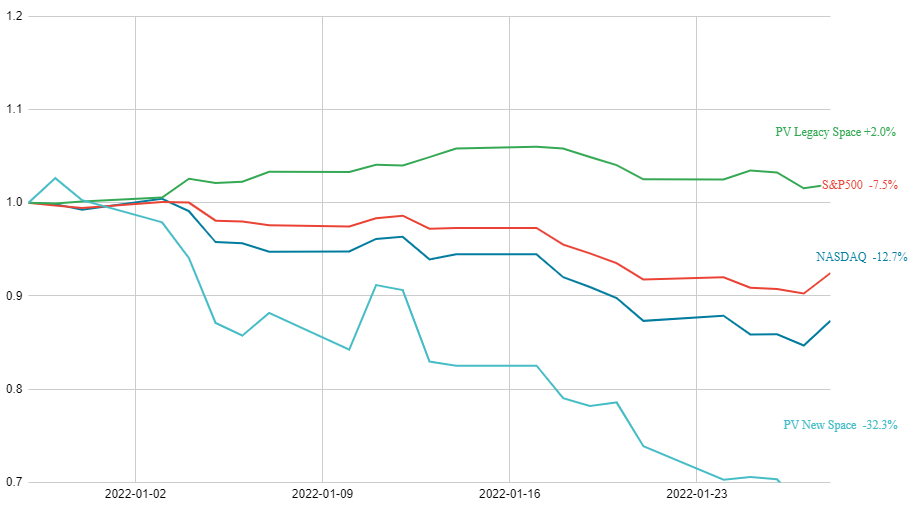

One-month performance (before market open, Jan. 31). Chart: Promus Ventures

Last week, the big names in US defense and aerospace contracting reported earnings. Ongoing supply chain and labor were a persistent headwind across the sector, and more broadly, results were a mixed bag. Let’s run through the space highlights.

On Tuesday, Raytheon (NYSE:RTX) and Lockheed Martin (NYSE:LMT) reported Q4 results. Lockheed’s Space segment net sales dropped 10% year over year (YoY) to ~$2.9B in Q4—and clocked in at $11.8B for the full year. Operating profit dropped 1% YoY, primarily thanks to lower revenue from ULA, “due to lower launch volume and launch vehicle mix.”

- CEO Jim Taiclet kicked off his call with analysts by saying Lockheed “will review” the FTC’s lawsuit to block the proposed takeover of Aerojet Rocketdyne (NYSE:AJRD), “and evaluate all of our options.”

On Wednesday, Boeing (NYSE:BA) and General Dynamics (NYSE: GD) reported Q4 numbers.

- $BA: Defense, Space & Security revenue dropped 14% YoY to ~$5.9B in Q4, “primarily due to lower volume and less favorable performance across the portfolio.” For the full year, the segment’s revenue grew 1% YoY.

- $GD: Aerospace revenues increased 5.1% YoY to nearly $2.6B in Q4, but operating earnings dropped nearly 12% over the same stretch.

On Thursday, Northrop Grumman (NYSE:NOC) rounded out a busy week of reporting. Space Systems Q4 sales increased 4% YoY to nearly $2.7B. And space sales jumped 21% YoY to $10.6B in 2021. “Space Systems is expected to remain our fastest-growing business and to become our largest segment in 2022,” CFO Dave Keffer said.

“One of our proudest moments was the launch of the Webb Space Telescope,” Northrop CEO Kathy Warden noted (the company was the prime contractor for JWST). Warden also highlighted Northrop’s 10-year, $3.2B NASA contract to produce SLS rocket boosters in support of Artemis missions IV–VIII.

Payload’s takeaway: These business segments shouldn’t be treated as a pure barometer of the space industry, due to the weighting of non-space defense and aviation operations.

Still, the quarterly reporting sheds light on how various space players are performing. To that end, a snapshot as we close out the first month of 2022:

- Promus Ventures Legacy Space Index, which tracks the above companies and other familiar aerospace names, is up 2% over the last month. The S&P 500 and Nasdaq are down 7.5% and 12.7% over the same stretch.

- On the flipside, Promus’s New Space Index, which includes recently de-SPAC’d launchers and Earth observation companies, is down a whopping 32.2% in the last month.