SpaceX unveiled its Starlink Mini terminal last week.

The internet-in-a-backpack meaningfully expands Starlink’s addressable market, particularly in low-income regions, and provides a glimpse into what the future of Starlink could look like as terminals get smaller and more efficient.

Starlink rapid iteration: The Starlink service has grown to 3M+ users since debuting in 2021. Like the Starship program, SpaceX has adopted a rapid hardware iteration model, continuously improving its terminals and phased array tech.

- In just a few years, the company has shipped Dishy (McFlatface), standard models, upgraded standard models, high-performance models, and now Mini.

- Each new terminal improves on the last, economizing hardware and becoming more efficient.

Below is the terminal iteration history, compiled by Starlink tracker Oleg Kutkov on X.

The Mini 101: The Mini is designed for transport and roaming activity. Having an internet solution that fits into a backpack meaningfully increases accessibility to the ecosystem.

The US market includes lovers of the great outdoors, work-from-anywhere community, and millions of individuals in field and technical professions. For developing countries, the Mini, priced at nearly half the cost of a standard model, will have an even larger market size, expanding into a full utility product.

The compact size and built-in router also vastly improve ease of distribution/use, helping move the product from the technical to the consumer category.

Mini comparison:

- Size: Roughly 12 inches by 10 inches (compared to 23 inches by 15 inches for standard models)

- Weight: 2.5 lbs (compared to 7 lbs)

- Power: Power consumption averages 25-40W, lower than the 75–100W averages for the standard version.

- Power is a massive factor for roam, as batteries power is limited.

- Speed: SpaceX says download speeds should range from 50-100 Mbps, which is less than the 150 – 250 Mbps download speeds for a standard dish. Although SpaceX seems to be conservative in its guidance as Starlink employees have posted test speeds with 124 Mbps to 180 Mbps.

- Nonetheless, SpaceX has guided customers to a performance tradeoff due to reduced antenna surface area.

The Mini also has a built-in Wi-Fi router, a milestone for ease-of-use.

Pause for an obligatory cute puppy 🤝 Starlink terminal photo:

Cost: Elon Musk said the Mini would be half the price of the standard product, noting it will have “massive demand in lower income parts of the world.” In Cartagena, Colombia, Starlink prices the Mini terminal at $195, compared to $330 for the standard.

US cost: In the US, the company will initially charge $599 for the terminal, higher than the $499 for a regular terminal. The initial elevated pricing aligns with the highly dynamic supply/demand-driven pricing schemes Musk likes to employ for Starlink and Tesla products: price high when demand is high, and lower pricing after the influx of early adopters cools.

When SpaceX considers pricing, it balances onboarding as many new subscribers as possible with regional demand and network capacity so as not to overwhelm—or underwhelm—the system. This flexible pricing has played out throughout Europe over the last nine months, with Starlink slashing monthly subscription prices to stimulate demand in areas with excess capacity.

