It has been a year in space markets. We’ve seen a host of mega mergers (looking at you Inmarsat, OneWeb, Maxar, Aerojet), big-time downfalls (ahem Virgin Orbit and Astra), and a healthy flow of VC funding flowing into space.

First, let’s jump in with the State of the SPAC.

Ups and downs: Picking up where we left off last year, the majority of space SPACs have continued their downward march, resulting in several Nasdaq delisting warnings.

The pain for SPAC investors deepened as they saw a rally in other speculative growth stocks this year.

- Cathie Wood’s ARK exchange-traded fund has soared 68% YTD—primarily attributed to a recent pullback in interest rate expectations spurred by CPI readings indicating JPow’s inflation-slaying is working.

However, for the space SPAC, prospects of lower interest rates are overshadowed by deeper existential concerns about seemingly endless cash burn.

Cash is King

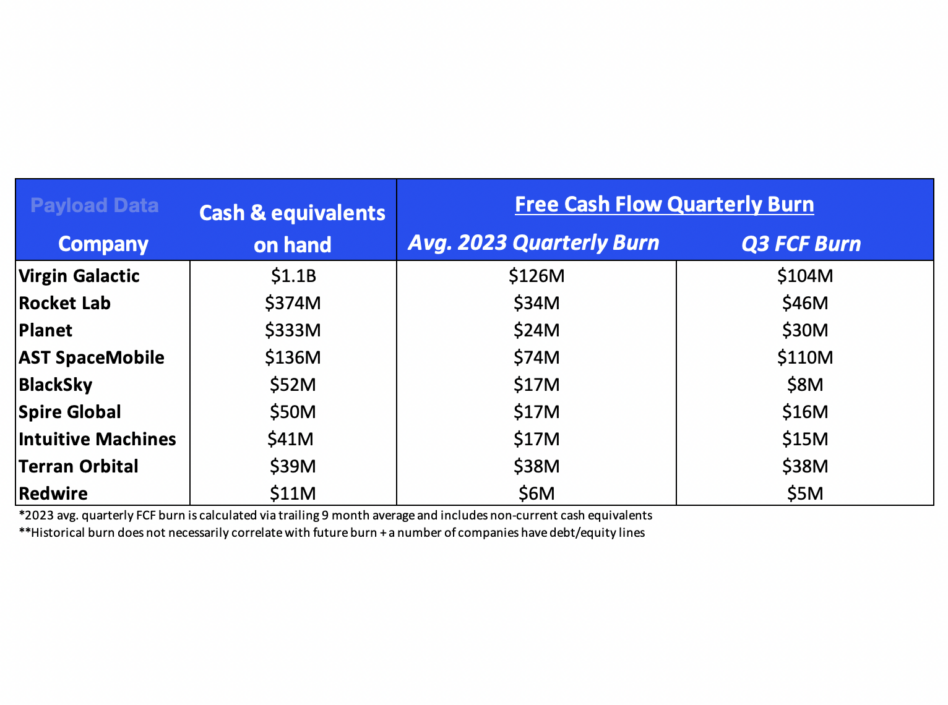

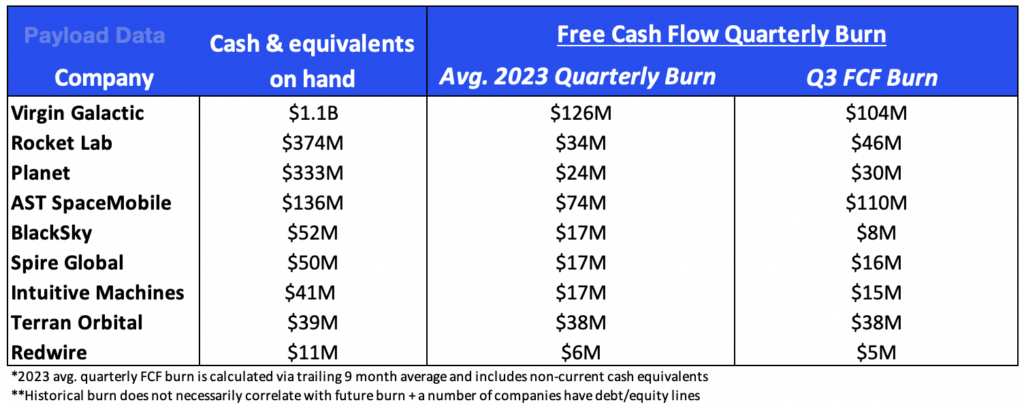

This year’s key theme among the SPACs is the degradation of cash balances and minimal appetite in public markets to replenish coffers. As a result, earnings calls have gone through a vibe shift with more hard-nosed discussions on cash flow breakeven timeline. Let’s pull back the curtain and see where cash stands.

Note: Several companies have access to lines of debt/equity that can be drawn down for additional liquidity as cash dwindles.

- Household names like Virgin Galactic, Rocket Lab, and Planet have amassed solid nest eggs to ride out cash-burn for the next few years.

- However, other SPACs find themselves in more precarious liquidity situations with less than 12 months of runway and minimal signs of meaningful cash burn reduction. This year witnessed Virgin Orbit and Astra exhausting their cash reserves.

