A small engineering firm from the Basque region of Spain nabbed an investment from Talde as it quietly lays the groundwork for a global space business empire.

Added Value Solutions (AVS) develops complex equipment for industries such as fusion, particle accelerators, and space.

On the heels of a significant investment in the firm, CEO Miguel Ángel Carrera told Payload how his company plans to capture the space market.

Playing the long game

“Space has been on my mind since the first day of AVS’s inception,” Carrera said. “In 2006, without any prior space experience, I visited [ESA] to interview with several stakeholders to draft a roadmap of what AVS needed to do to enter the space sector.”

To establish a track record for its eventual entry into the sector, AVS cut its teeth in fusion and particle acceleration, designing equipment with crossover to space.

Since then, the company has notched several space wins, including:

- Inking contracts with ESA, NASA, ISRO, plus partnerships with European primes like Airbus, Thales, and OHB.

- Building two instruments for NASA’s Perseverance rover.

- Developing three subsystems for the NASA-ESA Mars Sample Return Mission.

Time for a boost: AVS received its first outside investment in its 17 year history, aimed, in part, at fueling its space business.

Space only accounts for about 50% of the company’s contracts today, but Carrera expects this to grow to 70% in the next decade.

But AVS didn’t go the typical VC route. Instead, it gave a minority stake to Talde Private Equity, a Spanish firm that invests in high-growth SMEs.

One small step

Talde has invested in 160 companies over the last half-century, but AVS is its first leap into space.

“For Talde, it has been essential to invest in a company with a penetration in the space market already proven with projects carried out for clients such as NASA or [ESA],” Marc Baiget, a director at Talde, told Payload “Our analysis of the AVS investment has made clear the great potential of the space market and we will leverage on the knowledge acquired in the process to be ready for new opportunities in the market.”

The firm is not disclosing the investment amount, but Talde confirmed it was the third made through its €150M ($168M) investment vehicle launched in 2020.

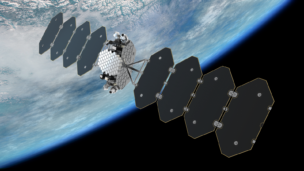

What’s next? Carrera seeks to position AVS as an advanced mechatronics and robotics provider for Moon, Mars, and in-orbit servicing missions. He has other big plans for the company, including boosting revenue from $27M in 2022 to $34M this year, and launching an EO sat it developed for the Basque government next spring.