Esper Satellites is a satellite company…without any satellites on orbit.

Despite this, the Melbourne-based EO startup’s sales have ballooned from less than $1M in revenue at the start of the year to more than $10M now, CEO Shoaib Iqbal revealed to Payload.

Counterintuitively, this sales growth came after the company’s first mission to orbit ended in failure.

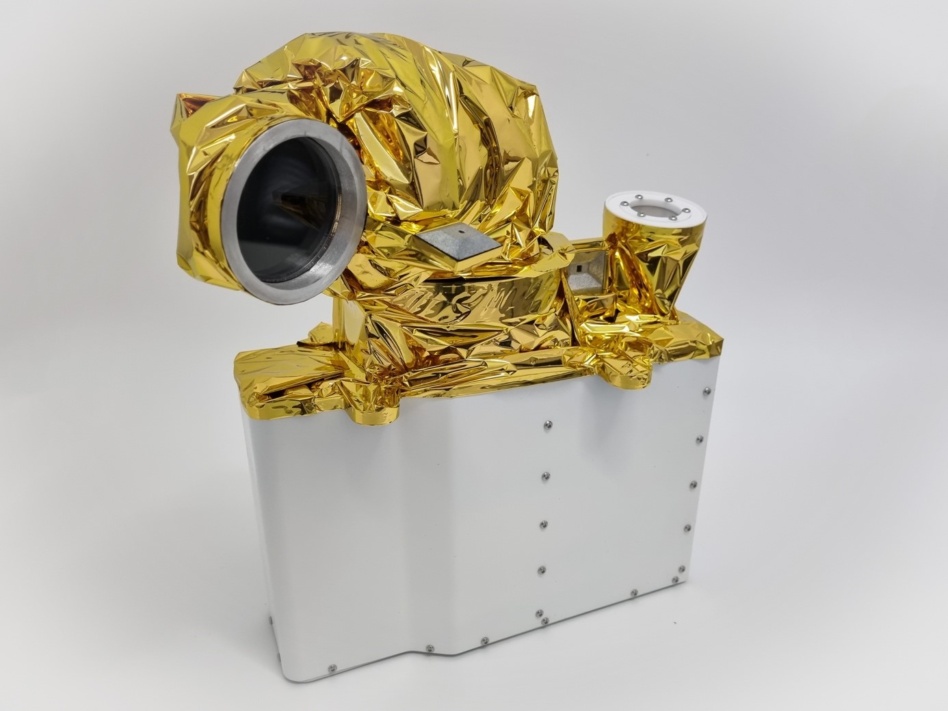

Somewhere: Esper’s first hyperspectral payload, Over the Rainbow-1 (OTR-1), launched in March aboard a Space Machines bus on Transporter-10. However, Space Machines failed to make contact with the satellite after it deployed on orbit, forcing Esper to make other arrangements.

The company’s solution is OTR-X, an attempt to bridge the data gap between the failed OTR-1 mission and the planned OTR-2 mission by utilizing a near-infrared sensor from a partner’s satellite already in orbit.

The result is that Esper started delivering data to clients while they prepared to put their own dedicated payloads in orbit.

“It’s very similar specs to what we were launching on the [OTR-1]. Obviously, the cost benefit that we provide on our own sensors isn’t exactly there, but what that does mean is that we’re open for business,” Iqbal said.

Proof pudding: OTR-X has validated Esper’s business model and shown that the more data the company has, the more interest it can garner from the market. Esper now utilizes data from a range of EO partners, not just hyperspectral imagers, and has contracts for future mission data from the mining, oil, and gas sectors.

Over the next few years, the company plans to build a constellation of 18 satellites. After OTR-2, which is expected to launch this year on an ISRO PSLV, the technology and cost structure will significantly improve.

What’s next: The company is on track to launch four payloads in 2026, dubbed the Four-Leaf Clover missions. While OTR-1, OTR-2 and OTR-X use near-infrared hyperspectral imagery, later missions will have even more advanced sensors.

“They’re our secret sauce, basically our magnum opus so far. The capability we have packed into those sensors that we’re going to be flying on the Four-Leaf Clover missions will blow everything else that’s currently on the market out of the water,” Iqbal said. “Especially with the pricing that we’re looking to operate. Per satellite we can still offer it for sub-$2 per square kilometer.”