Intuitive Machines will attempt its IM-1 lunar landing tomorrow afternoon with its first Nova-C lander, named ‘Odysseus,’ as it aims to become the first commercial spacecraft to achieve the feat.

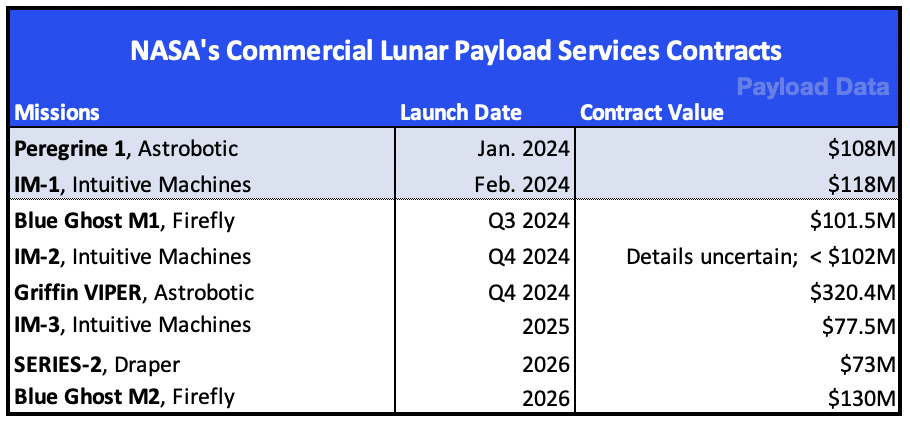

The contract, valued at $118M, is part of NASA’s broader $2.6B Commercial Lunar Payload Services (CLPS) program.

Intuitive has already earned NASA payments for several key milestones, including launch, stage separation, payload fairing separation, and establishing communication with the spacecraft. Now, less than 10% of the total contract value, approximately $13M, is pending for the completion of landing on the surface and gathering experimental payload data for NASA.

But wait, there’s more…Intuitive currently holds contracts for two more Nova-C missions with NASA. The company expects to secure the contract for IM-4 this quarter. Achieving a successful lunar landing would mark a transformative milestone for the company. No U.S. spacecraft has landed on the Moon since Apollo 17 in 1972.

If Odysseus is successful, it would significantly mitigate risks for both the technology and investors, enhance the likelihood of securing future CLPS contract awards, and boost the chances of winning related program awards (e.g., Lunar Terrain Vehicle) from NASA to support lunar and interplanetary exploration missions.

NASA venture capital: CLPS is NASA’s deepest foray into a commercially driven, hands-off approach to space exploration. In 2018, NASA announced the program, asking industry to fully manage the end-to-end delivery of agency payloads to the lunar surface. The program awards ultra-low-cost contracts (generally in the $100M range) to build novel lunar landers that can ferry ~100kg+ of payload to the lunar surface and to organize launch transport.

- NASA structured the low-cost contracts to encourage private capital participation and promote innovation and low-cost manufacturing.

- The ultimate goal—along with science—is to foster a sustainable commercial lunar market where NASA can add to demand rather than monopolize its own closed-loop economy.

“We want to be one customer of many customers in a robust marketplace between the Earth and the Moon, and we want multiple providers that are competing on cost and innovation,” said former NASA chief Jim Bridenstine when the program was announced.

How it works:

- NASA has doled out eight lunar lander mission contracts to date.

- The agency purchases services instead of directly owning and operating hardware.

- The contracts are fixed-cost, transferring much of the cost overrun risk to the companies.

- NASA does not provide funding for operations or R&D.

- Each contract is worth around $100M, a small amount considering the awarded companies are responsible for paying for launch costs in addition to building the lunar landers.

After paying for launch, the lunar lander startups are left with very tight budgets to build their spacecraft. “It doesn’t come easy, especially when you’re trying to break the barrier of a price point,” said Intuitive Machines chief Steve Altemus.

Aligning incentives: The agency structured the program to align incentives. The awarded startups are motivated to develop cost-effective landers that can generate profits and deliver returns to shareholders. The hope is that as costs go down, use cases go up, and an economy emerges.

“We think of it like venture capital—our investment is low because other people are investing in the customers,” said Bridenstine. “The portfolio is large, so we can take risks.”

NASA has already had a contract go bust.

Masten Space Systems bankruptcy: In 2020, NASA awarded Masten a $75.9M lunar lander contract. Two years later, the company went bankrupt and was acquired by Astrobotic. NASA lost $66.1M on the contract. For NASA it was a relatively small price to pay as it filters for the most sustainable long-term partnerships.

