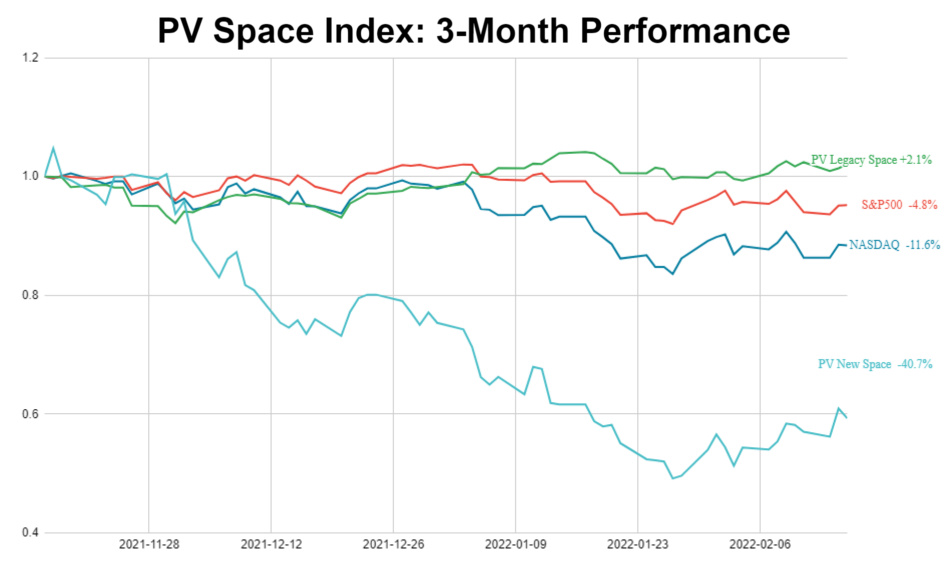

Graph: Promus Ventures. Snapshot taken Feb. 17, 2022 before market open.

As we’ve written before, investing in space is not for the faint of heart. In a recent op-ed for the FT, Sinéad O’Sullivan, a space economist, HBS senior researcher, and friend of Payload, digs a bit deeper into the dynamics of space investing.

The good: In 2021, privately held industry leader SpaceX reportedly crossed a $100B valuation after secondary share sales. Nine space companies went public via SPAC. And investors put $14.5B+ into space infrastructure companies, an annual leap of more than 50%.

- SPACs provide retail investors (and traders) an opportunity to back earlier-stage companies closer to the ground floor. Due to US securities laws, non-accredited investors have historically been barred from investing in startups.

The bad: Space, or more specifically, SPAC investing is a double-edged sword that cuts both ways. Virgin Galactic (NYSE:SPCE) traded up 32% earlier this week, but it’s also dropped by similar amounts over a single day in the past. Shares of Astra (NASDAQ:ASTR), as another example, dropped 26% last Thursday after a launch failure mid-flight.

O’Sullivan proposes a useful framework for evaluating the space investment landscape.

- Pure-play space stocks. This cohort includes the space SPACs, which make most of their money from space products/services. These are the names you’d find on Promus Ventures’ widely cited New Space Index. They have “large and concentrated exposure to unprofitable and largely unrealised sectors,” O’Sullivan writes.

- Legacy space companies, akin to “mini-ETFs.” These firms have multi-sector exposure across defense contracting, aircraft manufacturing, and the like. Space is part of a wider portfolio. That the Legacy Space Index is outperforming is not necessarily due to their space-specific business divisions, but likely due to Ukraine-Russia military tensions.

One final thought: Sure, space SPACs are down bad. It’s not unthinkable that some names in the cohort de-list, go bankrupt, or become acquisition targets. Rather than comparing the space SPACs to more established publicly traded companies, we’d also propose analyzing them alongside…

- Momentum stocks: ARK Innovation ETF (ARKK) is down 38% over the last three months.

- Sector-agnostic, small-cap, growth-stage SPACs: DSPC, an ETF that includes 25 de-SPAC’d companies, is down 42% over the same period.

- The PV New Space Index is right in the middle, at -40.7% over the last three months.