Consolidation is the order of the day in the legacy satellite world.

The latest: Luxembourg-based SES and American satellite operator Intelsat are in talks to tie the knot, the FT reports. The GEO operators are long-standing competitors, and in recent memory, duked it out in bankruptcy court. Is it time to let bygones be bygones?

- Bankruptcy? Intelsat filed for Chapter 11 protection in May 2020 and emerged as a private company in December after reducing its debt load from $16B to $7B.

As M&A sweeps the satellite sector, “neither wants to be the last one standing,” a source close to the SES-Intelsat talks told the FT. A merger would create a unified entity that produces ~$4B in annual revenue. But these are preliminary talks, and as any investment banker worth their salt would tell you, things can and do fall through.

The backdrop

Led by Starlink, LEO broadband players are mounting a fierce competitive challenge to the old orbital order. That’s led constellation players who primarily occupy other orbits to join forces (or, at least, to propose doing so). The north star = multi-orbit assets.

- Intelsat, it should be noted, is already a multi-orbit operator, having acquired O3b Networks, which operates medium Earth orbit (MEO) satellites. Intelsat, it should be noted, is already a multi-orbit operator.

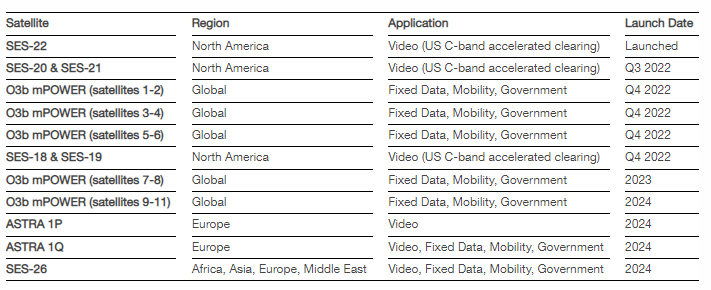

- But this week, SES reported another delay in the launch of the 11-satellite O3B mPower MEO constellation to Q4 of this year.

There’s plenty more horizontal consolidation where that came from…

- Eutelsat and OneWeb are pursuing a merger, which would give the French satellite operator a LEO beachhead and OneWeb fresh $$$ to finish the buildout of its first-gen broadband constellation.

- Viasat, by all outward appearances, is inching closer to closing on its $7.3B acquisition of the UK’s Inmarsat.

As always…

…there’s also the geopolitical and space sovereignty angles to consider. The French and UK governments would both have stakes in a combined Eutelsat/OneWeb entity, which could complicate negotiations. The Luxembourg government, meanwhile, owns one-third of SES’s voting shares. Finally, London has won significant concessions from Viasat in its acquisition talks with Inmarsat.

How about that timing?

An April Credit Suisse report seen by Payload said that an SES-Intelsat tie-up “could make sense,” given their globally oriented businesses, mutual MEO interests, and cost synergies, and potentially deliver a “~+30% uplift to the equity value.” Those synergies, Credit Suisse analysts estimate, could generate $2.6B in value.

More broadly speaking, the Credit Suisse report identifies three trends driving subpar returns for satellite operators over the last five years:

- The capex required to build and launch very high throughput satellites (VHTS) doesn’t scale with the revenue they generate.

- Video broadcast, a key use case for GEO satellites, is in secular decline and “becoming a material drag” on top-line performance.

- The satellite sector is fragmenting, “with ~55 satellite operators globally with high supply driving weak pricing.”

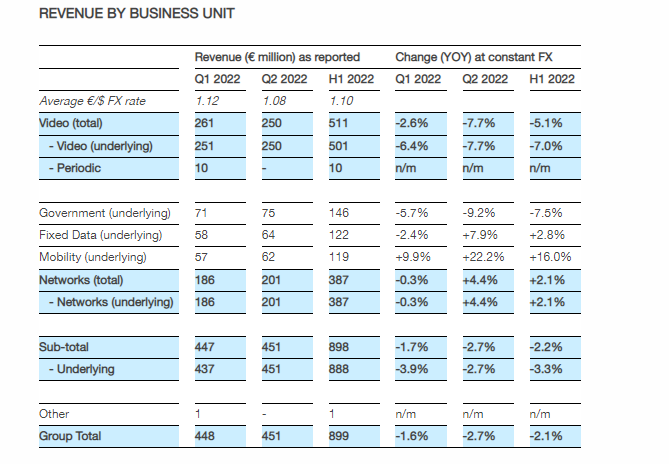

+ While we’re here: Thursday, SES reported H1 revenues of €899M ($920M), up 2.8% YoY. The company’s adjusted net profit was €168M ($172M) over the same period, up 11% YoY. Both SES and Intelsat stand to make billions for clearing spectrum bands and launching new satellites.