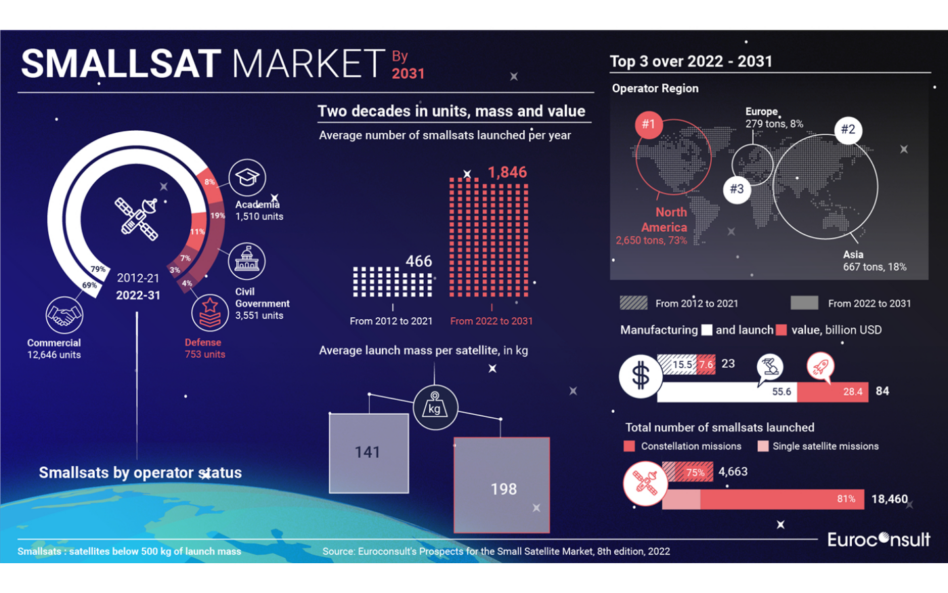

Euroconsult has released its 8th report on the small satellite market. The TL;DR–the smallsat industry has big things in the works over the next decade.

A boom in smallsat upmass

The market intelligence firm’s analysis found that ~18,500 satellites weighing <500kg are likely to reach orbit by 2031. That adds up to ~365 tons per year of upmass in smallsats alone, or an average of about a ton per day.

- From 2012-2021, an average of 466 satellites were launched per year. Over the next decade, that number is expected to nearly 4x to 1,846.

- 69% of those satellites are expected to be owned and operated by commercial space players, 19% by civil government entities, 8% by academia, and 4% by defense.

- Euroconsult expects 73% of that upmass to come from North America. Next up is Asia with 18% and Europe with 8%.

The many megaconstellations planned for the next decade are expected to make a big impact on this market. 81% of the smallsats to be launched by 2031 will be part of larger constellations, Euroconsult projects.

The value of the smallsat market is poised to grow, too, the company reports. Euroconsult expects that the smallsat manufacturing market will balloon to ~$56B from ~$16B in the last decade, and that the smallsat launch market will grow from ~$8B to ~$28B.

It’s not all sunshine…Supply chain issues and high inflation won’t spare the smallsat industry. “We anticipate that stakeholders that have yet to raise significant amounts of capital will likely face a difficult situation, leading to smaller constellations, canceled projects, and scope reductions, as well as consolidation,” said Alexandre Najjar, a senior consultant on the report, in a press release. Another issue, we might humbly add, will be the growing risks of satellite conjunctions and orbital debris.