D-Orbit, a European in-space logistics startup, secured €100M ($110M) as an initial raise in a Series C round, which will allow it to expand its service offerings and build out operations in the US, Europe, and the UK, the company announced this morning.

Marubeni Corporation, a Japanese industrial group, led the raise. D-Orbit expects to raise additional Series C funding that will close in the first half of this year.

The company says the round will bridge it to cash flow profitability.

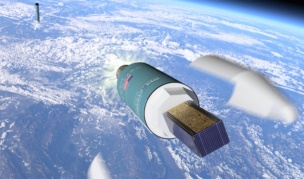

Space tug: D-Orbit provides last-mile satellite deployments, which is like taking an Uber (D-Orbit’s ION orbital transfer vehicle) to your final destination after getting off a plane (usually a SpaceX rideshare mission). D-Orbit also offers third-party payload hosting and cloud computing solutions.

The company escorted its first satellite home in 2020. Since then, business has been strong.

- Annual revenue has grown by triple digits each year since 2021.

- D-Orbit has logged 15 successful missions and has 13 ION space tugs in orbit.

“D-Orbit has continued to prove itself to be the leading in-space transportation provider, developing the technology and services needed to maintain a sustainable in-space economy,” said James Bruegger, a partner at Seraphim Space who participated in the round.

Refueling mission: In-orbit servicing is next up on the company’s product map. The company announced last year that it would participate in a Thales Alenia Space-led €235M ($257.7M) in-orbit servicing mission funded by the Italian Space Agency. In the demo, D-Orbit will oversee the gassing up of an ION OTV from a servicer spacecraft.