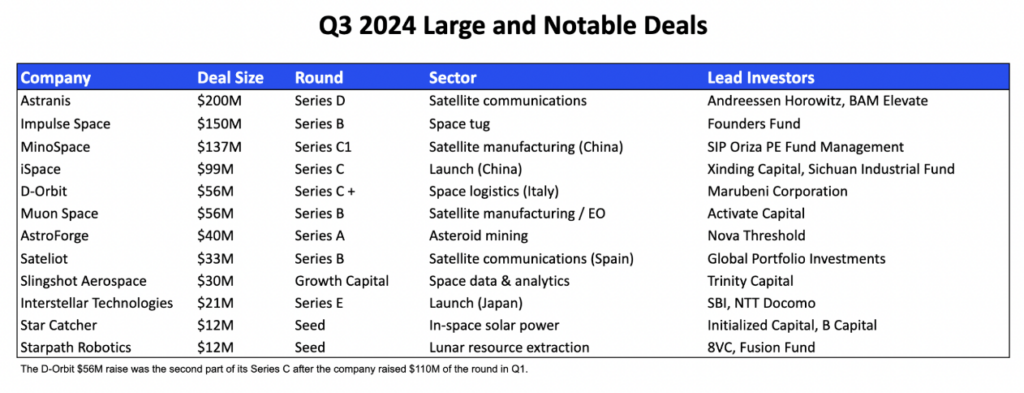

Two mega US space funding rounds closed in Q3:

- Astranis, a startup building small GEO broadband satellites for targeted service, raised a $200M Series D—the largest space sector round closed in 2024.

- Impulse Space, founded by SpaceX’s first employee Tom Mueller, raised a $150M Series B round for its orbital transfer vehicle.

Other notable US deals this quarter include bets on high-risk/high-reward companies like AstroForge asteroid mining, Star Catcher in-space solar power, and Starpath lunar resource extraction.

Continuing the trend seen all year, US launch and human spaceflight remain in a funding drought. Meanwhile, launch startup ABL Space Systems announced a round of layoffs last month, and Axiom is reportedly struggling with its liquidity as well.

Nearly half of this quarter’s large deals were international. Chinese investors, in particular, have continued to invest heavily in its commercial space sector, funding satellite manufacturer MinoSpace’s $137M Series C1 and launch startup iSpace’s $99M Series C.

Launch

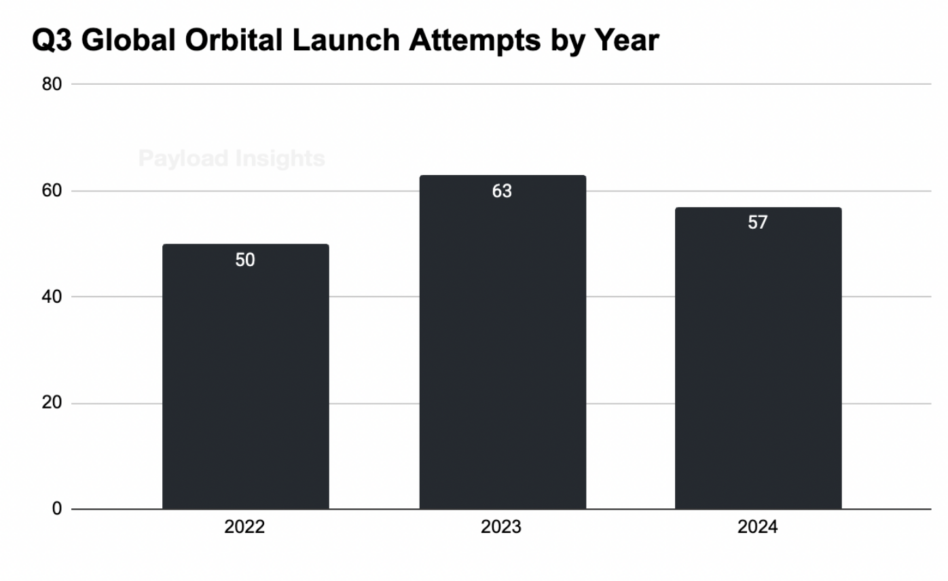

For the first time in years, global launches declined YoY in Q3. In addition to launch declines in China, India, and Russia, SpaceX suffered three Falcon 9 flight anomalies, which limited its YoY increase.

- A July 12 second-stage failure resulted in the loss of all Starlinks aboard

- An Aug. 28 returning booster tipped over attempting a drone ship landing

- A Sept. 28 second-stage booster failed to initiate deorbit burn properly

Rocket Lab was steady Eddie, again launching three Electron rockets this quarter.

EU launch is beginning to stir again, with Ariane 6 making its debut and Vega C nailing a pair of static fire tests ahead of Q4 return to flight.

Satcom user base

Starlink defied gravity this summer, significantly accelerating growth. Over the past four months, the service increased its customer base by 1M users.

The main driver of the uptick was likely the introduction of the Starlink Mini in June. We wrote about the implications of the backpack-sized terminal for Starlink adoption, and we are seeing it play out big time. The terminal is a game changer, particularly for developing countries where utility, flexibility, and low cost are paramount.

The rise of Starlink has affected just about every corner of the satcom market, with competing networks reporting customers switching to the higher speed SpaceX service. But Iridium has largely been able to ward off the threat as it is positioned just outside of its direct path in the backup connectivity market.

As a result, Iridium’s user base keeps growing, returning capital to shareholders through buybacks and dividends. On Sept. 19, the company announced it approved a $500M share repurchase program, its largest ever.

Earth observation commercial revenue

When Planet Labs went public in 2021, they forecast that revenue derived from the commercial sector would grow from 54% of total revenue in FY21 to 68% by FY26.

- Fast forward three years and commercial revenue has shrunk to 23%.

- The lukewarm commercial demand trend can be seen across the entire EO industry.

It’s more likely that Planet’s prediction was early rather than wrong. The industry still has work to do to reduce costs and turn imagery into actionable insights. Regardless, maybe ole reliable government customers aren’t so bad after all.

Aging GPS

The GPS chart is not a Q3-specific chart, but it received a fair amount of buzz when we highlighted it in our August Rise and Stall of GPS story. We’ve seen billions of dollars pour into the space economy over the past 10 years—think SDA, Artemis, SPACs, direct-to-cell, lunar landers—yet we continue deprioritizing our most important space assets: GPS satellites.

The network is growing old and wrinkly, threatening its competitive edge compared to international rivals.