Microsoft is scaling up its presence in space, in a figurative rather than literal sense. Azure, the company’s cloud computing arm, is focused on building out software tools and partnerships within the industry, rather than launching its own hardware into space.

Azure Space launched in Oct. 2020. It’s apparently been quite busy since then.

The Microsoft space unit made a slew of product and partnership announcements in Paris last week at WSBW. We’ll run through them here, along with highlights from a Payload interview with Jason Zander, Microsoft’s EVP of strategic missions and technologies.

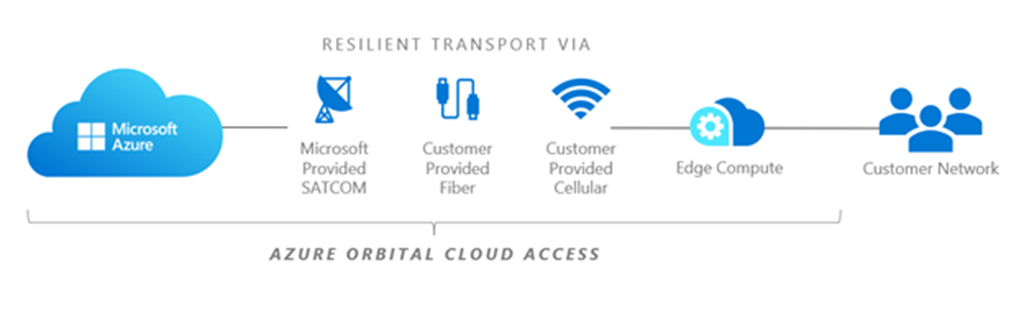

#1: Azure Orbital Cloud Access (in private preview)

This new service is targeted toward unlocking high-bandwidth, low-latency applications from anywhere on the globe, said Zander. Azure Orbital Cloud Access leverages “edge” devices and the Starlink constellation for connectivity. Theoretically, that could make this offering available anywhere that’s served by SpaceX’s satellite internet service.

- “Starlink’s high-speed, low-latency global connectivity in conjunction with Azure infrastructure will enable users to access fiber-like cloud computing access anywhere, anytime,” SpaceX’s Gwynne Shotwell said in a press release.

- But Rome wasn’t built in a day and these services aren’t rolled out in a day either. Microsoft says the service Cloud Access Preview is only available to Azure Government customers.

Microsoft detailed two case studies of its new product offering. Firefighters in Idaho and the Hsinchu Fire Department in Taiwan used services like Microsoft Teams video chat while on the go (and out of service from traditional telco infrastructure). On fixed vs. mobile satellite services, Zander said “our goal would not be to narrow between them.”

#2: Ground Station goes into general availability

Azure Orbital is a fully managed ground station as a service product, allowing operators to communicate with their satellites (and control them) in low (LEO) or medium (MEO) Earth orbits. Last week, Microsoft said Pixxel, Loft Orbital, and Muon Space had signed on to use the service.

- Azure’s ground station is colocated in or near Azure datacenters. Microsoft operates four of its own antennas, and plans to grow to 15 in the near future. The company also integrates with partners’ equipment, like KSAT’s Global Ground Station network.

- Azure Orbital effectively lets companies pull information quickly from space into ~the cloud~. There, they can then access and analyze data with the full range of Azure analytics and AI tools.

#3: Making strides in digitizing satellite communications

Azure and ST Engineering iDirect said they demonstrated a satellite modem running as a “fully virtualized piece of software.” Azure will continue to work with traditional ground segment equipment, while also supporting new virtualized applications. Microsoft and SES also say they’re creating the world’s first fully virtualized ground station for the latter’s 2nd-gen MEO constellation.

On Microsoft’s go-to-market strategy, “We’re partner-led,” Zander said. “I’m not designing or launching my own satellites…[which] allows me to get to market a heck of a lot faster, because I can work with folks that have already done all that hard work. They are experts—they’re literally rocket scientists.”

Why is Microsoft so invested in space? “Going forward, if you do not have a satellite solution, you do not have a hyperscale cloud,” Zander said. Satellites are complementary to traditional telco networks and Azure is also investing in 5G, Zander said, but the cloud shouldn’t be confined to areas with cellular connectivity. To build the “world’s computer,” as Microsoft calls its cloud internally, you’ve got to be able to hit all the edges.