Intelsat has struck a deal with CNH Industrial ($CNHI) that will add the company’s satcom network to the agricultural and construction equipment manufacturer’s fleet of tractors, combines, and other vehicles.

Notably, the two firms plan to be in the market months ahead of a much ballyhooed partnership between SpaceX and John Deere to develop similar connectivity.

Internet of Tractors: Space already revolutionized food production once, with the arrival of GPS-enabled precision agriculture that allows growers to manage their fields at a resolution of a few centimeters. Now, farmers are pulling data off of semi-autonomous machines to track what seeds are planted where, as well as fuel consumption and other metrics about the vehicles. That, in turn, allows them to increase yields and cut costs.

Right now, CNH and its rivals use mobile networks to collect this data, but large farms in rural areas often lack sufficient connectivity.

Enter the satellites: Using space assets to connect smart machines isn’t a new idea, but the cost of ground terminals that are often unsuitable for harsh conditions has led to slow progress. That’s begun to change: “There’s a pretty clear path where you’re going to see satellite connectivity take over a lot of your cellular,” said Marc Kermisch, CNH’s chief digital and information officer.

In January, ag equipment giant John Deere announced a partnership with SpaceX to connect its vehicles starting in late 2024. That will require developing a ruggedized version of Starlink’s ground terminal, which will come with a higher price tag than the $600 existing standard terminal.

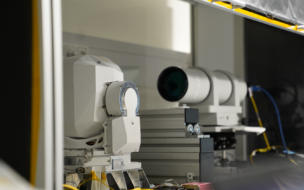

Intelsat, however, already has a ruggedized terminal developed by partner hiSky, which is used to connect large mining machines to its satellite network. The companies, which argue that Intelsat’s multi-orbit constellation will drive down prices, are developing an aftermarket upgrade kit that will add connectivity to machines, starting in Brazil in Q3 2024 and worldwide by mid-2025.

A matter of scale: The opportunity here is large—Mark Rasmussen, a business development executive at Intelsat, said this partnership is a pathway to connecting millions of agriculture and construction vehicles. Producing that many terminals is bound to drive down their cost, creating a virtuous cycle that could benefit the satcom supply chain at large.