China’s ban on the export of rare materials that are critical components for space solar panels could accelerate an ongoing industry pivot, according to some experts.

The ban focuses on materials used in semiconductors, and two specific materials—gallium and germanium—are fundamental to creating the highest-performing space solar panels. While China isn’t the only supplier of these materials, it is the largest, and global prices are rising.

Demand signal: Global industry can make enough III-V solar cells to generate about 2M watts of energy each year, said Andy Atherton COO of Solestial, a space solar power startup. But Atherton told Payload that new power demand in orbit is already closing in on 20M watts a year, thanks to the soaring number of spacecraft in orbit.

How do you fill the gap? Silicon—the most commonly used material for solar panels on Earth can also be used in space.

The catch is that silicon panels are more radiation sensitive: SpaceX churns them out for its Starlink satellites, and while they degrade faster than more expensive cells, SpaceX is able to replenish its satellites far more cheaply than competitors.

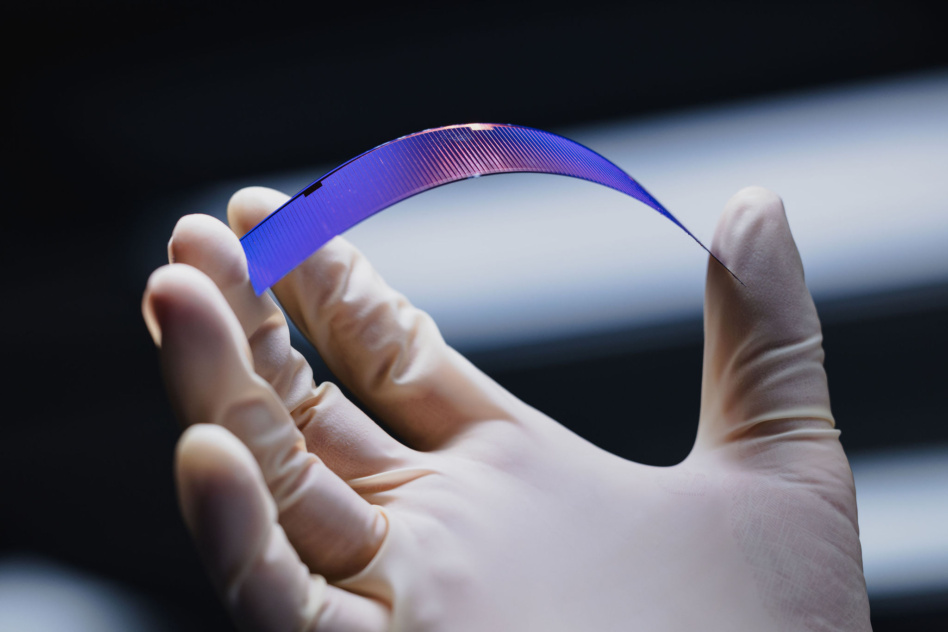

Mother of invention: Solestial, too, makes space solar panels from silicon, with an emphasis on resisting degradation—its core IP allows solar cells to self-recover from radiation damage.

Atherton said its products are about 20% less efficient than III-V cells, but significantly lower mass and ten times cheaper. Next year, the company expects to ramp production and make enough cells to produce 1M watts of power.

Industry map: III-V and silicon are complementary solutions, according to Atherton, with high-end photovoltaics suited for exquisite deep space missions. But “if you’re putting up 1,000 communication satellites, and each one of them needs five kilowatts of power, you’re not getting five megawatts of III-V in any reasonable time frame, for any reasonable cost,” he said.

It’s fine: A spokesperson for Rocket Lab ($RKLB), which manufactures III-V solar panels, told Payload that the company doesn’t “rely on these materials from China.” Boeing’s SpectroLab division, another major III-V producer, declined to comment.