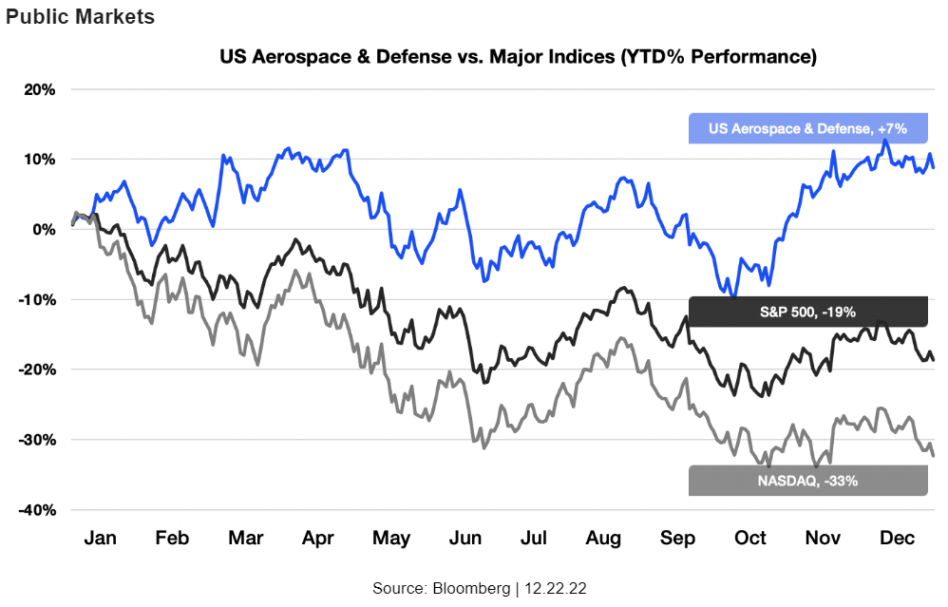

The key theme for aerospace within financial markets has been the bifurcation of performance between the traditional aerospace and defense (A&D) sector and space SPACs.

Despite the broader market’s abysmal performance this year, traditional A&D companies have outperformed phenomenally. Companies like Lockheed Martin, Raytheon, Northrop Grumman, and BAE Systems are trading 15%–37%+ YTD. The sector has strengthened on increased demand in response to Russia’s longer-than-expected war in Ukraine and the growing threat posed by China, a military and space near-peer adversary.

Source: Bloomberg | 12.22.22

Commercial space companies, meanwhile, that SPAC’d…have been decimated. The entire group is down 60%, market cap-weighted.

What happened?

- Space is still new: Pure-play space companies are a new area of investing for the public markets. Most investment banks have scant research coverage of the industry, so it’s hard to see how broader market participants would know how to trade them.

- R&D isn’t meant for public markets: The public markets are no place to build your first product—especially when your financial projections were based on technical milestones that were ambitious to begin with. By our estimates, only one company that has gone public via SPAC actually came close to its original projections. Fee-driven investment bankers led companies astray as they built comp tables and valuation models that were inherently flawed.

M&A Activity

There were two major A&D acquisitions this year, and they both happened in the last week.

- Maxar agreed to be acquired by global private equity firm Advent International in a $6.4B all-cash deal ($4B excluding debt), representing a 129% premium to its last closing stock price.

- Aerojet Rocketdyne agreed to be acquired by defense prime L3Harris Technologies for $4.7B (a 7% premium to Lockheed’s original offer in late 2020).

The recent M&A activity is no doubt an indicator that there is institutional capital focused on the space. The Aerojet transaction alone had many interested buyers, including GE, Textron and a number of PE shops. The Maxar deal has a 60-day “go shop” period running through Valentine’s Day that allows the company to find a more favorable deal for shareholders. We could easily see a competitive process heading into Q1.

- The Aerojet transaction falls into the broader trend of consolidation among the few large defense contractors. Remember, there were 51 prime contractors in the ’90s. Now, there are five: Lockheed Martin, Raytheon, General Dynamics, Northrop Grumman, and Boeing.

- The Maxar deal is a reminder that high-margin, cash-flow generating businesses continue to be a focus for private equity firms that are willing to pay hefty premiums over public multiples, or what defense primes are used to paying.

Circling back to space SPACs, we think that there will almost definitely be some consolidation or take-private transactions that occur next year. We’re already seeing a number of deals in broader tech SPACs and a number of the existing public space companies are starting to look like ripe targets for both financial and strategic buyers. Our popcorn is ready.

Private Capital

Source: Pitchbook | 11.30.22

Fundraising trends for space has followed the broader tech sector.

Both deal count and total capital raised are down considerably YoY. Relative to historical trends, starting in Q4 2020, all stages have seen a significant dislocation of deal activity. This is most pronounced in growth and late-stage businesses. Companies that didn’t need to come back into the market to raise capital either A) didn’t need to, or B) were able to meaningfully reduce opex and burn. This is why down rounds this year were fairly limited. We think this will change next year.

Two key predictions for 2023

- We expect a number of high-profile down rounds next year. For example, there are many launch companies with significant valuations from prior rounds that will have to come back to market. We don’t see how those companies will be able to maintain their prices without substantial technical progress (i.e., orbital success). The new reality of higher interest rates and stricter deal terms will set in quickly.

- Seed financing and valuations should remain strong. There’s still a significant amount of cash sitting on the sidelines. That cash will need to be put to work and seed-stage startups tend to be more insulated from public market volatility (particularly because their time to exit typically extends beyond the current market cycle). We expect the seed stage to remain healthy both in terms of size and valuations.

Bottom line: It’s been a turbulent year for the markets. Space companies aren’t exempt from this trend, and we haven’t seen the end of this shakeout. Winter is coming, as is more consolidation and companies shutting their doors. Still, the space industry has strong secular tailwinds. Those who can weather the storm will come out stronger than ever on the other side.

+ Grading the space SPACs…Case Taylor, a friend of Payload and author of the Case Closed newsletter, put together a report card that assesses space SPACs on a number of KPIs. Check out his full report and sign up for the newsletter, if this type of analysis strikes your fancy.