, and then make our services available to a whole new community of users, is game-changing.

Think about it: Within their application, now Esri users can just task a satellite and get imagery delivered in just a couple hours…without having to call customer service.

The ease of access, speed, and affordability has been a barrier to commercial adoption for many years. Bringing those barriers down, really enabled by these platform integrations, is similar to what we did with Palantir.

That’s going to make available not only our imagery, but analytics, to a whole new community. We’re just getting started. That’s what makes us so excited.

You and your peers tend to speak a lot about customer and user experiences, and investing heavily in UX. It’s a first-principle priority rather than an afterthought. On the Esri partnership, what does that look like under the hood? Is it an API, a button, or a feature integrated directly into the console?

It’s an app that is being developed that’s integrated in our console. So basically users can pull up a real simple user interface, point, and click to task a satellite. Within a few hours, it shows right back up in our platform project.

It’s completely seamless and integrated in their workflow. This whole customer experience went from slow and expensive, and you don’t know when you’re gonna get the data, to we’ve just torn all that data, and that’s never really been available. I see that as a really big accomplishment.

I’m curious about the long-cycle nature of contracts and government procurement. Also, on managing relatively capex-heavy satellite programs, what sort of challenges do you see with the variance of quarter-by-quarter results? And communicating that as a publicly traded company?

We’ve now got 10 quarters of consecutive growth. And you can see the growth we’re experiencing in the last several quarters and the directionality of our margins, revenue, performance, etc. So, I think the analyst community is now starting to understand our business as we execute. As I think I’ve told you before, we’re on the same path I laid out several years ago and we’re executing against that plan. And how the market is learning about the business and I think we’re on a really good trajectory there.

Do you define yourself as a software or a services company? BlackSky is obviously very focused on the software, but I also wanted to ask about the unit economics of each incremental satellite that you’re launching to orbit and operating.

If you kinda dig into our earnings call, right, 88% of our revenues are imagery and software-enabled analytics. Data and analytics products are driving our growth.

And because we’re operating off of what I’ll call a fixed cost base. We monetize that capacity. There’s a lot of operating leverage and that’s where you’re seeing our margin growth.

And then what’s even more important, because we’re able to really collect only what’s important and strategic to a lot of people, we sell that many times. We built a really strong platform here of selling data and then the upsell of analytics. That can include data and analytics from other third parties as well.

You lifted guidance for the year. Are there any other big events or milestones you’re looking forward to in the back half of 2022?

Clearly, Ryan, the EOCL was in line with what we expected. We’re growing our customers in the international end and across other parts of the US government. We’ve got good visibility and growth coming really from beyond that EOCL contract.

That really was the impetus in raising our guidance. I’m not gonna get into particular opportunities, but I’ll say we’re growing a robust pipeline of opportunity across all those sectors. We’re executing well and converting those into contracts.

I won’t push you on breaking NDAs or security clearances or anything, but I’m curious if there’s any other detail you could add about international entities and governments you’re working with. Any color you can share there?

We’re now working with multiple ministries of defense in different regions around the world, who rely on us every day for vital intelligence. It shows that we’ve got trusted relationships with those important customers. We’re expanding contracts and we’re adding more of those customers as we speak.

We’ll also say the EOCL validation also provides very strong support. So capturing additional customers because of the confidence the US government has placed on BlackSky in where we are today and where we’re going next. The international demand is very strong particularly because we have monitoring capabilities that they haven’t had. It’s a new and unique capability for them, that’s augmenting things they were doing before.