Ed. note: This is Payload Research analysis, authored by Mo Islam, Payload’s cofounder and Jack Kuhr, Payload’s Research Director. This is an educated best guess, not based on access to any SpaceX internal data or proprietary info!

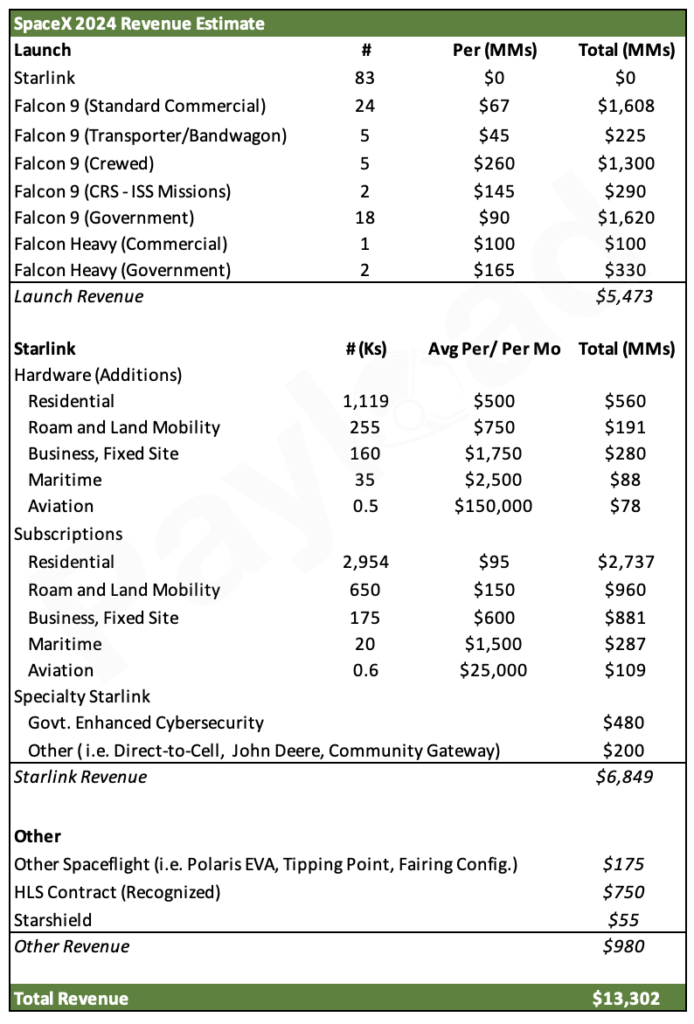

Last week, we detailed SpaceX’s 2023 revenue, estimating sales reached $8.7B. This week, we’re once again dusting off the crystal ball and predicting SpaceX’s 2024 revenue.

Please note: We calculated subscription revenue monthly; it isn’t a simple total subscriber x cost per month calc. Hardware sales outpace customer additions as some applications need multiple terminals installed.

Payload projects that SpaceX’s revenue will increase from $8.7B in 2023 to $13.3B in 2024, driven by a return to growth for customer Falcon 9 launches and Starlink’s user base growing from 2.3M customers to 3.8M.

Launch Assumptions

Payload forecasts that SpaceX will reach 140 Falcon launches in 2024, just short of the company’s 148 launch target (per VP of Launch Jon Edwards).

- Starlink launches: We attribute zero revenue to Starlink-dedicated missions. We assume that Starlink-dedicated Falcon 9 missions will grow from 63 in 2023 to 83 in 2024. The exact number here isn’t critical, considering these are non-revenue generating missions.

- Customer launches: After customer launches plateaued in 2023, SpaceX will return to growth in 2024. We assume the company reaches 24 standard commercial F9 launches (up from 12 in ’23) and 18 govt. F9 launches (up from 6 in ’23).

- Growth is driven by NASA lunar missions, increased SDA deployment, ESA partnerships, and commercial demand.

Starlink Assumptions

Predicting Starlink customer growth is challenging, given the service is still in its early days and growing rapidly. Here’s how we think about it:

SpaceX reported ending 2023 with 2.3M Starlink users (up from 1M at the end of 2022). The US customer base grew by ~90% last year, while international users grew by ~200%.

2024 Starlink user base: We estimate Starlink will finish this year with 3.8M users, adding 1.5M customers throughout 2024.

