Yesterday’s successful Chandrayaan-3 lunar landing sparked a wave of national pride and enthusiasm across India. The country’s fervor for space has spilled over into its stock market, where its space stocks are surging.

While India hasn’t caught the space pure-play SPAC bug like the US, it has several prominent publicly traded industrial companies that have directly supplied ISRO and Chandrayaan-3.

In the week leading up to the landing, India’s space stocks added $2.5B of market cap, according to data compiled by Bloomberg. Yesterday, Chandrayaan-3 supplier stocks continued that trend:

- Centum Electronics supplied 200+ mission-critical Chandrayaan-3 parts and modules—traded up 14.5% yesterday.

- Godrej Aerospace supplied thrusters and engines for the mission—rose 7.3%.

- Paras Defence and Space Technologies built the spacecraft navigation systems—climbed 5.8%.

- MTAR Technologies developed engines, booster pumps, and gas generators—increased 5% yesterday.

- Hindustan Aeronautics manufactured the Vikram lander module—advanced 3.9%.

The uptick in enthusiasm for space equities—although perhaps driven in part by speculation— signals an anticipation of further investment in India’s space economy.

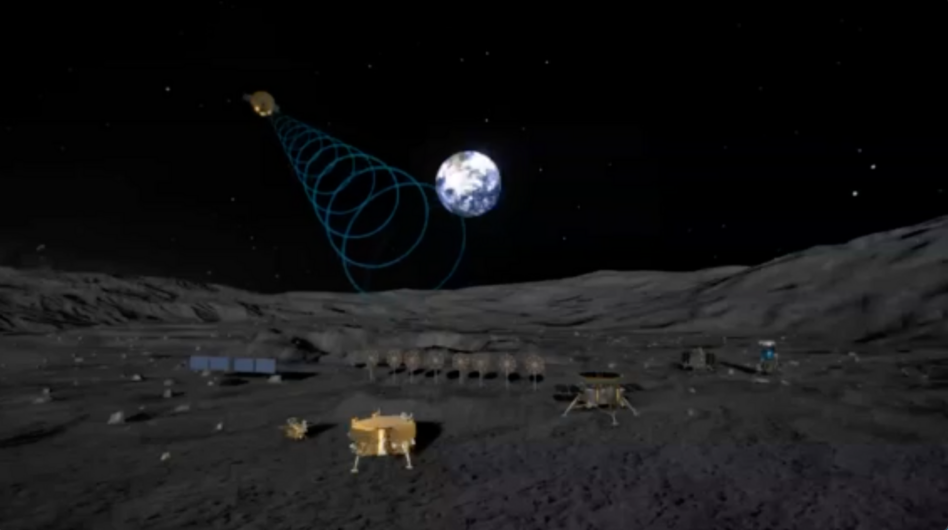

A spacefaring nation: The Chandrayaan-3 mission, with its modest cost of ~$74M, is already inspiring further missions. Post-lunar touch down, space officials discussed ramping up Chandrayaan-4 and -5 missions.

Moved to the private sector: In addition to further public-private Chandrayaan missions, India also aims to support a fully private-sector space economy. Earlier this year, India announced plans to privatize ISRO’s Small Satellite Launch Vehicle (SSLV), with 20 interested bidders.