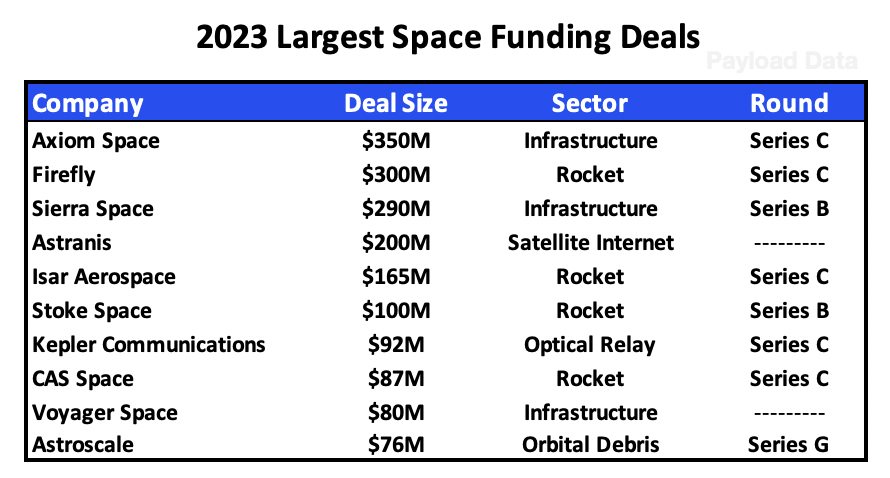

Enter VCs: The lesson of the SPAC is that R&D stage startups are often best suited for venture investing and not the public markets. VC firms have higher risk appetite, longer investing horizons, and specialized industry knowledge.

VC space investing was strong this year, with billions of venture dollars funneling into the industry.

SpaceX also reportedly raised a $750M round earlier this year. A common theme? Spaceflight and infrastructure businesses continue to garner the big bucks.

Back to SPAC: What happens next with the underperforming space SPACs?

For all-or-nothing startups with high capex and unproven products, mergers are often difficult to pull off. Exhibit A: Virgin Orbit, which was sold off for its equipment and facilities, not its R&D work.

However, for revenue-generating SPACs that have highly-valued niche products/services, consolidation could be in the cards. We’ve seen this play out this year with legacy space businesses.

This year in M&A: The old guard in space has had a busy year of mergers:

- Eutelsat completed its $3.4B merger with OneWeb, combining LEO and GEO capabilities to create a multi-orbit connectivity internet powerhouse.

- Advent, a private equity firm, closed a $6.4B take-private deal with Maxar.

- Viasat completed its $6.2B merger with Inmarsat after a year of regulatory scrutiny.

- L3Harris closed its $4.7B Aerojet Rocketdyne acquisition.

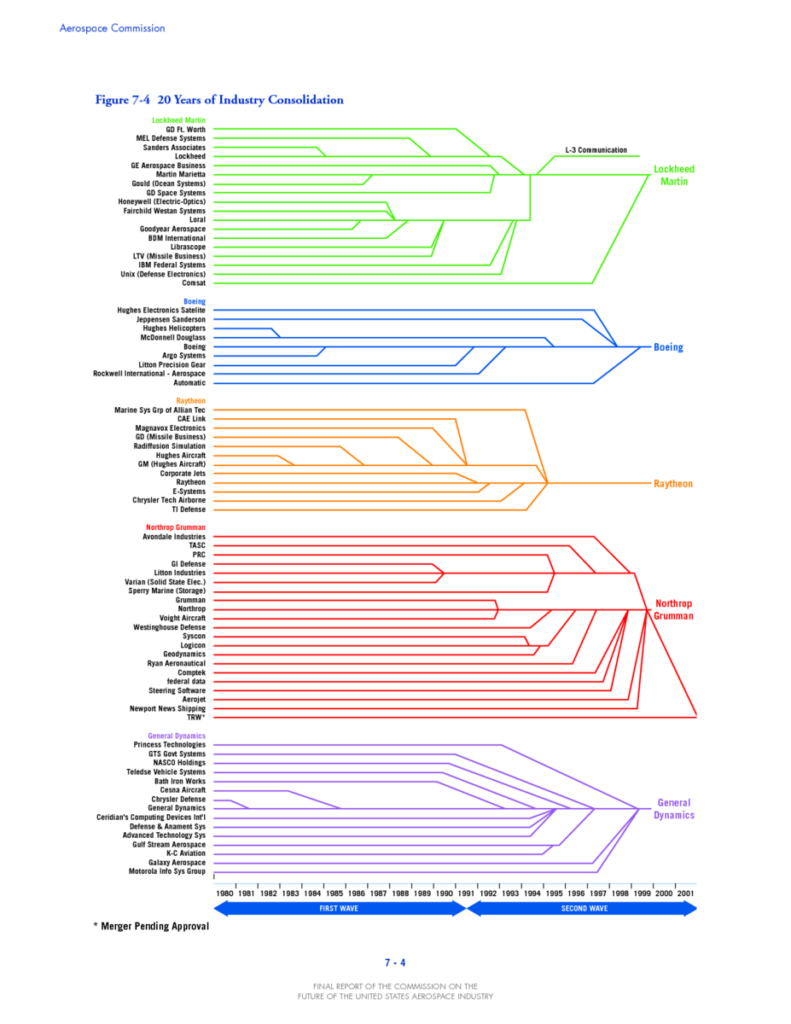

A&D consolidation is not a new trend. Below is the chart showing decades of acquisitions in the 80’s and 90’s that helped consolidate the market to the primes.

Image: 2002 Commission on the Future of the United Space Aerospace Industry