Space Capital has released its final quarterly report on the 2022 investing landscape. It was a tough year for fundraising, as the froth drained from the free-flowing capital markets of years past. Though the space industry saw receding levels of capital deployment, the report’s authors remain optimistic about the sector’s ability to bounce back.

2022 in review

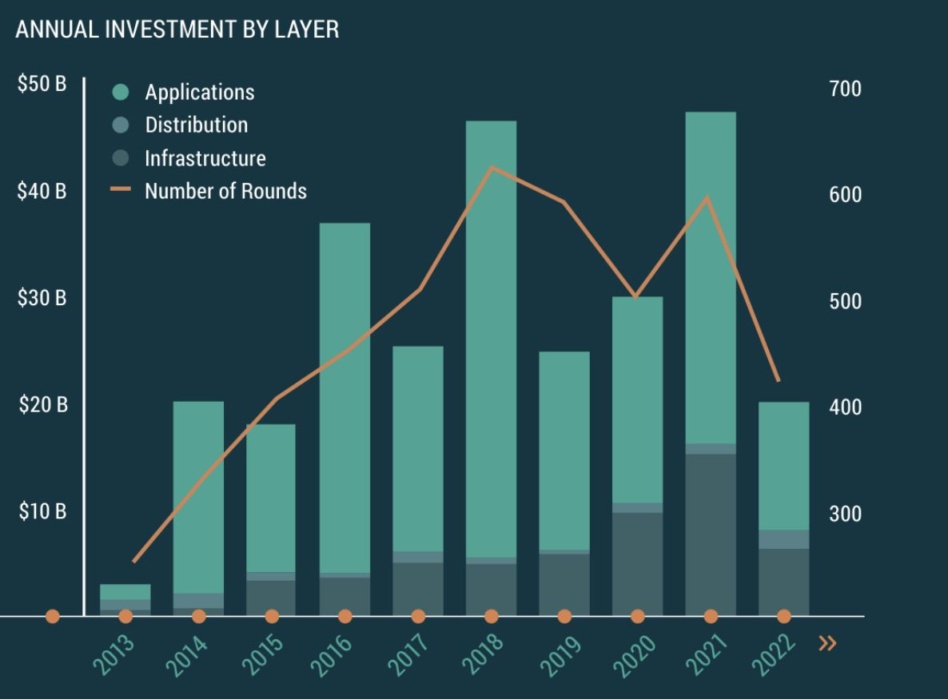

As capital markets tightened up last year, the space sector saw a dramatic drop in VC deals and funding…especially when sized up against the soaring highs of 2021. All in all, the space sector raised $20.1B across 420 rounds last year.

Later stage companies were impacted most by the drawdown, and early-stage companies pulled in only 4% less in capital than the year before. Seed and Series A rounds accounted for more than half of total rounds, at 41% and 25%, respectively.

Funding appeared to bounce back up in the back half of the year. Investment in Q4 increased 159% QoQ.

Breaking it down: US funds once again dominated in 2022, accounting for 46% of all dollars deployed into private space companies. China was next at 29%, with Singapore, the UK, India, and Indonesia following.

As it has in previous editions, Space Capital’s report highlights four thematic investment areas:

- Infrastructure, which includes launch systems and satellite manufacturers, pulled in $6.4B over the course of the year—the third most on record—and $1.8B in Q4 alone.

- Emerging industries was considered a subset of infrastructure (sans launch and satellites), and included stations, logistics, lunar, and industrials. Investment totaled $500M.

- Distribution, which covers any system used to connect, process, and manage data from space assets, accounted for $900M in Q4.

- Applications—by far the broadest of the investment areas, covering any service that utilizes space data—pulled in $2.5B in Q4 alone.

SpaceX was the poster child of infrastructure investment, pulling in $2B in fresh financing last year. That was equivalent to 32% of the total dollars deployed into launch last year, as funding raised by other rocket developers fell 78% YoY.

Looking forward: 2023 is likely to be another rough year in the capital markets, but space startups with strong products, leadership, and product-market fit are poised to succeed. “Despite the challenges caused by macro market headwinds, we’ve never been more bullish on space as an investment thesis,” the authors wrote.

In a recent op-ed analyzing the 2022 space market, Payload CEO Mo Islam argued a similar point. “It’s been a turbulent year for the markets,” he wrote. “Space companies aren’t exempt from this trend, and we haven’t seen the end of this shakeout. Winter is coming, as is more consolidation and companies shutting their doors. Still, the space industry has strong secular tailwinds. Those who can weather the storm will come out stronger than ever on the other side.”