Ed. note: This analysis was authored by Mo Islam, Payload’s cofounder and a former Wall Street analyst. This is an educated best guess, not based on access to any SpaceX internal data or proprietary info!

We’re attempting the impossible yet again: predicting SpaceX’s revenue. Before we get into Act 2—aka 2023—we’re revising our 2022 projections, which we published back in October, to account for new data.

2022 Revisions

As you can see below, Payload’s revised estimate gets us to a total of $4.6B.

Starlink: What’d we revise?

SpaceX reported 1M Starlink subscribers at the end of the year. Our prediction was 745,000 subs.

- SpaceX did report 100,000 Starlink RV subscriptions in October, and based on some extrapolation, that figure could very well have reached 125,000+ by year end. The difference between Starlink RV monthly subscription costs ($135/mo) and residential ($110/mo) are close enough that we did not separate the two. Reports of discounts on residential services, in our mind, offset the slightly higher RV cost.

- We broke Starlink Business out separately and assumed the B2B product captured ~15% of the total 1M subscriber base. We attempted to use existing satellite broadband service providers as a proxy to project residential vs. business user mix, but unfortunately that data wasn’t publicly available.

- We assume Starlink Maritime to be immaterial for now, and didn’t add any Starlink Aviation as it will roll out in mid-2023.

- Please note: Subscription revenue isn’t a simple total subscribers x cost per month calculation. We calculated the revenue on a monthly basis with an assumed growth rate.

Launch: What’d we revise?

Revisions to our launch assumptions were as follows:

- Reduced Transporter launches from four to three

- Increased commercial launches from 11 to 13

- Increased Falcon Heavy launch to one and reduced Falcon 9 (Gov.) from five to four

We originally decided to omit the awards for the development of the US Space Force’s (USSF) Transport & Tracking Layer (TTL) satellites and the Human Landing System (HLS) contract, due to lack of visibility of when milestone payments are recognized as revenue.

Alas, we changed our minds, as we felt it was not an accurate reflection of SpaceX’s progress on those contracts.

- TTL: We are recognizing $75M in revenue from this program. That figure is part of the $150M award to build USSF satellites. Note: two batches of TTL satellites are set to launch this year, which are separate contracts from the manufacturing of the satellites.

- HLS: In November 2022, NASA announced that it finally exercised an additional option ($1.15B) on its HLS contract with SpaceX. The modification will see SpaceX provide NASA with a second crewed demo landing mission. As this implies the company is clearly executing on its milestones, we felt it to be fair to recognize a part—$250M—of the initial contract ($2.89B) in 2022.

All in all, the adjustments increase launch revenue by $130M and Starlink revenue by $890M, driven by the outperformance of the subscriber numbers and a reallocation to the higher-priced Starlink Business subscriptions. In addition, our adjustments introduced $325M in revenue recognition from NASA lunar landing and Space Force next-gen constellation programs. All in, Payload has adjusted its 2022 SpaceX revenue estimate from $3.25B to $4.6B.

Now, let’s turn our attention to this year.

