On Monday, Spire Global (NYSE:SPIR) released preliminary Q4 and full-year 2021 financial results.

- The “space-to-cloud analytics” provider expects to post Q4 revenues of $15.3M, a 111% year over year increase, and full-year revenue of $43.7M, a 53% YoY jump.

- Annual recurring revenue (ARR) is expected to be ~$70.8M, a 96% YoY increase. And ARR customer count climbed past 500 in 2021, per Spire CEO Peter Platzer.

- 2022 guidance: Spire expects revenue to be $85M–$90M, and ARR at the end of the year to be in the $100–$105M range.

Spire 101: Started in 2012 as a CubeSat Kickstarter campaign, Spire offers satellite-collected maritime and aviation data, predictive weather analytics, and space services. Operations are split across seven offices on three continents.

Spire has a nanosatellite factory in Glasgow, Scotland. The company adheres to the agile development, vertically integrated school of satellite design, which stresses compact form factors, rapid iteration and refresh cycles, and software-defined, reprogrammable payloads.

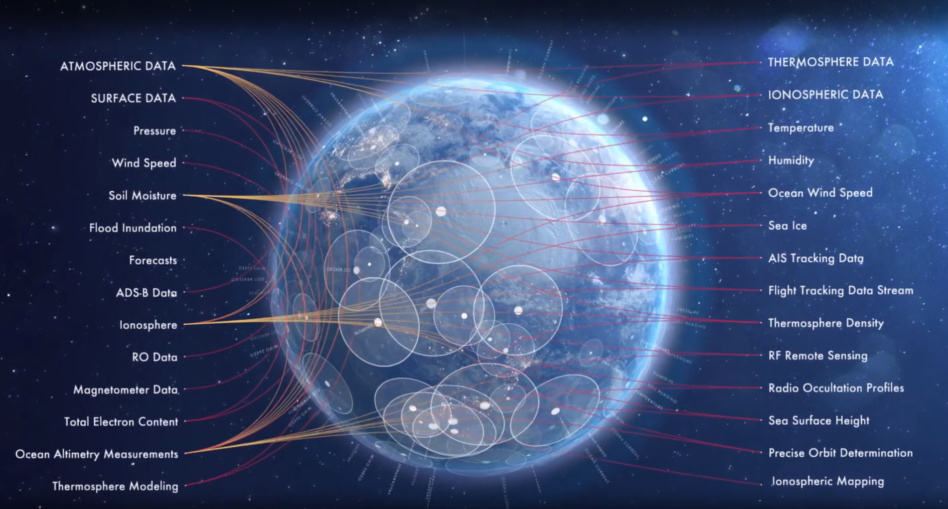

What the company sees: Spire builds and operates what it says is the world’s largest constellation of multifunctional satellites, and oversees a growing network of ground stations. Using radiofrequency sensors rather than cameras, Spire’s ~110 satellites monitor activity beyond the color spectrum visible to the eye. As the company says, it focuses on data that can’t be collected from Earth.

- Tracking a variety of signals, Spire’s LEMUR satellites observe and analyze maritime vessels, air traffic, and critical weather patterns. The company has built analytics products and forecasting engines on the back of these unique datasets.

- The company has also branched out into “Space Services,” or more accurately, space-as-a-service. That includes integrating and flying customer payloads on its own satellite bus, designing spacecraft from the ground up, and selling subscription-based space services.

Consolidation continues apace…Like Planet, Spire is using its cash and M&A to increase share in an ever-fragmented Earth observation industry. Spire completed its acquisition of exactEarth, a maritime data provider, at the end of November.

Investor context clues…Spire’s focus on ARR, a closely watched metric for subscription companies, suggests the constellation operator might want to be seen (and valued) as a SaaS-like company. Spire’s stock is down 26% YTD, but was up ~14% in pre-market trading.