Broadband wars are heating up.

Eutelsat completed its merger with OneWeb yesterday, combining LEO and GEO capabilities to create a multi-orbit connectivity internet powerhouse.

Enter the multiverse:

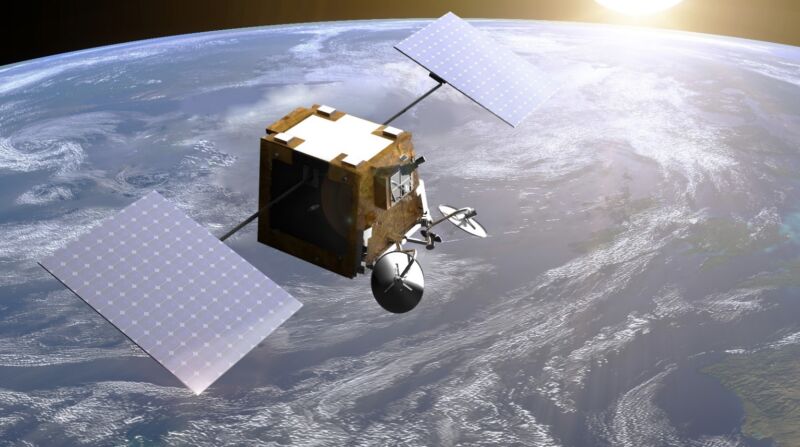

- LEO: OneWeb operates a 634-bird constellation in LEO that was completed earlier this year.

- GEO: Eutelsat has 37 high-capacity satellites perched in GEO.

Match made in the heavens: The deal combines the reliability and capacity of GEO coverage with OneWeb’s low-latency LEO capabilities, creating a robust connectivity business. Eutelsat will be able to augment its high-cash flow yet shrinking TV business with OneWeb’s fast-growing satellite internet business. Pre-merger, Eutelsat’s broadcast business made up 62% of sales, but declined 8.3% YoY.

- Eutelsat is expecting the deal to supercharge growth, increasing annual sales to 2B€ ($2.1B) by 2027.

Cost of doing business: Supporting OneWeb’s constellation of low-flying satellite internet sats is a capital intensive job. OneWeb will need a multi-billion dollar investment to refresh its constellation with its gen-2 satellite by 2028. The company expects the new satellites to lower latency and boost capacity by five times.

To finance the capex, Eutelsat will likely have to cut into its double-digit dividend yield. Since deal talks began in July 2022, the Eutelsat stock is down ~50%.

Post-merger, the company will remain on the Euronext Paris Stock Exchange, and will look to list on the London Stock Exchange.

Two Davids to take on Goliath: The merger of the two companies—which comes just four months after broadband competitor Viasat joined forces with Inmarsat—better positions the business to compete with the growing dominance of SpaceX’s Starlink. SpaceX operates a constellation of nearly 5,000 Starlink satellites that beam down internet from LEO. Starlink recently notched 2M subs, already doubling its base since the beginning of the year.