- US vs. global mix: We forecast global users will make up nearly 50% of the Starlink customer base by the end of the year. We assume:

- Starlink will add the same number of US customers as it did last year (600K), representing a ~45% YoY increase.

- The international base will add 900K users, a ~95% YoY increase. The growth is driven by continued geographic expansion, including an pending approval in India later this year. India could add 200K+ users in its first year of operation, or more if approved in short order.

- Pricing: We modeled a significant decrease in residential Starlink average revenue per user this year, declining from $105 in 2023 to $95 in 2024. The decrease is due to a higher international mix and significant price reductions in the European market. The cost of a Starlink subscription in France is down to ~$45/mo, versus ~$120/mo in the US.

- Lower pricing in Europe will support continued Starlink growth in the region.

- Business, fixed site: SpaceX will focus on selling to enterprises in 2024, boosting its customer base to 175,000. We are also increasing average business revenue as Starlink embraces custom pricing strategies.

- Aviation: Starlink is installed on 80 aircraft, with 400 additional planes under contract. We assume Starlink will reach 600 aircraft in 2024.

- Roam & land mobility: Starlink is a non-contract service, so consumer RV and mobile users will have high churn as they pause and restart subscriptions for their recreation season. SpaceX has switched from defining users as subscribers to customers, likely in part due to this dynamic. Payload estimates the lower ARPU due to churn is offset by higher-priced premium offerings and business land mobility pricing. Business mobility pricing ranges from $250/mo to $5,000/mo.

Other Assumptions

- Government enhanced security: In 2022, Elon Musk said the Starlink service in Ukraine was losing the company $20M/mo due to unpaid enhanced security measures for cyberwar defense. We assume SpaceX is now generating $40M/mo for military comms in Ukraine and other nations.

- HLS: $750M recognition of additional milestone-based booked revenue based on expected progress on Starship development.

- Other buckets: SpaceX has a host of other revenue-generating business lines that don’t fit neatly into Launch or Starlink.

- SpaceX is slated to roll out direct-to-cell connectivity this year.

- The Polaris Dawn crewed mission will conduct a spacewalk, requiring SpaceX to develop spacesuits.

- NASA is set to pay SpaceX $53M for its Tipping Point contract to demonstrate the cryogenic tank-to-tank fuel transfer.

- SpaceX recently rolled out its Community Gateway product, which will provide fiber-like speeds at scale in remote communities.

- We estimate SpaceX will be paid $55M for its Starshield service this year.

- Crew Dragon: We pegged a seat on Crew Dragon at $65M. This year, SpaceX has five crewed missions (or 20 seats) on the manifest: Crew-8, Crew-9, Polaris Dawn, Ax-3, and Ax-4.

- Hardware sales: We reduced average revenue from residential hardware slightly due to SpaceX selling Starlink terminals through distributors like Costco.

- Govt. F9: Government launch costs generally command a premium over the $67M F9 sticker price. SpaceX’s national security launches can be priced north of $100M, while NASA and ESA launch costs are slightly less.

- Rideshare: Revenue generated from Falcon 9 Transporter missions is likely significantly less than the $67M sticker price—we assume the average price to be $45M.

- Commercial Resupply Services: CRS missions to the ISS are estimated to be ~$145M each, based on prior award data.

Conclusion

Payload estimates SpaceX revenue will jump to $13.3B in 2024.

- Launch revenue increases from $3.5B in 2023 to $5.5B in 2024 (+56% YoY)

- Starlink revenue increases from $4.2B in 2023 to $6.8B in 2024 (+63% YoY)

Launch revenue is set to surge in 2024 with a jam-packed schedule. The company launched its Falcon family rocket 31 times in 2021, 61 times in 2022, 96 times in 2023, and is targeting 148 launches this year (though Payload assumes 140 for now). This will also be a pivotal year for Starlink as it will shed light on a sustainable growth rate and the overall market size.

SpaceX projections: Payload’s $13.3B revenue estimate is less than the $15B that SpaceX is reportedly projecting. The variance between Payload’s expectations and SpaceX’s projections can be attributed to our model’s more conservative outlook on Starlink growth. If Starlink is able to secure regulatory approval in India in short order, it would represent upside to Payload’s projections.

We’ll continue to monitor this and update our internal model. Stay tuned for a year-end revision based on new data that we gather over the course of 2024. And as always, please don’t hesitate to reach out with any questions or comments.