2023 Projections

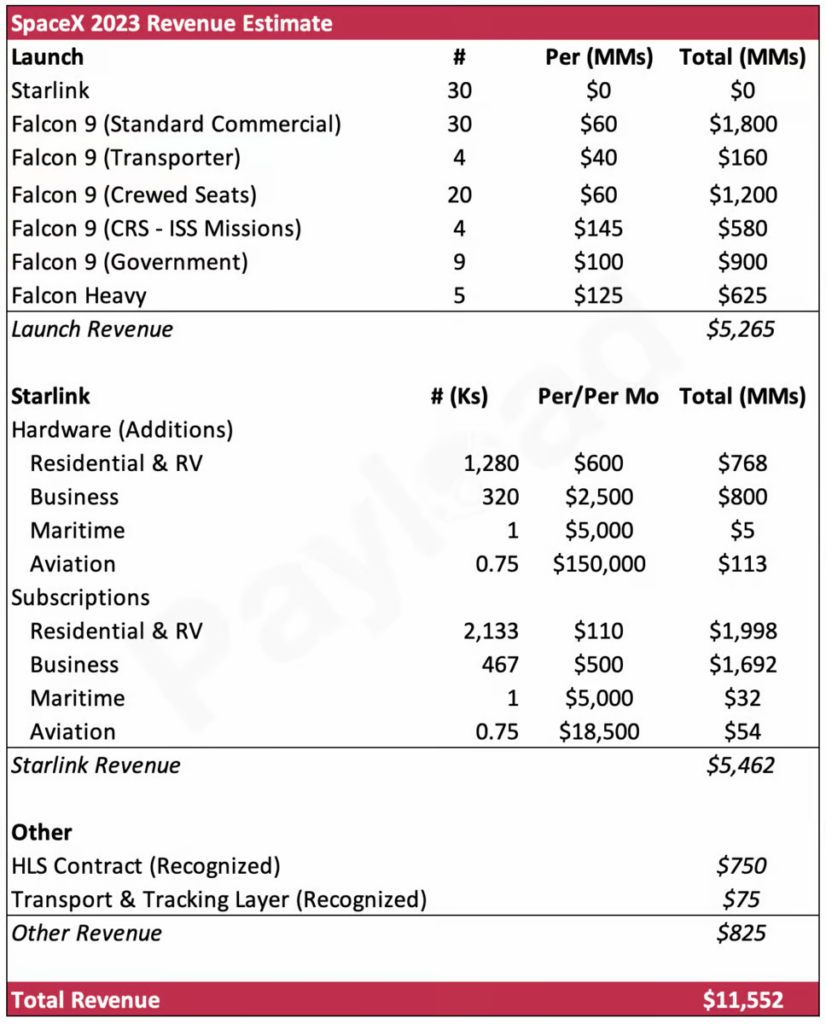

Launch assumptions

For 2023, we decided against altering too many of our 2022 assumptions on the pricing side of the launch services. We assume 87 launches for 2023, which is less than SpaceX’s 100 launch target.

- We attribute zero revenue to Starlink-specific missions. SpaceX has launched ~3,700 Starlink satellites so far. About 300 of those have deorbited, which means that SpaceX will launch at least 1,000 broadband satellites this year to meet its current target. This implies approximately 20 launches (@ 52 satellites each), but we assume 30 for good measure (to account for replacement missions and the launch of Gen-2 prototypes). The exact number here isn’t too critical considering these are generally non-revenue generating missions.

- Citing inflation, SpaceX increased launch prices to $67M in Q1 2022. We assume a slightly lower average of $60M, due to expected price slippage from some launches flying at less than full capacity.

- We priced the Falcon Heavy launches at $125M each. Falcon Heavy’s range is $90-$150M.

- Falcon 9 Transporter missions are likely significantly lower than the $67M sticker price—we assume the average price to be $40M.

- We now assume $60M per seat on the Crew Dragon, slightly higher than NASA’s Office of Inspector General (OIG)‘s estimate of $55M. Based on the August 2022 NASA $1.4B block buy of five crewed launches, it appears that the cost per seat may be hovering closer to $60M. This year, SpaceX has five crewed missions (or 20 seats) on the manifest: Crew-6, Crew-7, Polaris, Ax-2, and Ax-3.

- Commercial Resupply Services (CRS) missions to the space station are assumed to be $145M each, based on prior award data.

- Government launch costs are assumed to command a 50% premium to the $67M sticker price. SpaceX’s previous national security launch bids have been priced north of $100M.

Starlink assumptions

To estimate Starlink subscriber growth a year in advance is a difficult proposition, given the many variables in play. To name but a few of those variables: manufacturing cadence of user terminals, capacity per cell/satellite, number of satellites launched, and actual user demand.

Here’s how we think about it:

- Manufacturing of user terminals is a key bottleneck. In 2021, SpaceX was manufacturing ~5,000 terminals weekly. By fall of 2022, the company reported it was manufacturing 20,000 a week. If we assume a year-end manufacturing capability of 40,000 satellites growing linearly—if SpaceX can build a Raptor engine a day…this is not a wild assumption—then we can deduce an implied total of 1.6M terminals.

- SpaceX reported ending 2022 with ~1M Starlink users (up from 145,000 users at the end of 2021). We looked at a few different consumer hardware adoption curves to help justify our estimate for 1.6M additional Starlink subscribers (which is also in-line with the manufacturing cadence). We primarily looked at devices that offered a service that in one way or another was already accessible, i.e. DirecTV and the iPhone.