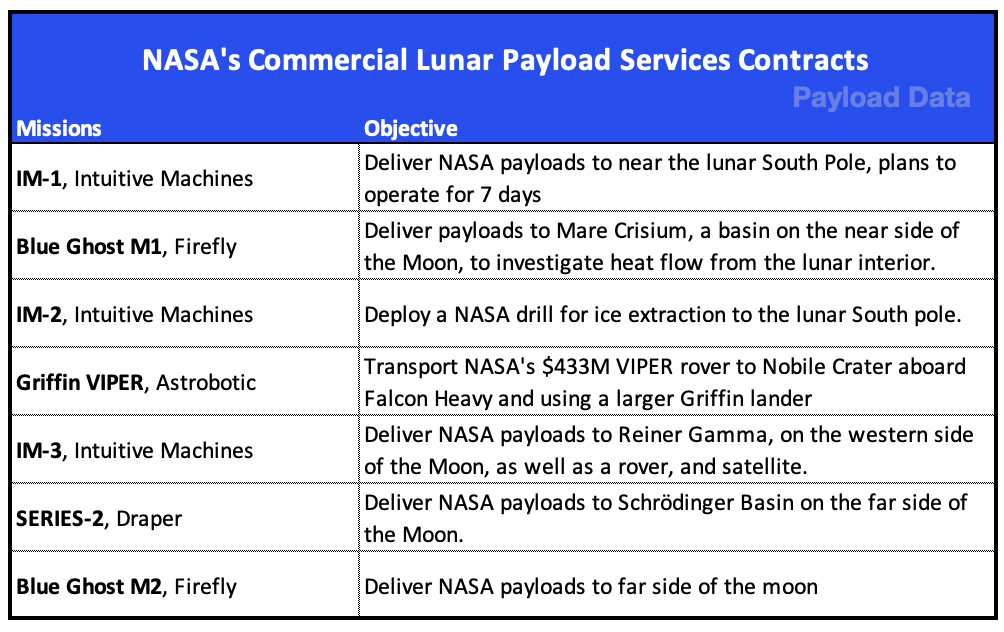

Everyone to the Moon: As more countries achieve successful lunar landings—Japan became the fifth country to do so on January 19, and China is poised to enhance its lunar exploration with the expected landing of the Chang’e 6 lander on the Moon’s far side in May 2024 for a sample return mission, along with more robotic missions planned—there is an expectation of increased Congressional support for NASA’s CLPS program. NASA has proposed a budget of over $200M for this program for FY24.

Beyond CLPS: Intuitive is also bidding for NASA’s moon buggy contract valued at $1B+ alongside partners Northrop Grumman, Boeing, AVL, Michelin, and Lunar Outpost (Boeing and GM secured the contract for the Lunar Roving Vehicle (LRV) during the Apollo era). The deployment of the LTV by NASA astronauts is not anticipated until the Artemis V mission, slated for September 2029. However, the preliminary stages involving procurement, research and development, and the creation of test models are expected to commence much earlier to ensure the timely delivery of the final moon buggies. NASA recently announced that it would delay the initiation of contract for the LTV program to vendors until March 31, 2024.

CLPS by the numbers

Although very different mission scopes, the scale of historical NASA’s Artemis program costs offers insight into just how expensive legacy space exploration contracts have become. The Artemis program has been—-in NASA’s terms—“plagued” by cost overruns stemming from cost-plus contracts, in which NASA bears the burden of paying for unforeseen expenses.

The CLPS contracts are structured differently—providing no funding for R&D, operations, or general cost-overruns. Again, CLPS scope is much different from Artemis and will be much less regardless of contract structure.

The CLPS contracts stipulate end-to-end delivery services, requiring the awardee to not only build a lander but also arrange its launch independently—which could amount to $60M+. The precise cost to build a lander is unclear, but it is certainly in the tens of millions of dollars.

- India’s successful Chandrayaan-3 successful lunar landing mission cost roughly $75M. Considering US manufacturing, CLPS mission expenses could come in above that.

Regardless of how you slice it, given the low-cost contracts, the margins are razor-thin. When you consider the R&D costs for the novel hardware, the contracts are likely in the red. To offset costs, NASA encourages lander missions to sign up commercial payloads. Firefly recently onboarded Fleet Space Technologies for its second Blue Ghost mission to the Moon. Rideshare payloads can go for over $4M a pop, according to Intuitive Machines’ financial reporting.

+ One is not like the others: NASA is paying Astrobotic over $300M (~$100M more than other missions) to transport the space agency’s water prospector VIPER rover.

- The 430 kg VIPER rover is significantly heavier than other CLPS payloads, requiring Astrobotic to build a larger lander and manifest on a Falcon Heavy launch.

- Plus, NASA is also paying for some extra TLC, considering they have spent $433.5M developing the rover.

Science goals: With eight missions targeting various regions of the Moon, the CLPS program was cleverly structured to enable a wide range of lunar exploration activities. Notably, NASA can spread out and broaden its search for water ice.

The risk of low-cost landers: The downside to ultra-low-cost manufacturing is that it heightens the risk of failed missions.

NASA is well aware of the risk. “Will every one of those landers be 100% successful? I doubt it,” Thomas Zurbuchen, NASA’s former science chief, said at the time of the program announcement. We saw this play out on the first CLPS missions last month, when Astrobotic’s Peregrine mission ended in heartbreak after a fuel leak on the spacecraft derailed its trip to the Moon.

In the end, some landers will fail, and some will succeed. The most reliable and economical architectures will go on to win additional contracts and build larger landers—thus pushing innovation and the lunar market forward.

The article was updated for the follow-on VIPER contract data.