Can anyone catch SpaceX?

That’s the question posed by a Morgan Stanley Research team in a recent, updated note to investors. Spoiler alert: The analysts seem to believe the answer is no.

Payload read and digested the updated memo, which was first covered Tuesday by CNBC. For starters, the report is front-loaded with choice quotes from investors:

- “More than one client has told us if Elon Musk were to become the first trillionaire…it won’t be because of Tesla.”

- “Others have said SpaceX may eventually be the most highly valued company in the world.”

- “As one client put it, ‘talking about space before Starship is like talking about the internet before Google.’”

Two peas in a pod

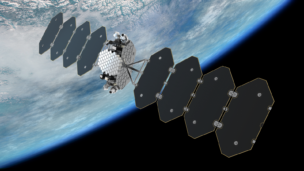

SpaceX’s rocket and Starlink businesses reinforce one another, the analysts write. As launches get cheaper and more frequent, it gets easier to deploy a full megaconstellation without breaking the bank. Since a full deployment requires the launch of thousands more satellites, Starlink represents an ultra-reliable “customer” for SpaceX’s rocket business.

The $100 billion space company has a double flywheel, the analysts write. It works something like this:

- As more rocket components graduate from expendable to reusable, launch costs could drop more. And launch cadence increases. Those unlocks, coupled with improved payload capacity and propulsion capability, could win SpaceX share in the heavy-launch market.

- Starlink gets better with scale, both from the network and end user perspective. Scale (and intersatellite links) help improve the coverage area, which in turn expands the addressable market of users and use cases. And all this, in theory, drives down production costs (TBD).

Starlink projections

In Morgan Stanley’s bull case, Starlink alone eventually reaches ~$133 billion in enterprise value (base case = ~$81 billion, bear = $0). That’s not the only eye-popping projection: The analysts estimate that Starlink’s buildout will cost ~$240 billion, burn $33 billion from 2020–2030, and become cash-flow positive in 2031.

- Under this projection, user terminals would be the most expensive line item, responsible for ~83% of all Starlink buildout costs.

Risk factors: What could get in the way of SpaceX’s plans for intergalactic domination? The analysts cite four types of risks: regulatory, execution, financial, and competition.