This morning, Deloitte released a forecast on the potential for growth within the space industry. The report, which pairs market data with a survey of space industry leaders, is intended to give execs in other industries the background they need to incorporate space into their businesses.

Bottom line upfront: “For space to grow, and fulfill the promise of all of these forecasts…it’s going to take other Fortune 500 companies understanding and seeing their opportunity and space and willing to experiment and try new things,” Alan Brady, an analyst on the report, told Payload.

To compile the report, the analysts interviewed 60 executives from across the space industry about various business sectors. The Deloitte team was looking to identify where innovation is happening, which segments are poised to see dramatic growth in the next few years, and what technologies could become commercially viable further down the line.

Defining growth

Understanding growth isn’t straightforward and analysts considered multiple metrics:

- The exponential increase in the sheer number of launches over the past few years

- Amount of investment flowing into various segments

- Demand signals from the government for certain products and services

- Number of new satellites heading to orbit.

The analyst’s ranking of areas ripe for growth, however, were determined by survey data from the space industry executives they spoke with.

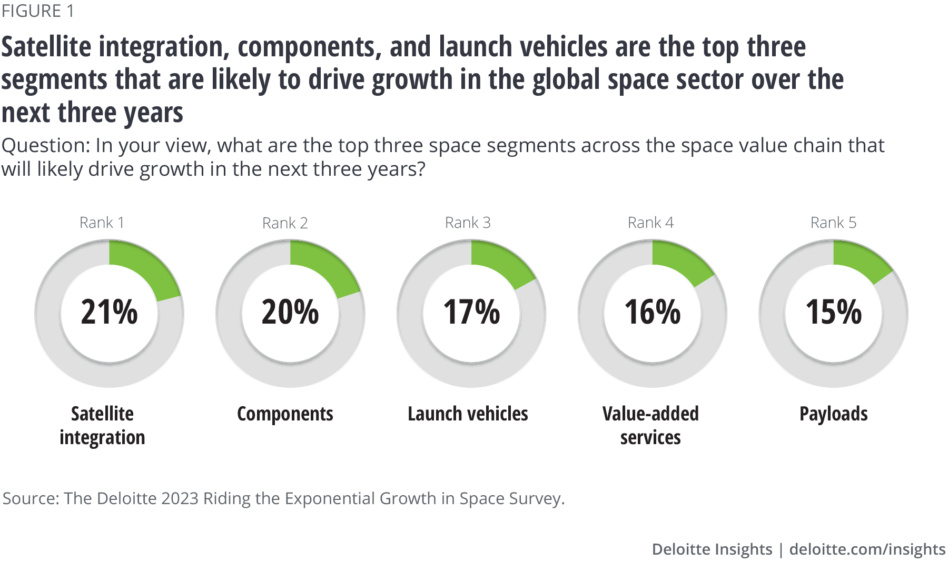

Leading the sector: The analysts identified several segments that are likely to lead the pack in growth over the next three years. Those segments, in order, were satellite integration, components, launch vehicles, value-added services, and payloads.

Ripe for innovation: Deloitte identified in-space servicing, additive manufacturing, and space sustainability as areas where technology could boom looking a little further into the future.

The case for space: Brady says that Deloitte’s analysts are still trying to engage non-space native F500 players and make the case that space tech can and should be part of their strategy. “I hope that the capital markets and we as an industry find a way to preserve what’s wonderful about that spirit of experimentation and diversity and variety, while continuing to grind towards a clear commercial viability for a lot of different slices of this industry,” he said.