Something unites the two most ambitious LEO communication networks: A lot of demand, but lingering questions about cost.

SpaceX’s Starlink network has proven that LEO constellations can provide global connectivity—but whether capital-hungry businesses can stay in the black remains to be seen.

Define “territory”: Elon Musk and other SpaceX execs say their satcom network is cash flow positive and in “profitable territory.” But sources who spoke to Bloomberg News last week paint a more negative picture, saying that the company is leaving launch costs out of data it shares with investors and is losing money on its user terminals. They expect SpaceX will need to raise money again to keep launching its newer, more powerful spacecraft.

Our best guess: Payload Research’s Starlink revenue estimate for 2024 is $6.85B.

The challenge facing SpaceX and its rivals is maximizing revenue from their pricey networks by winning licenses to operate in as many countries as possible. For example, SpaceX has struggled to win access to India’s telecom market, but we’ll be watching what happens during Musk’s visit to Delhi later this week.

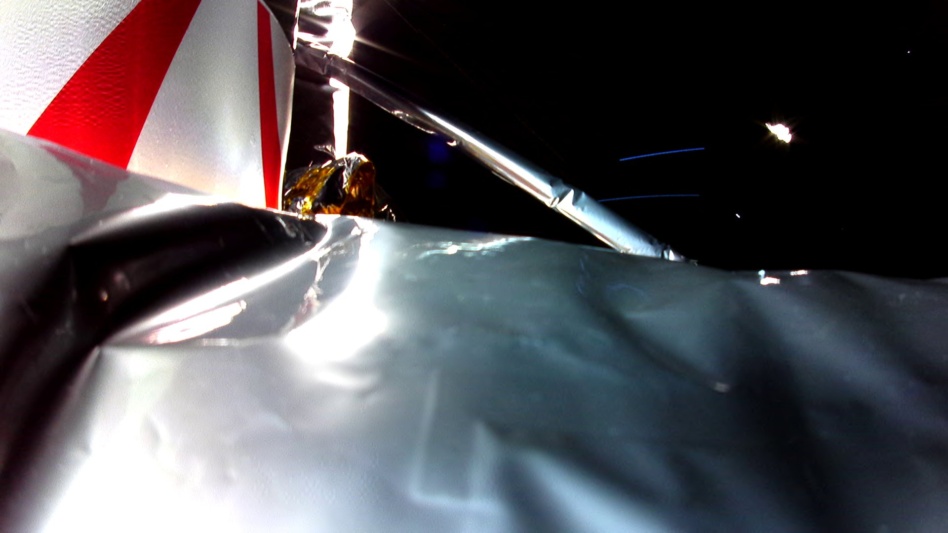

Competition incoming: In his annual letter to shareholders released last week, Amazon CEO Andy Jassy called the company’s Kuiper network “a very large revenue opportunity,” a direct response to investor concerns about the $10B+ investment in the satellite network.

And although Jassy also said “we’ve still got a long way to go,” there is a short time left to do it in: The company has to launch about 1,600 spacecraft between now and mid-2026; Jassy expects service to begin widely in 2025.

Kuiper’s satellites will start launching this year on ULA’s remaining Atlas V rockets, but the company has reserved launches on ULA’s Vulcan, SpaceX’s Falcon 9, and Blue Origin’s New Glenn.