Starlink Growth

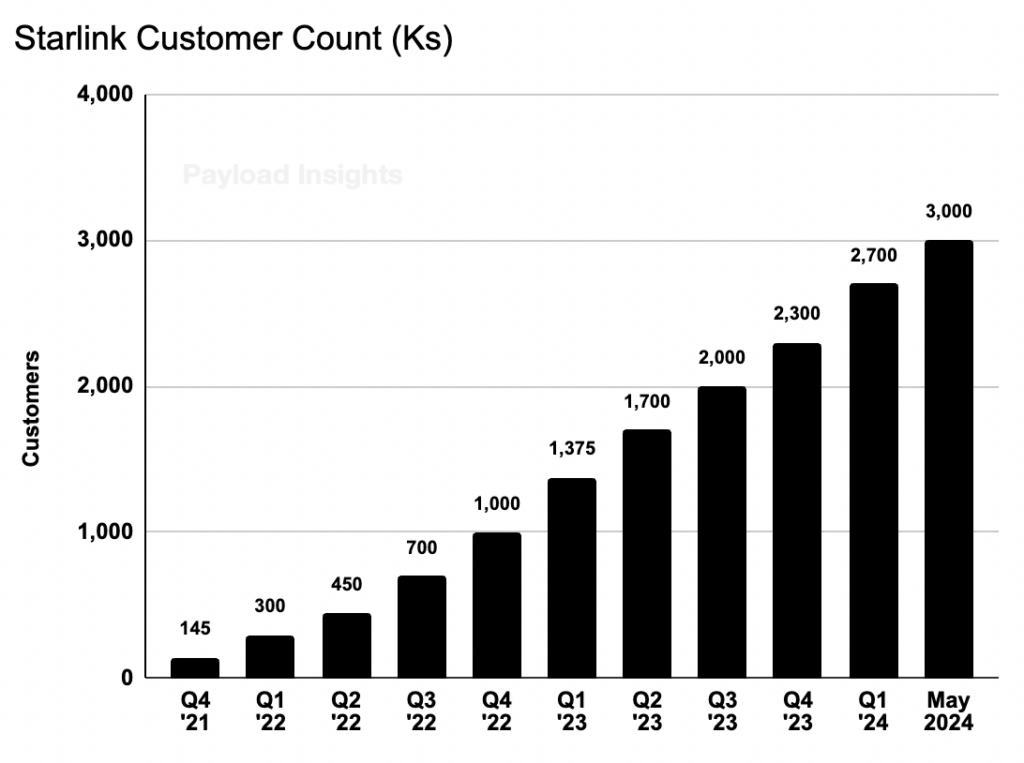

Starlink reached 3M users in May, with growth accelerating thus far this year driven by continued international adoption.

- In 2023, global users accounted for roughly 40% of total customers.

- With Starlink now available in 100 countries, we forecast international users to surpass domestic users in 2024.

SpaceX’s bread and butter is its consumer residential terminal. In 2023, 2.6% of total users were business enterprises, and 17% (~400,000) were roam customers. The Starlink Mini will add a meaningful tailwind for the roam category, supporting customer adoption, particularly in low-income countries where portability, flexibility, and lower-cost products will be welcomed.

Starlink customer adoption has been swift as it both engages first-time satellite users and drives users to switch from competing services—highlighted by declining user trends in the Hughesnet base.

Smaller-er Terminals

In just three years, Starlink has transformed from clunky terminals to slim, lightweight notebook-sized devices. What does this mean for Starlink hardware in the next three to five years?

With each new terminal iteration, SpaceX improves its phased array tech, which helps enable miniaturization. Nonetheless, building terminals smaller does have a performance trade-off that improved tech can’t fully make up.

There is also a lower limit as to how small terminals can shrink as physics and wavelength dynamics need their room to operate.

Kuiper sneak-peak: Last year, Amazon Kuiper unveiled a preliminary design of its micro-terminal, which measures 7 inches square. While Kuiper has not yet started building its constellation, the design provides a glimpse into the potential size of future small phased array terminals, possibly offering insight into what a mini Mini Starlink could look like.

Can SpaceX cut the cut size of a Starlink Mini terminal from 12 inches to 7 inches in three to five years and maintain home internet-like speeds? Probably.

In addition to improving and condensing terminal tech, SpaceX will pull other levers to support performance as terminals get smaller, including deploying larger antennas with Starlink V.2, increasing satellite deployment with Starship/Falcon 9, and lobbying to change EPFD rules.

The $250B question: Ron Baron, a famed long-term SpaceX investor, declared on CNBC last year that he believed Starlink would IPO in 2027 at a $250B – $300B valuation—a staggering figure, considering SpaceX’s entire valuation currently sits at $180B.

Starlink appears to be on an unrelenting climb to 10M users over the next couple of years, largely driven by the company’s residential connectivity business. The miniaturization of terminals—along with direct-to-cell capability (SpaceX has launched 90 DTC satellites)—will provide further support and help open up Internet of Things applications.

As with other advanced tech (mainframe computers, clunky wireless phones, cameras), as hardware get smaller, it moves into the mass consumer market and opens up use cases.

IoT: Starlink connectivity IoT use cases could include Teslas, smart infrastructure, construction, military operations, drones, and robots. The internet has no bounds, and future tech will require connectivity.

- John Deere partnership: Earlier this year, SpaceX announced a collaboration with John Deere to append Starlink terminals on its machines for farming management connectivity. If SpaceX can shrink the size of Starlink terminals enough for other applications, the market for potential partnerships opens up.

Concluding thoughts: For a majority of internet applications, fiber and cellular networks work just fine. In a city, it is likely easier to hotspot on your phone to bang out a couple of emails than it is to set up Starlink. However, the connectivity market is one of the largest in the world and offers significant opportunities for Starlink to step in when existing networks are unavailable. Just last week, Comcast tapped Starlink to fill in the connectivity gaps in underserved regions. Comcast has 2.5M business enterprise users.