- Though SpaceX’s growth is marginally better, user adoption is similar to DirecTV’s, which attracted 320,000 users the first year, 1.2M the second year, and 2.3M the next.

- Apple, by comparison, sold 1.3M iPhones in 2007 and 11.6M units in 2008. This was when smartphones were thought to be well understood. For Apple, global growth was ultimately stifled by how quickly they could tap new distribution channels.

- Across the 1.6M additional subscribers, we estimate an 80% share for Residential & RV (grouped together again) and 20% for Business. This brings the total additions to 1.28M for Residential & RV and 320,000 for Business.

- Starlink Aviation rolls out in a few months with hardware costing $150,000 and monthly fees ranging from $12,500 to $25,000 (we use the $18,500 midpoint). The market here is fairly significant. The US alone has roughly 24,000 business aircraft. Today, just 30% of those jets have broadband connectivity. In the rest of the world, that number is sub-6% (across 14,000+ aircraft). Gogo, the world’s largest provider of connectivity services for the business aviation market, serves ~5,000 aircraft with satellite broadband. We assume SpaceX captures 750 aircraft in the first year of the Starlink Aviation service.

- The world has millions of recreational boats. We think that Starlink Maritime will initially (and unsurprisingly) attract luxury clientele (i.e. yacht owners). There are roughly 10,000 luxury yachts globally. We assume 1,000 subscribers, with some commercial maritime customers in the mix as well. In our view, Maritime ultimately won’t be a large driver of Starlink 2023 sales.

A word on capacity: For the time being, we do not believe data capacity is a major concern, considering that at least 1,000 additional satellites will go up this year. We’ve analyzed a variety of different estimates regarding the capacity of Starlink satellites.

Models can be based on “cells” (the geographic area that’s covered by a single node in a network) or a user-based methodology where you analyze concurrent streams and oversubscription rates. For example: 200 concurrent streams (which is debated) at 100Mbs per satellite x a 5x oversubscription rate x 4,400 satellites = 4.4M theoretical capacity.

Either way, we don’t believe capacity will be an issue later this year. Even with reports of throttling and price hikes, we expect the additional satellites that will be launched this year to balance current issues.

Other revenue assumptions

SpaceX should continue execution on its existing major contracts outside launch and Starlink:

- HLS: $750M recognition of additional milestone-based booked revenue based on expected progress on Starship development.

- TTL: $75M recognition from manufacturing and development contract from the USSF

This brings our launch revenue projection to $5.27B (+119% YoY), Starlink revenue projection to $5.46B (+192% YoY), Other Revenue projection of $825M (+154% YoY) and total 2023 revenue projection to $11.55B, (+151% YoY).

Conclusion

SpaceX is clearly at a point where its ability to scale revenue is real.

- The company launched 31 times in 2021, 61 times in 2022, and is targeting 100+ this year (though Payload assumes 87 for now).

- Starlink’s scale is currently capped by its ability to build user terminals and how quickly it can start launching Gen-2. The Gen-2 designs are why Starship is critical to the company’s success. However, even without Gen-2 there is a clear path to how Starlink revenue can catch up to Launch revenue (and become cash-flow positive) this year.

- SpaceX is outperforming on the execution of its Human Spaceflight business. The company should continue to increase its pricing power overtime.

- HLS revenue recognition should start to rapidly increase, especially once Starship is operational (we assume this is a significant milestone payment).

- And Starshield should start to grow into a decent part of the business this year (though we do not attribute any revenue for now).

This tells us that the risk to our projections may be more to the upside than it is the downside. On a separate note, given how vocal SpaceX management is being around the health of Starlink, we expect that a IPO scenario is likely over the next 18-24 months. Gwynne Shotwell recently stated that Starlink will have “cash flow positive quarter” in 2022 and “will make money” in 2023.

Ultimately, we recognize predicting SpaceX’s revenue is extremely challenging, given the multitude of variables we’ve laid out here. In fact, we know that even some investors in SpaceX don’t have accurate data around historical financials or projections. That’s just Elon being Elon.

We’ll continue to monitor this and update our internal model. Stay tuned for a year-end revision based on new data that we gather over the course of 2023. And as always, please don't hesitate to reach out with any questions or comments.