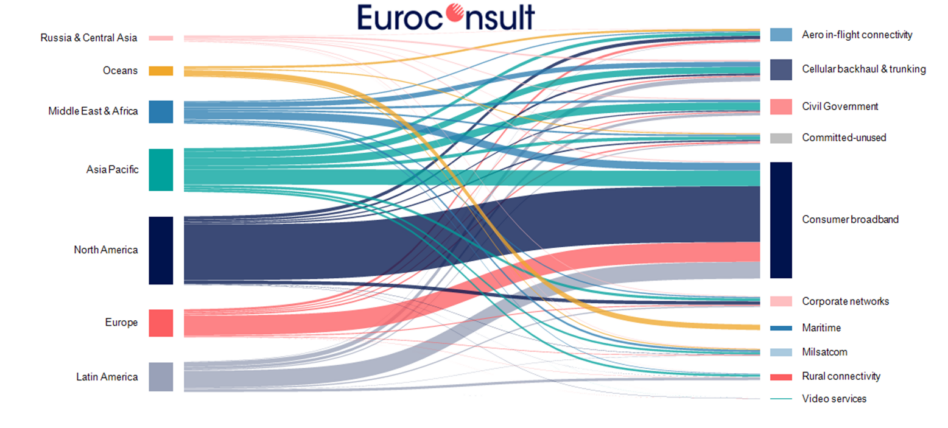

Projected HTS capacity demand in 2030. Graphic: Euroconsult

Euroconsult has released the 6th edition of its report on the High Throughput Satellite (HTS) market. The takeaway: Business is booming. The HTS market has seen major growth since 2019, and that growth is expected to continue booming over the next few years.

Euroconsult predicts growth in nine key areas:

- Consumer broadband

- Rural connectivity

- Civil government

- Corporate networks and energy

- Military communications

- Cellular backhaul and trunking

- Aero in-flight connectivity

- Maritime communications

- Video services

Non-geostationary HTS: Broadband constellations in LEO, including Starlink, OneWeb, and SES O3b/mPOWER, are expected to account for 90% of satellite capacity supply by 2026.

- In 2021, Starlink grew global capacity by 350% nearly on its own.

- OneWeb and SES are beginning constellation operations this year, which will also drive capacity growth.

Not all of the growth in LEO broadband capacity will be able to be exploited right away, though. The report notes that regulations and lagging authorizations will cause delays in allowing access for end users.

Geostationary HTS: Capacity in GEO is also expected to increase over the next few years, though not at the breakneck speeds of LEO capacity. This growth will be driven by increased flexibility on GEO satellites using software-defined systems, per the report.

- Software-defined systems from Airbus, Thales, and Astranis alone have accounted for 80% of GEO HTS orders in 2021.

The big picture: Euroconsult projects that by 2024, global HTS capacity will reach 26,500 Gbps, a more than 10x increase over 2,100 Gpbs capacity in 2019. Consumer broadband is projected to account for 60% of that growth, again pointing to Starlink as the main driver. Demand for HTS capacity is expected to grow by 26% per year over the next decade.

And this increase in capacity demand is expected to come from all across the globe. Right now, North America accounts for ~50% of HTS capacity demand. By 2030, that number will be about 33%.